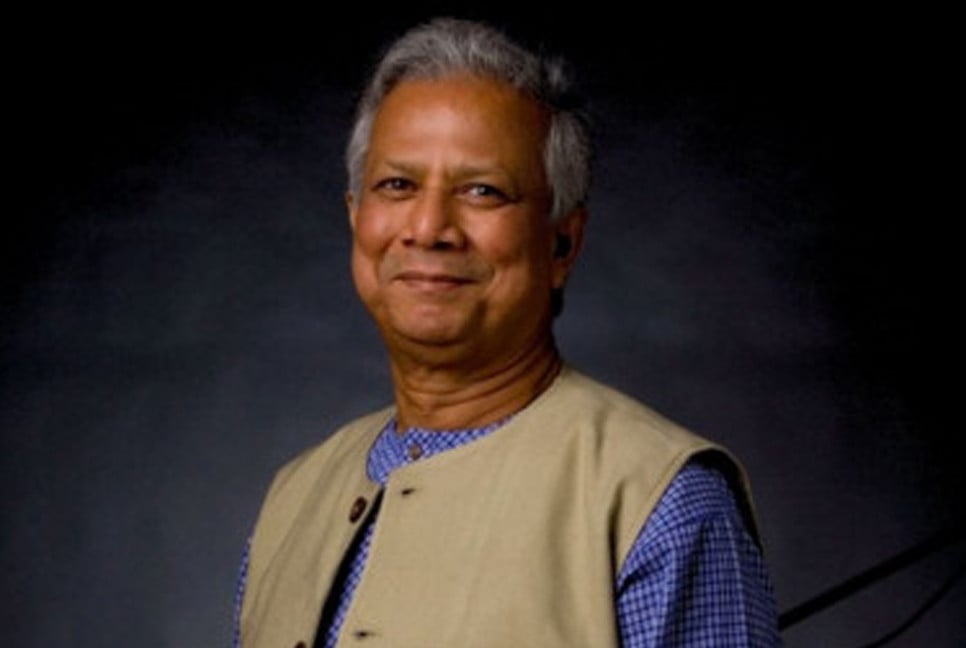

Center for Policy Dialogue (CPD) distinguished fellow Dr Mustafizur Rahman said the anonymous loan in banking sector gives wrong signal to the economy.

"Such fake loans should be stopped to encourage good borrowers. Persons involved in the process should be brought under the law," Dr Rhman told media on backdrop of increasing non-performing loan (NPL) in the banking sector.

The NPL in banking sector topped Tk 1.34 trillion according to latest data of Bangladesh Bank.

"It is so harmful for the economy. Therefore, Bangladesh Bank should take decisions independently and emphasise to bring them under the law," Dr Rahman added.

The eminent economist thinks that the economy is going through a challenge.

"We should focus to increase quality of management of banking service to improve good governace jn the sector," he said.

Regarding influence of board directors on bank, Rahman said that the regulatory body supports the directors providing benefits different times.

"For example, appointing four directors from the same family. These directors have been given the opportunity to stay in the bank for nine consecutive years. The regulatory body should ensure exemplary punishment," Dr Rahman said.

Bd-pratidin English/Lutful Hoque