As apparently no one is standing beside the more than one crore small and medium-sized entrepreneurs across the country, they are struggling to survive on their own.

Many of them are being forced to close their business because of economic crisis, bank loan shortage, bureaucratic complications, and eruption of new extortionists.

Besides, the country’s industrial sector is on the verge of collapse due to domestic and foreign conspiracies. Industrialists are forced to close their factories as pressure of inflation mounts, and worker unrest due to foreign conspiracies.

However, a number of entrepreneurs complained that they are not getting police assistance to stop tyranny of new extortionists.

Industries that are helping the country to keep its economy running are struggling to survive rather than expanding their businesses, resulting in a stop on new job creation.

Entrepreneurs say that the private sector is now heading towards catastrophe due to multifaceted crises including reduced credit flow, high interest rates, anarchy in the dollar market, insufficiency in Letters of Credit (LC), gas shortage, and decreased sales due to high inflation.

Workers dissatisfaction on a regular break disrupts the entire industrial sector for several days.

Local entrepreneurs are being forced to curtail their businesses due to various pressures. They have to cope with the huge pressure of inflation amid the shortage of gas and electricity, the absence of infrastructure, and the dollar shortage.

High interest rates on bank loans are not allowing entrepreneurs to stand still. Many industries are coming to a standstill as they are not able to import as per demand.

Many entrepreneurs in the country are now struggling to operate businesses due to the lack of loans due to the dollar crisis and the liquidity crisis in the banks.

Many believe that local entrepreneurs are being pressured by foreign conspiracies.

Due to the Covid pandemic in 2020, businessmen across the country had to go through a terrible crisis, when many industries called their business a day. After improvement of the situation, the global political crisis hit the country’s industries, as the crisis lead Bangladesh to dollar crisis.

In 2020, the government introduced new bank loan policy that was a relief for the entrepreneurs. But the global problems, like dollar crisis, energy crisis, and inflation in the country had drew a negative impact on the sector.

At the end of last year, the dollar crisis became so severe that within two to three months, the dollar price reached 125-26 taka from 85-86 taka.

The average inflation in the country in the current 2023-24 fiscal year was 9.73 percent. The latest inflation stood at 11.38 percent with a rate of 14 percent in the food sector.

During this time, the dollar price against taka has increased by about 25 to 30 percent, resulting in an increase in raw materials import. However, entrepreneurs are not able to open LC due to dollar crisis.

The prices of necessary raw materials in the domestic market have increased dramatically.

On the other hand, the common people are cutting back on purchases due to inflation pressure. Imports of all industrial goods have decreased significantly.

According to Bangladesh Bank data in the last three months, in the first quarter of the current fiscal year, the LC opening of capital equipment has decreased by more than 25 percent.

At the same time, the LC settlement rate of capital equipment has decreased by more than 40 percent. The LC opening for the import of industrial raw materials has decreased by about 30 percent.

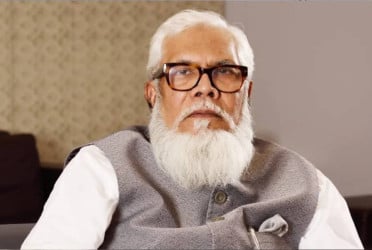

Mir Nasir Hossain, former president of Federation of Bangladesh Chambers of Commerce & Industry (FBCCI) said: “The law and order situation has developed but it is still struggling to gain faith as many industries have come under attack.”

“Businessmen are not safe yet,” he expressed his concern, and said that the police were inactive for a long period, and still they are not confident that is a great exigency for us.

He said: “The Contractionary Monetary Policy has also increased the interest rates on bank loans, which has made it difficult for entrepreneurs to repay loans. He identified this as one of the reasons behind loan default.

“Extortion at various stages of the supply chain is one of the main reasons for this price increase. If the businessmen are not good, employment in the country will not increase, the economy will not be able to stand,” he furthered.

Ashraf Ahmed, former president of Dhaka Chamber of Commerce, said: “The IMF [International Monetary Fund] warned us of an uncertain and economic downturn situation in coming days.”

He furthered that the organization fears of such situation because of political instability, floods, and hard monetary policies.

“For months, most businesses have been facing production losses due to law and order and security issues, energy shortages and tight banking liquidity.”

“This has been compounded by the tightening of working capital provision from a handful of affected banks,” he furthered.

Inflation, especially in food sector, has been quite strong during this period, he informed.

The businessman said: “The country’s economy will collapse if the entrepreneurs are not getting the chance of creating new opportunities.”

At the end Mr Ahmed called concerned authority to support the entrepreneurs.

Translated by Afsar Munna