Bangladesh Securities and Exchange Commission (BSEC) in collaboration with government will take initiative to digitize monitoring system of the capital market in order to combat forgery, reports BSS.

As part of this effort, BSEC will establish a fully digital and transparent governing board for data interoperability (FinTech), which would also ensure interoperability of software services and operations of different organizations under BSEC, said a press release.

A memorandum of understanding (MoU) was signed today between the Bangladesh Computer Council (BCC) of the ICT Division and BSEC at the BSEC Multi-purpose Conference Hall.

The implementation of the Digital Transformation of the Bangladesh Capital Market: Data Interoperability (FinTech Board) will be financed by the World Bank-funded Enhancing Digital Government and Economy (EDGE) Project of BCC, with a target to complete it by 2026.

Ranajit Kumar, Executive Director of BCC, and Mohammed Shafiul Azam, Executive Director of BSEC, inked the MoU on behalf of their respective organizations.

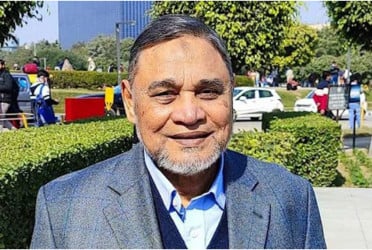

Chaired by BSEC Commissioner Dr. Shamsuddin Ahmad, it was attended by ICT Secretary Md. Shamsul Arefin, BSEC Chairman Shibli Rubayat Ul Islam, EDGE Project Director Dr. Muhammed Mehedi Hassan, and BSEC Executive Director Mohammed Shafiul Azam.

Shibli Rubayat Ul Islam said the use of ICT in the capital market will not only reduce corruption but also curb the activities of those who are involved in manipulation, fraud, and looting in the share market.

He said automation of BSEC and implementation of the FinTech Board at the initiative of the government will ensure interoperability of software-based services and operations among the organizations of BSEC and transparency of the capital market's functions.

"The digital transformation of the traditional system of share market will help make a cost-effective capital market and bring the trust of the investors," ICT Secretary Md. Shamsul Arefin said, adding that the beneficiaries including investors would be greatly benefitted as they would get better and faster services.

He said that the yesteryear controlling and monitoring system in the shared business would no longer exist as automated surveillance would be put in place.

"We want to strengthen surveillance system to check the fraud and forgery in the share market," Ranajit Kumar said and added the automation of traditional systems will help make a vibrant capital market.

As per the MoU, emphasis will be given on standardizing data and performance, implementing technological standards, defining processes and data, and creating a modern and sophisticated digitized ICT infrastructure. This digital transformation aims to enhance the contribution of the capital market to the economy and achieve 'Vision 2041'.

BSEC will establish a fully digital, transparent, and governing FinTech Data Interoperability Board which would emphasize standardization of data and performance, with a two-fold focus on the implementation of technological standards, the MoU said.

According to the MoU, BSEC will conduct feasibility analysis, business and technical requirement analysis, project management, quality assurance, and other related activities to ensure the successful implementation of the FinTech Board project.

The Bangladesh Computer Council (BCC) will handle the procurement process and provide technical support for the implementation of the Digital Transformation of the Bangladesh Capital Market and the establishment of the FinTech Board by BSEC.

Bd-pratidin English/Lutful Hoque