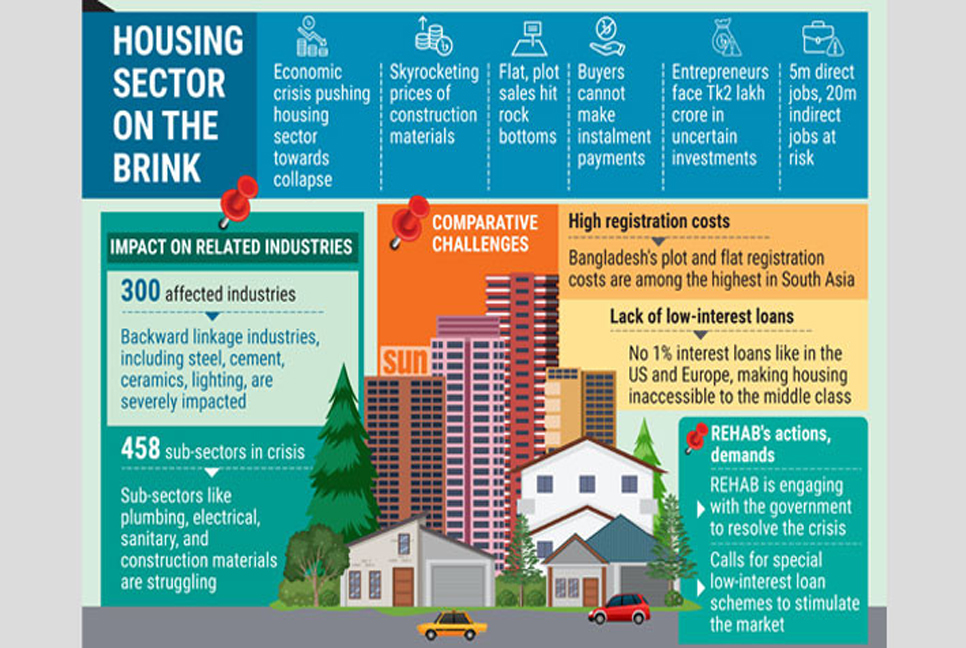

The country’s economic crisis has cast a long shadow over its housing sector, pushing it to the precipice of collapse. This domino effect has crippled over 300 associated industries, leaving a staggering 458 sub-sectors in dire straits.

The Real Estate and Housing Association of Bangladesh (REHAB) warns that millions of livelihoods are at stake, as the housing sector directly employs five million people and indirectly supports nearly 20 million others.

According to the organisation representing housing sector owners, recent hikes in the price of construction materials have taken a toll. Sales of plots and flats have hit rock bottom, instalment payments have stopped, and there is no liquidity flow in the market.

As a result, entrepreneurs with investments totalling nearly Tk2 lakh crore are facing uncertainty. Many businesses are at risk of closure, causing widespread concern among entrepreneurs.

They entrepreneurs noted that while developed countries like the United States and European nations offer 1% interest loans for the housing sector, no such facility exists for buyers in Bangladesh. To overcome the ongoing crisis, a special low-interest loan fund for housing sector buyers must be created, they urged.

Speaking on this matter, REHAB Senior Vice-President Liakat Ali Bhuiyan said, “Business conditions are currently dire. Buyers are unable to pay instalments. They are holding onto their money and observing the situation. REHAB has already initiated discussions with the current government to address the overall situation and challenges of the housing sector. The government has also assured us of resolving our issues.”

The REHAB leader added that the organisation will soon meet with the National Board of Revenue (NBR) to discuss reducing the excessive registration fees for plots and flats. Additionally, REHAB will soon hold a meeting to assess the losses incurred by the backward linkage industries and determine the necessary actions.

Iqbal Hossain Chowdhury Jewel, director of the Federation of Bangladesh Chambers of Commerce and Industry (FBCCI) and managing director of JCX Developments Limited, said, “For the past three months, many buyers have stopped making instalment payments. Following the recent protests, 30% to 40% of buyers have cancelled their orders. Some are irregular in their payments. While 15 to 20 flats were sold last month, the number has reduced to only 1-2 this month.”

“If the current situation persists, not only the housing sector but other businesses connected to it will collapse. This could result in increased unemployment.

“On top of everything, interest rates have risen, leading to a liquidity crisis. Loans have decreased compared to demand, causing businesses related to the housing sector to crumble. The growth of the Gross Domestic Product (GDP) might also slow down.”

Therefore, he maintained, liquidity issues must be resolved as quickly as possible, and loan interest rates must be reduced. Efforts must also be made to restore confidence among the public by alleviating their fears.

Additionally, the complexities around importing raw materials for the housing sector must be addressed, and registration costs for plots and flats should be reduced, the business leader emphasised.

According to REHAB, between 2010 and 2012, an average of 15,000 flats was sold annually. Between 2013 and 2016, more than 12,000 flats were sold each year. Between 2017 and 2020, the number increased to 13,000-14,000 annually. From July 2020 to June 2022, around 15,000 flats were sold each year. However, due to the rising cost of construction materials, flat sales have since declined.

In the fiscal year 2022-23, nearly 10,000 flats were sold, and in fiscal 2023-24, the number dropped further.

This indicates that demand for flats has steadily decreased, and the housing sector is now in severe crisis amid the country’s economic challenges both before and after the fall of Sheikh Hasina’s government.

REHAB suggested that in order to make housing more accessible for the middle class, there is a need to reintroduce single-digit interest rate loans for housing, a facility that once existed and enabled many in the middle class to become flat owners.

A similar arrangement is essential to fulfil the housing dreams of the middle class and revive the housing sector.

Registration costs in Bangladesh are among the highest compared to other South Asian and developed nations. Lower registration fees would encourage buyers to declare the correct prices, ensuring that the government receives the appropriate revenue, observed REHAB.

In this context, Towfiqul Islam, senior research fellow at the Centre for Policy Dialogue (CPD) and an economist, said, “The housing sector is currently beyond the purchasing power of the average citizen. Even the middle class cannot afford to buy flats. Unlike in developed countries, long-term loan facilities for housing sector buyers are not available in Bangladesh. Additionally, the country’s economy is in a difficult situation, which has further impacted the housing sector.”

However, Towhida Sultana, managing director of Advance Homes Private Ltd, said, “The cost of all materials, including rods and cement, in my nine ongoing projects has increased by about 20%. The situation in the housing sector is dire. There are no bank loans, and flats and plots are not selling. Buyers who purchased flats earlier are now facing difficulties with registration due to the high costs. Meanwhile, stone imports have been halted. Overall, business owners are worried, and buyers are hesitant to invest in new projects.”

It has been learned that the ongoing economic crisis has severely impacted backward linkage industries such as bricks, sand, steel, cement, construction, sanitary, ceramics, glass, aluminium, cable, and lighting. Employment for millions of construction workers is at risk amid growing uncertainty.

According to REHAB, the 458 sub-sectors of the housing industry have been hit hard, with major materials such as steel, cement, wires, sanitary fittings, locks, keys, boards, and doors being significantly impacted.

The housing sector plays a crucial role in the country’s GDP, and a decrease in construction material prices could encourage renewed investment in the sector, said the association.

In this regard, Tanvirul Haque Probal, former president of REHAB and managing director of Building for Future Limited, said, “For the past two months, my business has been suffering. Naturally, the backward linkage industries have come to a standstill. However, I hope everything will return to normal soon.”

MA Awal, first vice-president of REHAB, also expressed his hope that the situation will normalise soon.

Backward linkage industries

According to sources related to the housing sector, more than 300 backward linkage or supporting industries are involved in this sector. The product-based sub-sectors are divided into 18 categories, with a total of 458 sub-sectors.

The civil sector, which includes essential sub-sectors such as rods, cement, ready-mix, bricks, and stones, comprises 11 sub-sectors.

The electrical sector has 30 sub-sectors, including cables, circuit breakers, switches, sockets, meters, and lights.

The wood sector encompasses 25 sub-sectors, including wood, doors, and locks.

The plumbing sector, which includes pipes, glass, taps, fittings, and water pumps, comprises 20 sub-sectors.

The tiles sector, which consists of various domestic and foreign types of tiles, marble, stone, and mosaic chips, includes 13 sub-sectors.

The sanitary sector has 33 sub-sectors, including commodes, basins, bathtubs, hand showers, connection pipes, and gratings.

The paint sector consists of 6 sub-sectors, including paint, foam lab, buns, and polish.

The hardware sector, which covers 97 sub-sectors, includes floor brooms, hairbrushes, safety nets, royal plugs, plumber brushes, hose pipes, padlocks, masking tape, and more.

The electrical sector has another 18 sub-sectors, covering lifts, substations, solar systems, generators, and intercom systems.

The sub-contracting sector, which includes aluminium, grills, fire doors, steel infrastructure, skylights, LPG systems, swimming pools, and more, has 64 sub-sectors.

The construction machinery sector consists of 19 sub-sectors, including excavators, light trucks, road rollers, bulldozers, dump trucks, and pipe driving machines.

The labour sector, covering civil, electrical, sanitary, tiles, paint, soil testing, and pile work, has 26 sub-sectors.

Additionally, 90 more sub-sectors are involved with the housing industry, including land development, administration, home appliances, and office stationery.

Investments worth nearly Tk2 lakh crore by over 2,000 industrial enterprises across these sectors are now under threat.

Among the 300 backward linkage industries are 27 construction material sectors, 43 bath and kitchen fittings manufacturing and supply sectors, as well as 44 electrical and 44 furniture sectors, along with many others.

Several backward linkage industries, including the country’s cement, rod, steel, and re-rolling mills, ceramics and tiles, chemicals, bricks, sand, stones, paints, PVC pipes, wood, glass, aluminium, kitchen fittings, gas stoves, water heaters, irons, flushing equipment, electrical substations, transformers, lights, cables, fans, air conditioners, air coolers, building insulation, glass doors, timber, electrical security doors, building safety systems, mosaic, paints, ceramic products, various types of pipes, fittings, cables, glass products, stone products, iron products, furniture, wood products, plywood, cables, electrical fittings, construction machinery, adhesives, steel products, aluminium sectors, and more, contribute significantly to the economy. With the housing sector under threat, the backward linkage industries are also facing a crisis.

Entrepreneurs in these sectors believe that if the housing sector revives, the linkage industries will recover as well.

Additionally, 20,000 construction managers, 10,000 diploma engineers, 3,000 graduate engineers, and nearly 500 architects are employed by housing companies.

Bd pratidin English/Lutful Hoque