Following the fall of the Sheikh Hasina government amid the student-people uprising, Islami Bank has been cleared of occupation, yet there has been no change in its top executive leadership. Mohammed Monirul Moula continues to serve as the Chief Executive Officer and Managing Director (MD) of the bank.

After the takeover of Islami Bank by the S. Alam Group in 2017, the group and its affiliated companies siphoned off a staggering 88,000 crore taka through 45 accounts over various periods.

Banking industry experts believe that such a large sum of money could not have been withdrawn without the consent of the MD.

Along with siphoning off public deposits under the guise of loans, large sums were also smuggled abroad—all with the approval of the bank's MD, Monirul Moula. All these loans were disbursed in violation of banking regulations.

Following political changes, Bangladesh Bank freed Islami Bank from the control of the S. Alam Group, although the process has not been fully completed. While several officials, including Deputy Managing Director Md. Akij Uddin and Miftah Uddin Ahmed, had been dismissed, key figures such as the MD, Additional Managing Director (AMD), Senior Executive Vice Presidents, and other senior officials who assisted in facilitating the illicit withdrawal of funds through loans remain in their positions.

According to sources, over the past seven years, 82% of the bank's total loan disbursement—amounting to 1,75,000 crore taka—has been granted to the Chattogram-based group, both under legitimate and questionable circumstances.

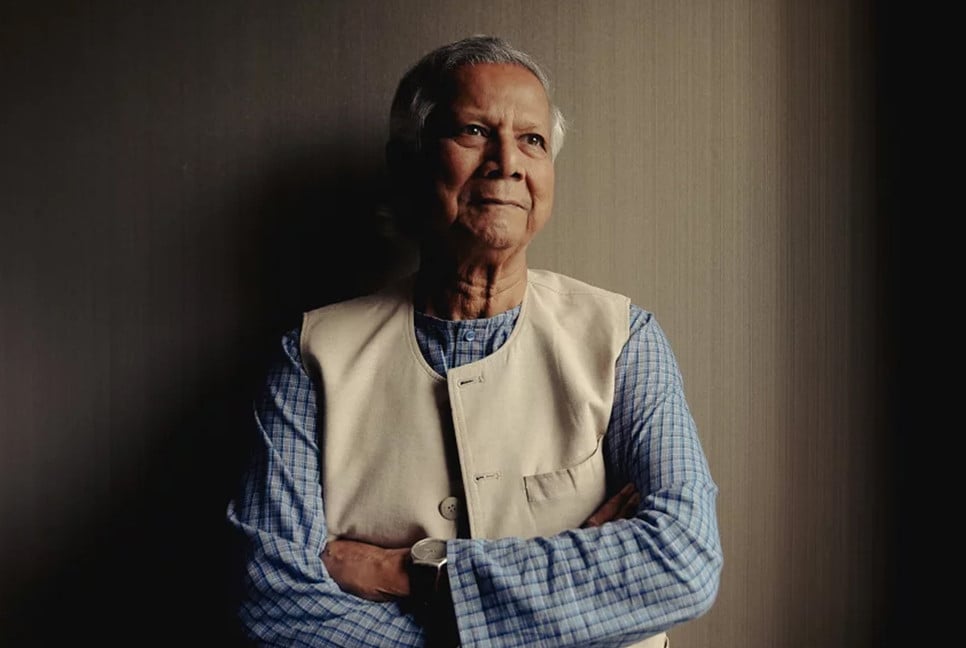

Mohammed Monirul Moula, MD and CEO of Islami Bank, is said to have played a pivotal role in facilitating the irregular loan distributions.

Since taking office on January 1, 2021, he has overseen the reckless distribution of thousands of crore taka in loans to nominally registered companies under the S. Alam Group.

Among these, 26,000 crore taka was loaned to S. Alam’s affiliated companies, while the remainder was distributed to 29 associate companies, including Deshbandhu Group, Unitex Group, and AnonTex Group.

Reports indicate that between November 1 and 17, 2022, Islami Bank disbursed 2,460 crore taka in loans to Nabil Group.

Branch officials involved in distributing the loans had stated that the funds were released under direct instructions from the head office, particularly the MD.

According to the available information, without verifying the loan repayment capability or the necessity of the loan, Islami Bank Chaktai branch in Chattogram approved a loan of 890 crore taka to Murad Enterprise, a tin-sheet sales company, just one month after opening its account.

A year later, the company was granted an additional loan of 110 crore taka.

Documents from BB reveal that Murad Enterprise is a shadow company of the S. Alam Group, and Islami Bank took very minimal collateral from Murad Enterprise.

According to the records, 35,924 crore taka was loaned from this branch to 10 companies. The S. Alam Group and its affiliated companies, including Nabil Foods, Nabil Auto Rice Mills, M S A J Trade International, and Anwara Trade International, received a total of 29,575 crore taka in loans from Islami Bank Rajshahi branch.

Additionally, the group secured 23,900 crore taka in loans from the bank’s offshore banking unit and other branches in violation of regulations.

Reviews have shown that despite multiple reports of irregularities in Islami Bank's loan distribution, the bank's Managing Director, Monirul Moula, has consistently denied these allegations.

At that time, he had stated in the media, "The highest portfolio is maintained for loans or investments. Therefore, a bank that has been operating for 40 years like ours has no opportunity to engage in such irregularities. There is a system in place, and everything operates within this system. There are no anonymous loans; they are all in the name of the respective entities."

Regarding the loans granted to nominally registered companies, Monirul Moula had claimed, "The companies that have received loans are not at risk of default. Even if a company were to default, the funds would be recovered from the collateral."

However, following political changes, the bank's worsening condition has come to light. The issuance of both legitimate and fictitious loans has led to a severe liquidity crisis. The bank is struggling to meet the required Cash Reserve Ratio (CRR) and Statutory Liquidity Ratio (SLR) set by the central bank, and a deficit in its current account had been concealed for a long period.

Despite these significant issues, there is growing speculation in the banking sector about how the MD continues to remain in his position at Islami Bank.

In addition to the MD, several senior officials involved in the irregular loan distribution remain in their positions, including Additional Managing Director Altaf Hossain, Senior Executive Vice President (SEVP) G. M. Mohd. Gias Uddin Quader, SEVP and IT Head Ahmed Zubaerul Haque, Audit Head Md. Raja Mia, MD Secretariat officials Khaled Mahmud Raihan and A M Shahidul Imran, Head of Service Wing Ehsanul Haque, SVP Md. Sohel Aman, Chief Marketing Specialist Gandhi Kumar Rai, Momtaz Uddin Chowdhury, Abdul Mannan, Mostak Ahmed, HR Department’s Md. Mostafa, Md. Jahedul Islam, and Abdullah Md Khaled. Additionally, AVP Amin Ullah Pasha, Md. Taherul Amin, and Md. Khaled Morshed are also mentioned.

In addition to the head office, several branch officials have been implicated in irregularities in loan distribution, including Chattogram Zonal Head Meah Md. Barkat Ullah, Northern Zonal Head Nurul Hossain Kawsar, Agrabad Branch Head Abdul Naser, former Rajshahi Zonal Head Md. Mizanur Rahman, Rajshahi New Market Branch Head Munshi Rezaur Rashid, Gulshan Corporate Branch Head ATM Shahidul Haque, Rajshahi Branch Head Wasiur Reza, Khathungonj Branch Head Sirajul Kabir, Nizam Road Branch Head Md. Asiful Hoque, Jubilee Road Branch Head Md. Shahadat Hossain, Pubna Branch Head Md. Shahjahan, and Chaktai Branch Head Monjur Hasan.

Efforts to contact Islami Bank’s MD, Mohammed Monirul Moula, for comments on the matter have been unsuccessful.

When asked about taking action against the bank officials involved in the irregularities, Islami Bank Chairman Obayed Ullah Al Masud said, "The bank's funds have been diverted to different channels. Immediate action is not being taken against the lower-level officials, but the corrupt officials are being identified. Gradual steps will be taken."

Translated by ARK/Bd-Pratidin English