The interim government has decided to increase VAT [Value Added Tax] rate in the middle of the fiscal year aiming to bolster revenue earnings and satisfy IMF bailout conditions. Instead of providing relief from the pressure of inflation, the government decided to increase the cost of living of the people one step further.

With the increased VAT, the government will generate very little revenue, leaving people suffering a lot.

Therefore, experts have suggested increasing the number of VAT payers instead of increasing the VAT rate as they believe that the increased VAT rate will put people who are crushed by the high inflation into further sufferings.

Since the interim government took office on August 8, various uncertainties have been emerged among people, the experts furthered, adding: “As there are elections and political uncertainties ahead, the industrial sector has also come to a standstill.”

Therefore, there is no fresh investment and employment opportunity created. Although the daily expenses have been increased, their income remained the same. In such situation, the decision will have a negative impact on people regardless of classes.

The lower and middle class people will face the most pressure as the VAT is associated with the product from retail market. If VAT is increased, the sellers will put it on buyers’ shoulder.

A source in the National Revenue Board (NBR) said: “VAT is being increased on 43 goods and services to comply with the conditions of a $4.7 billion loan from the International Monetary Fund (IMF).”

If the VAT is increased, the businesses that are already in recession will be closed as people will be likely to cut their restaurant, travelling and clothing costs.

Additionally, if VAT is increased in the middle of fiscal year and in unstable and uncertain political conditions, then people will reduce their purchases which will prologue the ongoing recession in business.

Experts suggested the government should rather expand the VAT payers’ net to include a big share of the 70% common people still living outside the VAT base.

Instead of hiking VAT rates, the industry owners have also called for recovering illegal assets from money launderers, covetous businessmen and corrupt government officials for boosting state coffers.

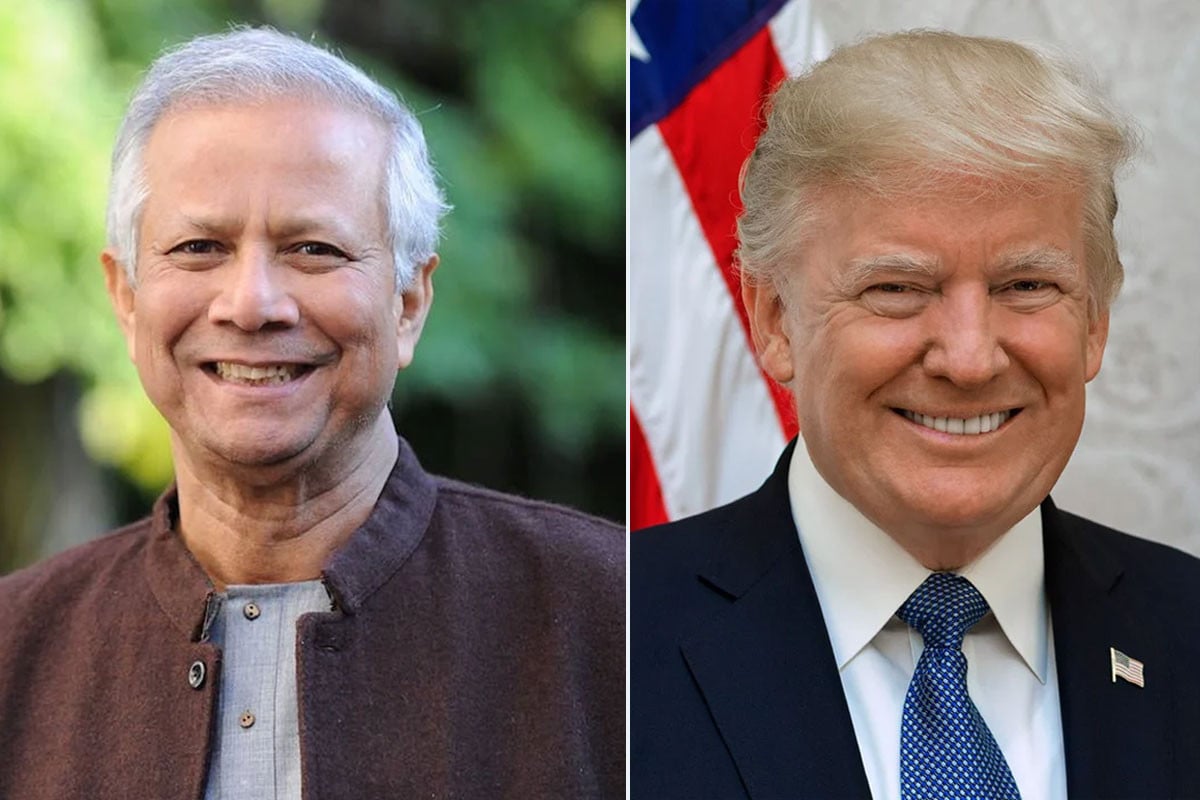

The have asked the Prof Yunus-led government to bring to book the “looters” of people’s money, and removing pro-Awami League employees from government offices.

Imran Hasan, secretary general of the Bangladesh Restaurant Owners Association, has told the Bangla daily Bangladesh Pratidin that the restaurant sector would face more pressure due to the VAT hike on high-end services.

Other business owners in the tourism and hospitality sector agree that the ongoing crisis in their businesses would be prolonged once the VAT hike is enacted. They also claimed that the proposed 15% Vat is not applied in “any other country of the world,” saying the existing 5%-7% VAT on the luxury sector is already more than enough.

Being asked about VAT increase, rickshaw puller named Hatem Ali stressed that no government thinks of the common people.

NBR sources said that with the change of government, there has been a deficit in the revenue collection and that forces government to amass more revenue.

Finance adviser Dr Salehuddin Ahmed said that the increase will not affect people’s everyday life.

However, experts have blamed the pro-Awami League bureaucrats in the interim government for apparently forcing the government to adopt plans detrimental to their business and even the wider economy.

Translated by Afsar Munna