Stock indexes in Asia dropped sharply on Monday as U.S. President Donald Trump's firm stance on tariffs fueled fears of a recession. Investors began pricing in nearly five U.S. rate cuts this year, causing Treasury yields to plummet and the dollar to weaken.

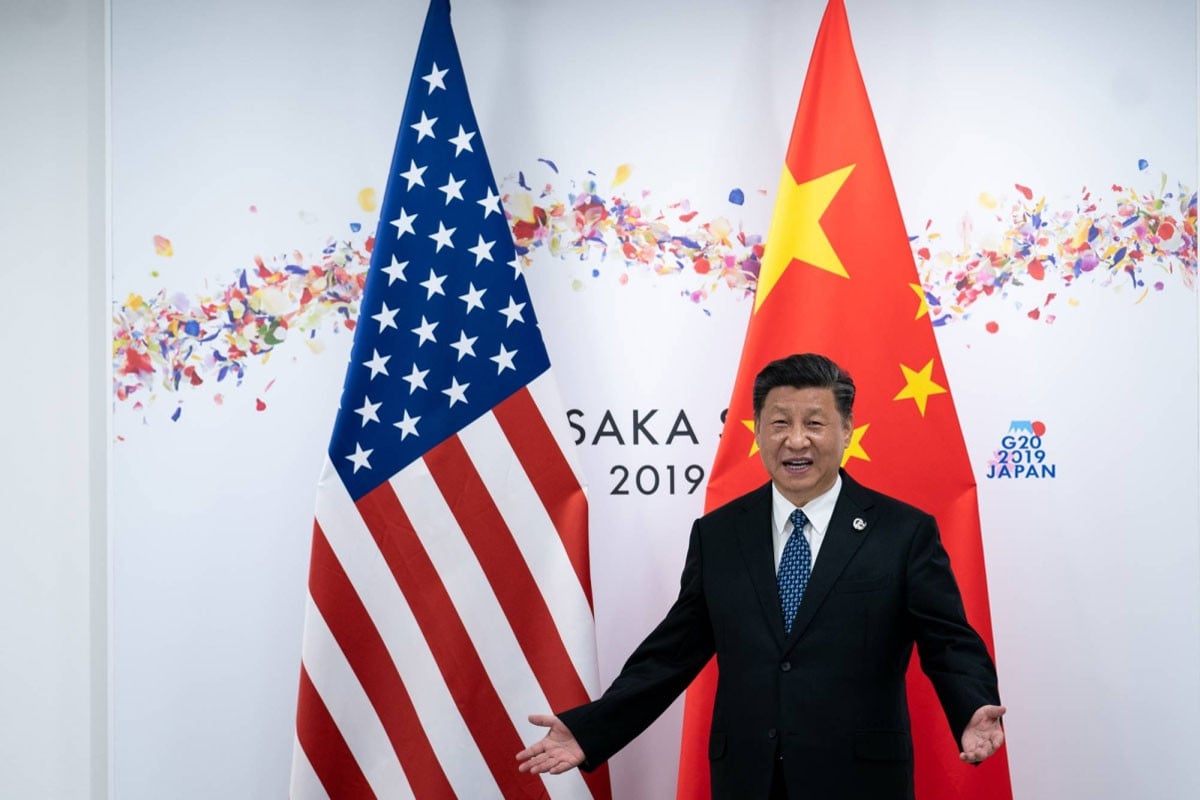

Trump's tariff stance

Despite the market turmoil, Trump showed no signs of backing down from his tariff policies, insisting that a trade deal with China would not happen until the U.S. trade deficit was addressed. This uncertainty contributed to the steep market losses.

Recession fears trigger rate cut bets

Futures markets suggest the Federal Reserve may cut rates as early as May, with many speculating a series of rate cuts through 2025. Experts now predict a 60 per cent chance of a U.S. recession, with JPMorgan forecasting the first Fed easing in June.

Global impact

The global downturn was widespread, with European stocks and Asian indexes, including Japan's Nikkei and South Korea’s market, suffering heavy losses. Emerging markets, including India, also faced sharp declines.

Safe-haven flight and oil prices

As investors sought safer assets, U.S. Treasury yields dropped and the dollar weakened against the yen and euro. Meanwhile, oil prices continued their downward trend, with Brent crude falling to $64.23 per barrel.

Corporate and inflation pressures

As inflation concerns rise due to tariffs, analysts warn of shrinking corporate profit margins. The earnings season, starting this week, could see fewer companies providing forward guidance due to these pressures.

Courtesy: Reuters

Bd-pratidin English/FNC