China has halted exports of a wide range of rare earth metals and magnets—vital components for global industries including automotive, aerospace, electronics, and defense. The Chinese government did this in a significant escalation of trade tensions with the United States.

Shipments have stalled at ports across China as the government implements a new regulatory system requiring special export licenses for heavy rare earth metals and rare earth magnets. The move, seen as retaliation for recent tariff increases by the Trump administration, has left companies worldwide scrambling to secure alternative supplies.

Rare earth magnets are essential for electric motors used in electric vehicles, drones, robotics, and military applications. Without them, production could slow or stop entirely. The new licensing system remains largely undeveloped, raising concerns among industry leaders about prolonged disruptions.

Michael Silver, CEO of American Elements, said his firm had preemptively increased its inventory, but warned many U.S. companies were unprepared. “If factories run out of rare earth magnets, they can’t assemble electric motors—period,” he said.

Daniel Pickard, a U.S. trade adviser, emphasized the risks to national security and economic stability, while MP Materials CEO James Litinsky highlighted the particular threat to defense contractors reliant on rare earth inputs for drones and next-generation weapons systems.

China currently supplies 99% of the world’s heavy rare earth metals and 90% of its rare earth magnets. Export restrictions are being enforced inconsistently across ports, with some allowing exports containing minimal traces of restricted elements, while others demand full certification before approving shipments.

Meanwhile, factories in Longnan and Ganzhou—the heart of China’s rare earth production—are quietly resuming mining, despite past shutdowns over environmental concerns. JL Mag Rare-Earth Company, a key supplier to Tesla and BYD, continues to dominate global magnet production.

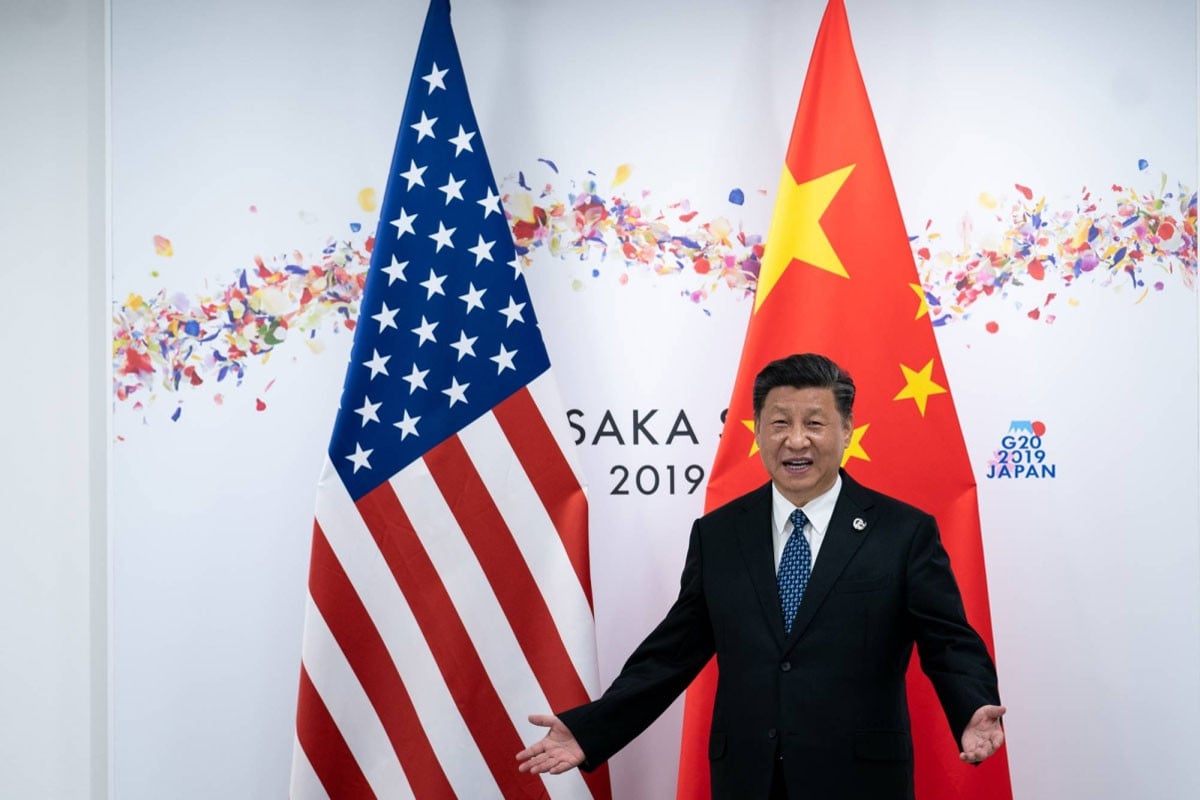

China’s Ministry of Commerce has declined to comment, but analysts note that this rare earth export halt—unlike a similar threat in 2019—is now fully in motion, signaling a serious disruption to global supply chains.

Source: NY Times

Bd-pratidin English/ Jisan