- Mymensingh youth who participated in Ukraine war for Russia dies

- CA to hold bilateral talks with Modi, other BIMSTEC leaders tomorrow

- Rescue team led by Bangladesh Army continues its operation in Myanmar

- Thai ministers meet CA on BIMSTEC sidelines

- ‘Evidence of conspiracy to thwart July-August trial found’

- Kagiso Rabada leaves Gujarat Titans squad for personal reasons

- Gold price declines after hitting all-time high on Trump tariffs

- India says 'examining the implications' of US tariffs

- Russia, Cuba, North Korea escape Trump's tariff

- Over 100,000 child deaths, 63,000 stillbirths annually in Bangladesh

- Trump's tariffs dull the dollar's safe-haven sheen

- BIMSTEC Secretary General calls on Touhid

- CA joins official dinner of BIMSTEC

- Real Madrid got $154M from UEFA to top prize money table last season

- Rejuvenated IPL match-winner Siraj praised for 'fire in his belly'

- Top Russian official in Washington for talks on improving ties

- Strict action to be taken to stop extortion in hills: Home Advisor

- China arrests 3 Filipinos on charge of spying

- Strong earthquake strikes eastern Indonesia

- Anti-discrimination Movement’s former coordinator Tanifa killed in road accident

DCCI for single-digit VAT rate in budget recommendations

The Dhaka Chamber of Commerce Industry (DCCI) proposed setting the Value Added Tax (VAT) rate at a single-digit level in the national budget for the fiscal year 2025-26, reports UNB. The chamber on Tuesday also recommended a 1% VAT rate for informal sector businesses to enhance transparency,...

VAT return deadline extended to tomorrow

Due to technical glitches, VAT returns for the current month can be submitted online until tomorrow (March 18). Although the deadline for filing VAT returns is usually the 16th of every month, the National Board of Revenue (NBR) extended the deadline as many taxpayers were unable to complete the...

NBR plans single VAT rate if businessmen agree

National Board of Revenue (NBR) Chairman Md Abdur Rahman Khan on Tuesday said the government wants to implement a single, universal Value Added Tax (VAT) rate in the country. He added that the decision will be made if the businessmen come to a consensus. If necessary, we will lower the rate,...

NBR announces VAT exemptions for several essential goods

The National Board of Revenue (NBR) has introduced VAT exemptions on several essential products, including biscuits, salt, mustard oil, flour, LP gas, and more. These exemptions apply at different levels of the supply chainsome at the manufacturing stage and others at the merchant level. In a...

Highway restaurants must install electronic VAT machines: NBR

The National Board of Revenue (NBR) has made the installation of Electronic Fiscal Devices (EFDs) or Sales Data Controllers (SDCs) mandatory for all highway restaurants to curb tax evasion and improve Value Added Tax (VAT) collection. The decision follows complaints from consumers that many...

No VAT on purchases at supershops: NBR

Customers will no longer have to pay Value Added Tax (VAT) for purchases at the superstrores, reports UNB. The retail price of the products will be the final price to pay, according to a National Board of Revenue (NBR) release. The NBRs VAT department issued a notification in this regard on...

NBR reduces VAT on biscuits by half

The National Board of Revenue (NBR) has reduced the Value Added Tax (VAT) on both machine-made and hand-made biscuits by half, reports UNB. A notification to this effect was issued on Wednesday, 19 February. Under the new regulation, the VAT on these products has been slashed from 15% to 7.5%....

BAJUS calls for action against VAT-evading jewellery companies

The Bangladesh Jewellers Association (BAJUS) has urged the National Board of Revenue (NBR) to take action against jewellery establishments that lack VAT registration. In this regard, the association sent a letter to the NBR on Monday. According to NBR data, only 8,000 of nearly 40,000...

Finance Advisor clarifies reason behind VAT hike

Finance Adviser Dr Salehuddin Ahmed clarified why VAT on various products was increased at the start of the year instead of raising it through the budget. He stated In the July-August uprising, individuals who were seriously injured in the anti-discrimination student movement were given 35 lakh...

Paying extra VAT better than under-the-table transactions: Finance Adviser

Finance Adviser Dr. Salehuddin Ahmed has said that paying extra VAT is better than making under-the-table transactions. He made the remarks on Monday during his keynote address at a seminar titled Reforms in Customs, Income Tax, and VAT Management to Address LDC Graduation held at the NEC...

Tax hikes scrapped for mobile bills, medicines, restaurants

The National Board of Revenue (NBR) on Wednesday issued four separate notifications revoking a move to hike tax rates for mobile bills, restaurant eating cost, medicine purchase, and broadband internet use. Furthermore, value-added tax (VAT) hikes on non-branded clothes, and vehicle repair...

'Country's overall food situation satisfactory'

Finance Adviser DrSalehuddin Ahmed said, the overall food situation is currently satisfactory, although whether this is reflected in the market is a separate matter. He also reassured that the countrys food stock is in a strong position. Salehuddin Ahmed made these remarks after the meeting of...

NBR revises VAT rate across sectors

The National Board of Revenue (NBR) has issued several notifications by re-fixing the rates of VAT, Supplementary Duty and Excise Duty on some goods and services, which were increased on January 9, aiming to strengthen the countrys economic base. The government had issued the Value Added Tax and...

Mountain of complaints on telecom services

The telecom services in the country are in turmoil, with customers grappling with poor service quality and rising costs. Amid this crisis, the number of mobile and internet subscribers continues to decline every month, signaling a deteriorating trust in the industry. The situation has worsened due...

Govt ends special OMS program for low-income people

The government has decided to discontinue the special Open Market Sale (OMS) program that provided low-cost agricultural products to low-income groups via trucks. Finance Advisor Dr. Salehuddin Ahmed announced on Tuesday that the program would cease operations starting January, following a decision...

VAT hike for auto workshops cancelled

The National Bureau of Revenue (NBR) on Monday announced that it has cancelled the decision to hike VAT on auto workshops and motorbike repairing garages by 5 percent to 15 percent, meaning the previous 10 percent VAT rate will be reinstated. It was the governments latest retreat from a decision...

VAT increase sparks public discontent

The governments decision to increase VAT (Value Added Tax) on over a hundred products and grant higher allowances to government employees has triggered widespread dissatisfaction among the common people and experts. They argue that it was the unexpected movement of students and ordinary citizens...

Commerce adviser defends govt’s move to increase VAT

Commerce Adviser Sk Bashir Uddin on Saturday defended the interim governments recent move to increase Value Added Tax (VAT) saying that indirect taxes are critically important for an unregulated market, reports UNB. Depending on direct taxes may be very good for the developed economy. For an...

Debapriya slams 'inconsiderate' VAT hike by interim govt

Dr Debapriya Bhattacharya, who led the committee that prepared the White Paper on the state of Bangladeshs economy, on Saturday strongly criticised the interim government for increasing value-added tax (VAT) inconsiderately. We are astonished to see how inconsiderately the value-added tax was...

Businessmen to raise movement if VAT is not withdrawn

Traders in the agro-processing sector have called for the withdrawal of the increased VAT and customs duties on processed food products. Traders in this sector have warned of taking to the streets with movement if initiatives are not taken to withdraw VAT and taxes within 7 days. At the same time,...

Additional VAT on restaurants withdrawn

Amid widespread protest against value added tax (VAT) increase in various sectors the government has decided to revert VAT at restaurants to 5%. The NBR announced the removal of the additional VAT on Thursday (January 16), as the Bangladesh Restaurant Owners Association staged a human chain and...

NBR wants answer from field level offices

The National Board of Revenue (NBR) has asked its field level offices to send their feedback on how to remove any bottlenecks in implementation of VAT-related laws and rules to boost the revenue collection, reports UNB. The VAT collection is regulated by Value Added Tax and Supplementary Duty...

No hope on the horizon

From business leaders to ordinary citizens, everyone in Bangladesh is feeling the weight of an escalating crisis. As Abu Ahmed, a former professor at Dhaka University, put it, There is no good news for the common people. Only desperation is growing. More than five and a half months have passed...

Revenue deficit stands at Tk42,000cr in 5 months

Chief Advisers Press Secretary Shafiqul Alam on Sunday said that the interim government has decided to impose VAT to reduce the revenue deficit, not in compliance with the conditions from the International Monetary Fund (IMF). The press secretary said, The tax-to-GDP ratio in Bangladesh has been...

Govt's VAT, SD hike on 100+ products suicidal

Dhaka Chamber of Commerce and Industries (DCCI) President Taskin Ahmed has urged the government to reduce expenses by 20% to save Tk50,000 crore and avoid burdening businesses with increased value added tax (VAT), supplementary duty (SD), and gas prices, reports UNB. Speaking at a press event in...

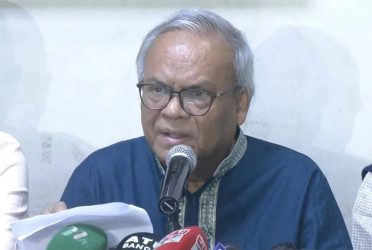

Interim government gradually fails: Rizvi

BNP senior joint secretary general Ruhul Kabir Rizvi said the interim government is gradually failing to control the daily essentials. The interim government is failing to give relief to the common people. The additional burden will be put on the mass people for increasing VAT on more than 100...

VAT, supplementary duty increased on over hundred goods, services

The interim government has increased the value added tax (VAT) and supplementary duty in the middle of the 2024-25 fiscal year, resulting in a rise in the cost of living. National Board of Revenue on Thursday has issued two ordinances in this regard, they are value added tax and...

Restaurant owners criticize VAT hike Plan, threaten strike

The Bangladesh Restaurant Owners Association (BROA) criticized the governments plan to increase Value Added Tax (VAT) amid the current high inflation, stating that it would directly impact the general people. The leaders of the association issued the warning at a press conference held at a hotel...