The dollar (DX=F), one of the world's safest places to park money in times of turmoil, has been shunned by investors as an option for now as uncertainty over tariffs and concern over their impact on US growth intensifies.

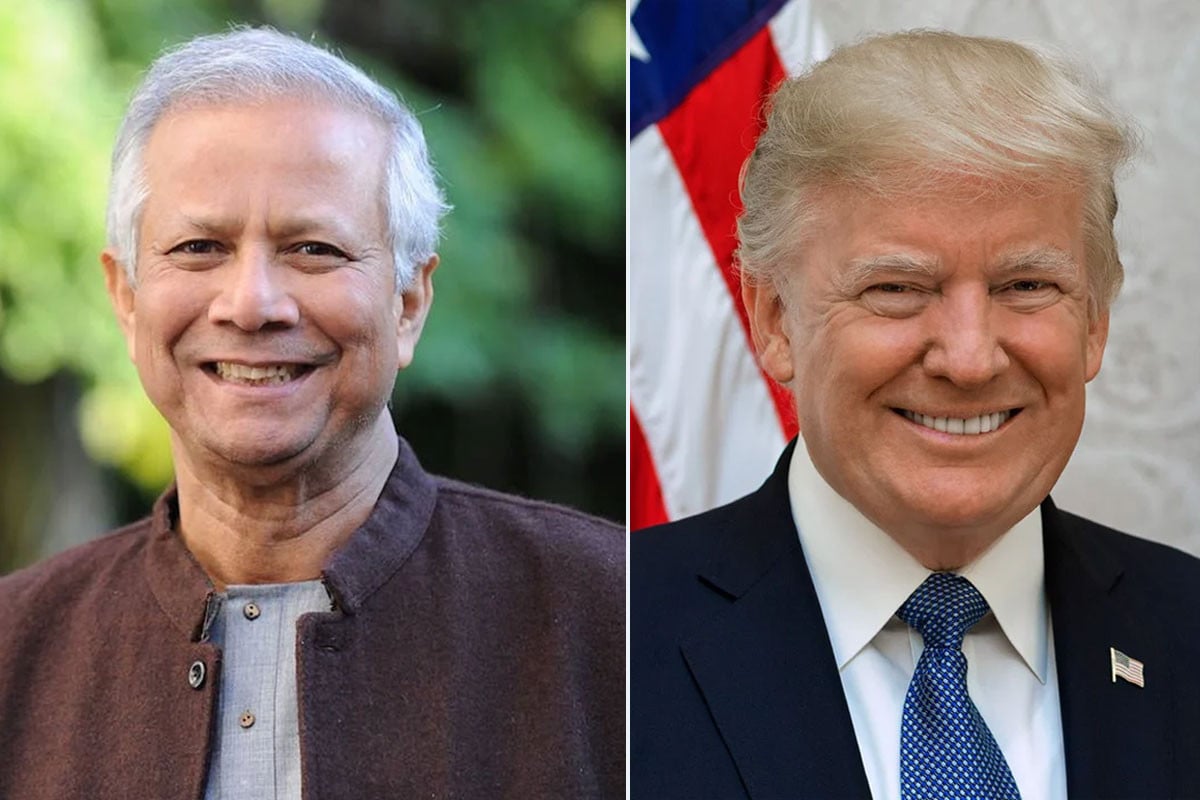

US President Donald Trump announced far broader and bigger tariffs on Wednesday on roughly 60 countries, including massive tariffs on China and its largest trading partners.

The dollar slid broadly while other safe havens rallied as equity markets shuddered at the tariff news.

Greenback takes backseat

The dollar has lost its shine as a chief safety option primarily because of the home-grown turmoil unleashed by Trump tariffs that have heightened the risk of a U.S. recession.

While the dollar typically rallies when the S&P 500 stock index falls, both have fallen recently, in a sign the greenback is not benefiting from safe-haven flows.

"I have for a long time held the view that the dollar, yen and Swiss franc are the three main safe-haven currencies, and now I am starting to change that view", said Russell Investments head of currency and fixed income strategy Van Luu, referring to the dollar's recent performance.

The dollar index has shed nearly 4% this year and had the worst start to a year since 2016, LSEG data shows.

"It seems investors have yet to fully price in recession risks, allowing dollar weakness to persist as capital rotates out of U.S. assets amid fading economic exceptionalism," said Rong Ren Goh, a portfolio manager in the fixed income team at Eastspring Investments in Singapore.

But while Trump's fast-and-loose economic policymaking has hurt confidence in the dollar as the default safe haven, some investors reckon it may regain appeal eventually as global growth suffers.

Source: Reuters

Bd-pratidin English/Lutful Hoque