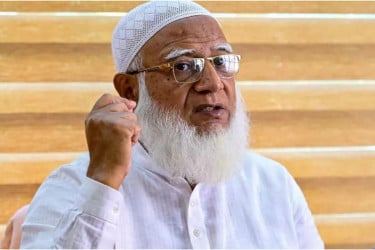

Islami Bank Managing Director (MD) Muhammed Monirul Moula has been placed on mandatory leave for a period of three months, effective from Monday.

The bank has decided to send a formal letter to Bangladesh Bank, detailing allegations against the MD and requesting regulatory action.

Monirul Moula is reportedly implicated in irregularities related to loans involving the much-discussed Chattogram-based businessman, S Alam. In response, the bank has taken steps to address the issue.

The decision was made during the 359th meeting of the Islami Bank Board of Directors, held on Sunday. During the meeting, the bank’s Additional Managing Director, Omar Faruk Khan, was appointed as acting managing director. A member of the board confirmed the development.

Following the fall of the Awami League (AL) government, Bangladesh Bank restructured the bank’s board, appointing former banker Obayed Ullah Al Masud as chairman. Since 2017, Islami Bank has reportedly been under the influence of the business group owned by the controversial figure S Alam, a known associate of former prime minister Sheikh Hasina. After the board restructuring, four auditing firms were engaged to investigate suspected financial irregularities.

Citing a ‘reliable source’ within the bank, the media reported that the audits uncovered loan irregularities amounting to nearly Tk1 lakh crore involving S Alam’s group. After gaining control of Islami Bank, S Alam is said to have supported Monirul Moula’s rise within the institution. He was swiftly promoted—first to additional managing director, and later appointed as MD in December 2020.

On 5 August, following the fall of the AL government, most board members and several deputy managing directors (DMDs) reportedly went into hiding. Despite these developments, Monirul Moula remained in his position for reasons that remain unclear.

It has now emerged that Monirul Moula was directly involved in the loan irregularities. Consequently, the board decided during Sunday’s meeting to place him on a three-month leave. In addition, the bank will send a formal request to Bangladesh Bank under Section 46 of the Banking Companies Act, seeking his removal and submitting evidence of misconduct.

Although it is typically the responsibility of Bangladesh Bank to take disciplinary action against a bank’s MD, Islami Bank has chosen to proactively initiate the process by notifying the central bank directly.

Bd-Pratidin English/ AM