Bitcoin has the potential to be the "most Islamic form of money ever invented," according to experts at the Bitcoin Mena conference in Abu Dhabi, challenging the widely held belief that the cryptocurrency is haram (forbidden) under Islamic law, reads a KT report.

Speakers at the recent conference argued that Islam permits the exchange of anything perceived as money at its spot value—a principle that applies to Bitcoin. While some Muslim scholars assert that money must have intrinsic value and be exchanged hand to hand to be halal, citing a hadith from Prophet Mohammed regarding transactions of commodities like gold, silver, wheat, and dates, experts contend that this interpretation is often misunderstood.

Harris Irfan, CEO of Cordoba Capital Markets, explained that the hadith refers to exchanging items at their present value, not their future value. He argued that Bitcoin aligns with this principle, stating, “Things that are perceived as money should be exchanged at spot value, not at an interpreted future value.”

Economist and Bitcoin advocate Saifedean Ammous echoed Irfan’s view, asserting that the hadith’s reference to "hand to hand" transactions refers to final cash settlements. He emphasized that Bitcoin transactions eliminate ambiguity in ownership, unlike fiat currencies, which are vulnerable to inflation and interest-based systems, including riba (forbidden interest) in Islamic finance.

While many Islamic scholars label Bitcoin as haram because it is not government-backed and lacks intrinsic value, Irfan countered that value is subjective, citing historical shifts in the worth of commodities like oil. He further highlighted that Bitcoin's value is not subject to manipulation by banks or governments, which can engage in double spending through fractional reserve banking.

The conversation also extended to Islamic banking, which some critics argue is not entirely free from interest-based practices. Irfan noted that Islamic banks function similarly to conventional banks, creating money through debt contracts.

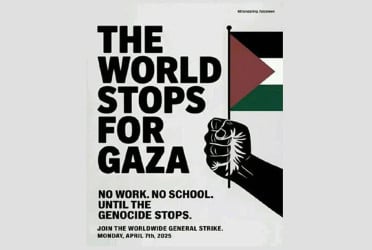

Despite Bitcoin's volatility, Irfan pointed out that fiat currencies are often more volatile due to the control exerted by central banks. He also emphasized Bitcoin's role in facilitating financial transactions in regions with restricted access to traditional banking systems. "The only way I can send money to Gaza for medicines and aid is through Bitcoin,” he said.

Ammous remarked that, historically, innovations like the internet and photography were once considered haram by some scholars but were later widely accepted. He believes Bitcoin could follow the same path, warning that the Muslim world risks missing out on its revolutionary potential.

Experts also stressed the growing disparity between early Bitcoin adopters and those entering the market now, with Ammous adding, “Bitcoin’s price would have gone up a hundred-fold.” He urged more Muslims to embrace Bitcoin as a legitimate and modern form of money, highlighting the missed opportunities for those who delay their investment.

Bd-pratidin English/ Jisan