International Monetary Fund (IMF) again sets deadlines for the reformation of banking and financial sectors of Bangladesh. It has praised publishing economic white papers and various reformative initiatives taken by the interim government and extended its support to these.

Finance Division sources said IMF fixed policy and structural reforms in the banking and financial sector by June of next year. The monetary organization has agreed to provide additional funds needed to complete these reformations.

According to the source, the IMF has strongly recommended to resolve the alleged irregularities and corruption in the banking sector and to make the necessary reforms in the policies. It has also strongly recommended forming strict policies to ensure the freedom of the Bangladesh Bank and ending interference of the board directors in the operational activities of the banks.

Meanwhile, Bangladesh will present government initiatives to reform the financial sector in the annual meeting of the World Bank and IMF scheduled to be held in Washington on October 21-26.

The Finance Division said an IMF delegation visited Dhaka from September 24 to 30. This year’s visit was different from other years as a new government with no ‘political agenda’ is in the driving seat. The interim government is especially working to reform the country. That’s why the IMF has high expectations from this government.

During the visit, the delegation discussed various initiatives taken by the government. Before leaving Dhaka, they gave their suggestions and deadlines.

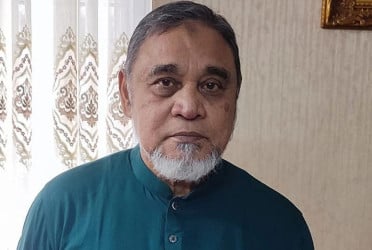

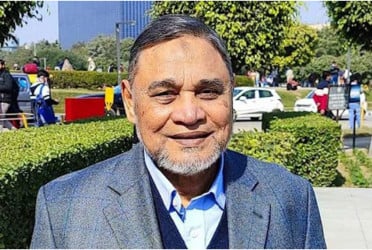

The IMF delegation placed their expectations in separate meetings with Finance Advisor Dr. Salehuddin Ahmed, Bangladesh Bank Governor Dr. Ahsan H. Mansur, and Dr. Debapriya Bhattacharya, head of the economic white paper publication committee. They believe that it is high time to bring effective reforms in the financial sector for sustainable development.

The delegation also discussed the 33 conditions that Bangladesh is bound to comply with to get the next two instalments under the 4.7 billion dollar loan programme. They assured that the IMF will provide necessary assistance to Bangladesh to address these four challenges -- increasing reserves, reducing inflationary pressures, revenue sector reformation and increasing revenue, and lack of good governance in the banking sector.

Among the previous conditions, they suggested implementing -- increasing social spending, raising fiscal revenue, modernizing the monetary policy framework, increasing exchange rate flexibility, reducing financial sector vulnerabilities, developing capital markets, creating an enabling environment for increasing productivity and investment, and better adapting to climate change.

According to the terms of the loan programme, at least 50 per cent of government transactions, excluding interest payments, subsidies, loans, equity and liabilities, must be completed through electronic funds transfer by June 2025. Bangladesh Bank has already started preparing a working paper to present the progress and reformation programme in these subjects.

bd-pratidin/Munna