The dollar crisis is getting worse day by day. The interest rate on bank loans has already exceeded 14 per cent. It is becoming almost impossible to control the dollar exchange rate. Businessmen are under pressure because of the rising interest payments, dollar exchange rates, and other costs. Because of this, they are seriously struggling to repay bank loans on time, and thus they are becoming loan defaulters. Furthermore, it is becoming increasingly difficult for businessmen to run businesses because of the policies set by the central bank. Stakeholders are saying that the dollar crisis is a massive problem for business owners. Because of this dollar crisis, it has become a challenge to open LCs (Letters of Credit). This is having a massive impact on overall business operations. As a result, there are delays in repaying bank loan installments which is causing a lot of businessmen to become loan defaulters. Businessmen should give special facilities to overcome this situation.

The country’s businessmen have become concerned about rising interest rates. At the same time, the amount of overdue loans in the banking sector is also increasing. A lot of good businessmen are not able to pay their loan instalments because of the pressure of high interest rates. Businessmen are in crisis due to the increase in interest rates. Gas and electricity bills have doubled. To tackle inflation, operational costs including employee salaries have been increased by 30 per cent. A lot of businessmen are forced to shut down their businesses due to the doubling of loan interest rates. If this continues, defaulted loans will increase rapidly which will ultimately lead to price hikes of essential products and inflation.

A few months ago, Bangladesh Bank allowed the interest rates of loans to be determined by the market. On the same day, the bank implemented the 'crawling peg' policy to determine the dollar's exchange rate which ultimately resulted in a 6.36 per cent devaluation of the taka against the dollar within a day. The central bank set the rate Tk 117 for one dollar even though at the beginning of that day, the exchange rate was set at Tk 110. Thus, officially, the dollar price increased by Tk 7 in just a single day. Considering the declared dollar rate, over the last two years, Taka has been devalued by almost 40 per cent. From Tk 84, the dollar is now being traded at Tk 121 to 122.

Because of this devaluation of the Taka, the prices of imported products have increased rapidly. At the same time, the cost of business also increased. Recently, even though remittance has increased slightly, export volumes have decreased for a number of reasons. As a result, the country is facing a dollar deficiency. Many small companies that have regularly paid off their loans in the past are now struggling to pay their instalments properly.

According to the statistics of Bangladesh Bank, in the last year, default loans have increased by almost Tk 110,000 crore. One of the big reasons for this is that businessmen have failed to make timely instalment payments due to increased dollar rates.

Businessmen said that they are unable to open LCs for imports in accordance with the demand due to the dollar crisis. According to the Bangladesh Bank, in the 2022-23 fiscal year, the import rate declined by 15.81 per cent. By December 2023, this rate had nearly reached 30 per cent for the 2023-24 fiscal year. Currently, imports are at half the amount that was being imported monthly in the 2021-22 fiscal year. Many companies are unable to hit the optimal production capacity as they cannot import capital machinery and raw materials.

Multiple businessmen told Bangladesh Pratidin that most banks do not want to open LCs at the current dollar rates set by the central bank. They have to pay more than the fixed rate. When the fixed rate was Tk 110, no bank agreed to open LCs at that rate.

A senior official of a leading business group said that banks only want to open LCs if they get paid more. Sometimes, they have to buy dollars from the kerb market. Furthermore, they also informed that private sectors are in serious crisis due to reduced loan flow, increased interest rates, dollar crisis and chaos over the dollar exchange rate, inability to open LCs, gas crisis and high inflation. If the situation does not improve businessmen will become loan defaulters and that will further destabilize the banking sector. As the crisis is intensifying day by day, the dollar exchange rate is also increasing rapidly. Even in January 2023, the maximum exchange rate for the dollar was Tk 85. Currently, it is Tk 117. However, no bank is providing dollars at Tk 117 even though it is the declared rate by the central bank.

Importers alleged that banks are charging between Tk 124-125 per dollar. So the dollar exchange rate has increased by almost 47 per cent. This is causing continuous losses for many businessmen.

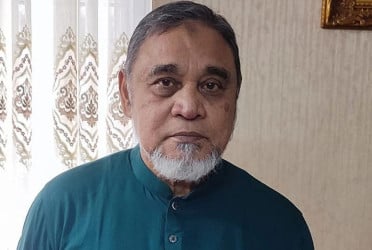

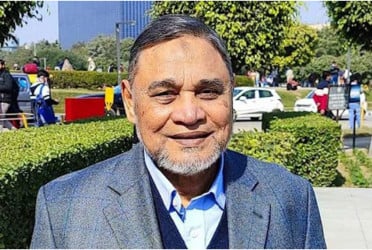

Abdul Hai Sarkar, chairman of the Bangladesh Association of Banks (BAB), said, “As business owners must buy dollars at excessive rates and pay extra money for LCs, authorities should consider providing subsidies and sacrifice to these businesses.”

bd-pratidin/Rafit