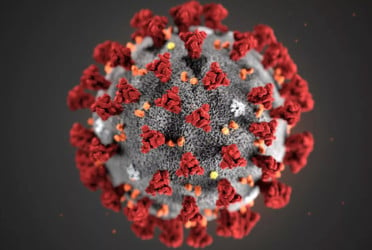

The country's 80 percent of the banks were victims of cyber attacks in 2022 as many banks have become victims of malware in addition to data theft.

Bangladesh Institute of Bank Management (BIBM) revealed these data.

The organization said that more than 80 percent of the country's banks do not have the ability to prevent such risks. BIBM published a report on this in a recent event.

Everything from banking sector transactions to accounting is now dependent on technology. But BIBM took the initiative to find out how secure that technology system is.

For this, the BIBM has conducted a survey on 32 commercial banks of the country. The survey revealed that 81 percent of the country's bank systems have closed at some point due to poor management. Data was stolen from 11 percent of banks. 61 percent of banks have been victims of malware (virus) attacks. 15 percent of banks have had their servers hacked. And fraud happened in 20 percent of banks. 81 percent of banks have lost data.

Mahbubur Rahman Alam, Associate Professor of BIBM said, 11 percent of bank information stolen and 15 percent of bank server intrusion incidents are less in number but highly sensitive and unacceptable.

Accorting to the report, 23 percent of these accidents were high risk. 13 percent are very high risk. Moderate risk was about 40 percent of attacks. The lowest risk was 21 percent. Due to these accidents, 47 percent of banks had to face losses. The major cause of these accidents is lack of technical knowledge. 89 percent of banks do not have skilled manpower to deal with cyber attacks. Therefore, 80 percent of banks try to deal with cyber attacks through external manpower or outsourcing.

Deb Dulal Roy, Executive director of Bangladesh Bank said, “After getting into trouble, I told everyone to take two days of training. End after training. Then again everybody went to sleep (hibernation) for 10 years. But then nothing of the security system will be right.”

Kaniz Rabbi, Assistant Professor of BIBM said, “Where information technology is being updated every moment, if we update every two years, then you can understand that we are really behind in this regard. I think banks should pay some attention to this.”

Mushfiqur Rahman, the Chief Information Security Officer of First Security Islami Bank Limited said, If 20 to 30 percent of the money that goes abroad for technology management is used for research and development, then we can be free from the risk of cyber attacks in the future.

@ The article was published on print and online versions of The Bangladesh Pratidin on October 22, 2023 and has been rewritten in English by Tanvir Raihan.