The nation's economy is grappling with the detrimental effects of smuggling, while expatriates continue to send their hard-earned money back home. Meanwhile, corrupt officials and bribery networks are siphoning off the country’s wealth, leading to extravagant lifestyles abroad. These dishonest individuals exploit the nation’s resources, undermining development and stealing vital public assets meant for the country’s growth.

Instead of contributing to the nation's economy, a powerful smuggling syndicate has siphoned off at least 17 lakh crore taka from the country. Operating under the protection of political figures, the criminals are funneling these ill-gotten gains into purchasing lavish villas and apartments for themselves and their families in Dubai, Canada, Malaysia, and Singapore. Meanwhile, many of the banks they looted are now teetering on the brink of bankruptcy.

Despite the change in government, money launderers remain beyond reach. Groups like Summit, which have amassed vast fortunes in countries such as Singapore through illicit money laundering, continue to operate with little interference. Efforts to recover these funds have so far been limited to sending letters, with little tangible progress in holding those responsible, accountable.

As the government prioritizes tackling money laundering, new revelations have emerged regarding the purchase of 847 luxury properties, including flats, villas, and other assets in Dubai. Among them, former Land Minister Saifuzzaman Chowdhury is reported to have acquired 137 flats. Further sensational details have come to light through a report compiled by the Foreign Real Estate Investment Database, shedding more light on these questionable transactions.

Bangladesh is currently facing a severe economic crisis, as reported by Bangladesh Bank and both domestic and international media. The ongoing instability, fueled by the dollar crisis, rising defaults, and financial scandals, shows no signs of abating. Meanwhile, scandal involving the anonymous looting of bank funds and their illegal transfer abroad has become the latest topic of national concern.

Dubai has emerged as a key destination for money laundering from Bangladesh, joining Canada, Singapore, and Malaysia as a hub for illicit financial activity. Former ministers, lawmakers, bureaucrats, businessmen, and individuals from various sectors are reportedly involved in funneling money into the city. Leaked information continues to surface, revealing details of property purchases in one of the world's most luxurious cities, further fueling concerns over the growing scale of the operation.

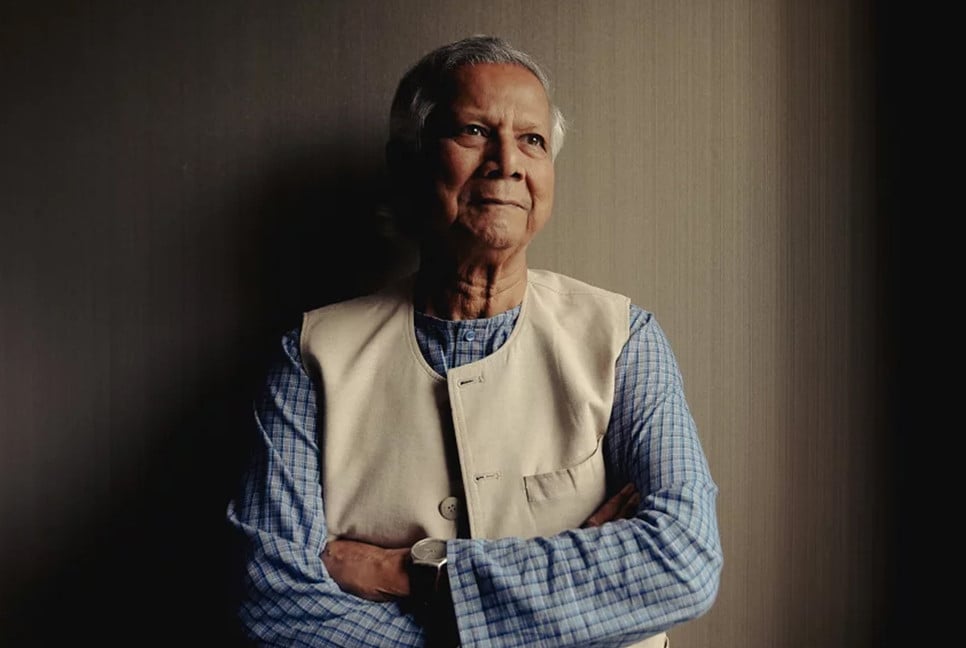

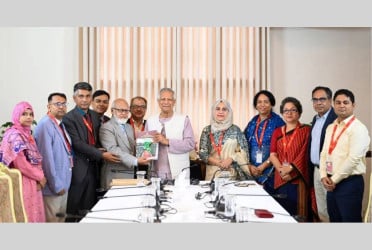

With Dr. Muhammad Yunus now at the helm of the interim government, the call for the return of smuggled funds has gained significant momentum. Analysts are optimistic that his extensive global network will enable him to recover a substantial portion of the illicitly transferred money. These funds, they believe, could play a crucial role in the nation's economic recovery and reconstruction amid the ongoing crisis.

Economists and bankers remain hopeful that the laundered money can be recovered, though they acknowledge that the process will take time. They point out that the funds were primarily siphoned off with the assistance of banks that were heavily influenced by the previous government. Additionally, the lack of proper oversight in many of these banks has contributed significantly to the issue. While the recovery of these funds will be a lengthy process, experts believe the government is taking the right steps toward achieving this goal. However, some economic analysts argue that fully recovering the money may be nearly impossible. They suggest that a successful bilateral government-to-government effort could potentially lead to the return of at least a portion of the funds.

Following a review of the information, it has been revealed that the Organized Crime and Corruption Reporting Project (OCCRP) in its report 'Dubai Unlocked,' along with the Norwegian media outlet E-24, have already exposed details about property purchases linked to money laundering activities.

A recent report, based on data from 2020 to 2022, reveals that Bangladeshis have acquired ownership of at least 100,000 companies across various cities, including Dubai and Abu Dhabi in the United Arab Emirates, using money laundered from Bangladesh. Additionally, the 'Atlas of Offshore World' report, published by the EU Tax Observatory, states that Bangladeshi nationals hold offshore assets valued at approximately 700 billion taka in global tax havens. This amounts to 1.3 percent of Bangladesh’s total GDP, with at least 600 billion taka parked in Asian tax havens, and the remainder spread across Europe and the United States.

Earlier, the Pandora Papers published by ICIJ also included many Bangladeshis in the list of money launderers. Recently, the government, including the Governor of Bangladesh Bank, is saying that the amount of money laundered from the country is at least 17 lakh crore taka. Although there have been many discussions about money laundering, many initiatives and activities of the government are known, it is still limited to sending letters. The smuggling ring and their masterminds have not yet been identified. Various government sources say that despite efforts to bring back the money, success is still elusive.

According to data from Global Financial Integrity (GFI), an average of 1.5 lakh crore taka has been laundered from Bangladesh annually since the 1990s. A significant 85 percent of those involved in this illicit activity are businessmen, who are using under-invoices and over-invoices in the import-export trade to move large sums of money. There are also growing concerns about the rise in money laundering through digital currencies. The sheer scale of these financial crimes has been detrimental to the country's economy, with Bangladesh’s GDP growth reportedly decreasing by an average of 2-3 percent each year due to the outflow of illicit funds.

The government had previously developed a strategy paper titled 'National Strategy for Preventing Money Laundering and Combating Financing of Terrorism 2019-21,' which identified ten key destinations for money laundering. These included the United States, the United Kingdom, Canada, Australia, Singapore, Hong Kong, the United Arab Emirates, Malaysia, the Cayman Islands, and the British Virgin Islands, along with several other countries. While measures have been taken, including the creation of the strategy paper, the success in recovering money laundered abroad has been minimal, with little progress in repatriating the illicit funds.

Hundreds of Bangladeshi-owned flats and villas are now scattered across Dubai, including within the iconic Burj Khalifa, the world’s tallest building. Built over five years by 6,832 workers, with 4,000 of them hailing from Bangladesh, this luxurious skyscraper stands as a testament to their hard work. These expatriate workers, many from struggling families, left their loved ones behind and traveled to the scorching desert in hopes of changing their fortunes, sending their savings back home as remittances. However, a corrupt class of individuals has exploited this hard-earned money through various schemes, using it to purchase luxury apartments in this very building. Reports indicate that these illicit gangs have acquired at least 77 flats in the Burj Khalifa alone by laundering the country's funds.

Bangladeshis have become prominent property owners in Dubai's most prestigious and luxurious neighborhoods, including Palm Jumeirah, Marsha Dubai, Wadi Al Safa, Al Habiyah, Hadek Sheikh Mohammed Bin Rashid, Madinat Al Sheba, Jabel Ali, and Mercada. These areas, renowned for their opulence, attract billionaires from across the globe, but now, they are also increasingly filled with properties acquired through money laundering by corrupt Bangladeshi individuals. Local sources report that these elites have purchased not just one or two, but dozens of properties in prime locations, including Dubai Maritime City, Grande, The Polo Residence, Royal Atlantis, Dubai Hills, Rukon, Wadi, Palm Jumeirah, Burj Khalifa, and numerous other luxury buildings and condominiums.

Kaler Kantho has uncovered information regarding the purchase of 847 flats, villas, apartments, and commercial properties in Dubai, funded through thousands of crores of taka laundered via bank fraud, import-export schemes, tax evasion, and bribery. According to a report compiled from the Foreign Real Estate Investment Database and Kaler Kantho's own investigation, 134 Bangladeshi individuals have acquired 847 of these properties in some of Dubai's most exclusive areas in recent years. The prices of these properties range from a minimum of 35 million taka to several hundred million taka.

The list also reveals several well-known individuals, including former Land Minister Saifuzzaman Chowdhury, who is reported to have purchased 137 flats and hotel apartments. These properties, located in prime areas such as Nad Al Sheba, Palm Jumeirah, Burj Khalifa, and The Polo Residence, were bought in his name.

The investigation has revealed that a 3,353-square-foot flat in Palm Jumeirah is priced at approximately Tk 40 crore, while a 985-square-foot flat in Burj Khalifa costs around Tk 11 crore. Former Land Minister Saifuzzaman Chowdhury purchased the majority of his properties in The Polo Residence, where a 932-square-foot flat is valued at around Tk 4 crore. When calculating the total cost based on the smallest flat sizes, it is estimated that Chowdhury spent at least Tk 550 crore on his 137 flats.

Sources indicate that the property purchases do not stop there; reports suggest that Saifuzzaman Chowdhury owns additional flats in Dubai. Moreover, he is also said to have acquired numerous properties in other countries, including the United States and the United Kingdom. Allegations are mounting that many of these properties were bought using money smuggled out of Bangladesh. In addition, information has surfaced regarding four flats registered under the name of Chowdhury Nafis Sarafat, including two in Burj Khalifa and two in Grande.

A review of the data reveals that Saifuzzaman Chowdhury ranks first among the top ten buyers of flats, villas, and other properties in Dubai, having purchased a total of 137 properties. Rubaiya Laskar follows in second place with 32 properties, while Ashiqur Rahman Laskar ranks third with 30 properties. Mostafizur Rahman is in fourth position, also with 30 properties, and Md. Idris Shakur rounds out the top five, having acquired 21 properties.

Mirza Samia Mahmud holds the sixth spot on the list, having purchased 15 properties. Khalid Hekmat Al Obaidi is in seventh place with 15 properties located in various areas of Dubai. Manoj Kanti Pal follows in eighth place, owning 14 properties. Mohammad Shafiul Alam ranks ninth with 13 properties, while Kazi Mohammad Osman rounds out the top ten, having acquired 12 properties.

The number of flats and properties that exist in Dubai-

Of the 847 properties acquired through smuggling proceeds, 338 were flats, 70 were villas, 45 were hotel apartments, and 24 were residential apartments. Additionally, 357 other properties, including offices, shops, and commercial spaces, were purchased. Among these, 77 properties are located in Burj Khalifa, 28 in Palm Jumeirah, 145 in Marsha Dubai, 96 in Wadi Al Safa, 15 in Al Habiyah Third, 33 in Hadek Sheikh Mohammed Bin Rashid, and 34 in Madinat Al Matar. Other notable locations include 125 properties in Nad Al Shiba, 20 in Jabel Al Industrial, two in Mirdif, six in Al Mercadh, with another 260 properties scattered across various other areas.

Other individuals who acquired properties with smuggled funds-

A review of the list reveals that Kazi Mohammad Osman, Mohammad Salman, and Mukarram Hossain Omar Farooq each purchased 12 properties. Syed Ruhul Haque acquired 11 properties, while Golam Mohammad Bhuiyan, Mohammad Abdul Majid Ali, and Mohammad Emran Hossain each bought 10 properties.

The list also includes 10 individuals who have each purchased eight flats and properties. These individuals are Farzana Chowdhury, Ian Wilcock, Khurshida Chowdhury, M Sajjad Alam, Mohammad Golam Mostafa, Mohammad Elias Bazlur Rahman, Nasir Uddin Ahmed Chowdhury, Nazrul Islam Anu Mia, Samira Ahmed, and Tasbirul Ahmed Chowdhury.

Seven individuals are listed as having purchased six flats and properties each. These individuals are Abu Yusuf Mohammad Abdullah, Humaira Salimul Haque Esha, Mohammad Shafi Abdullah Nabi, Mohammad Waliur Rahman, Nahid Qureshi, Salimul Haque Esha, Samina Salman, and Syed Salman Masud.

The list also includes 37 individuals who have each purchased four flats and properties. These individuals are Ahmed Imran Chowdhury, Ahmed Ifzal Chowdhury, Alhaj Mizanur Rahman, Anjuman Ara Shahid, Anwara Begum, Aziz Al Mahmud, Aziz Al Masud, Bilkis Iqbal Dada, Chowdhury Hasan Mahmud, Dewan Shazedur Rahman, Farhana Munem, Fatima Begum Kamal, Gulzar Alam Chowdhury, Hasan Ashiq Taimur Islam, Hasan Reza Mahmudul Islam, Iftekhar Rana, Juron Chandra Bhowmik, Khaled Mahmud, MD Abdus Salam, MD Abul Kalam Arshad Ali, MD Iftekhar Uddin Chowdhury, MD Rabbi Khan, MD Selim Reza, Md. Mizanur Rahman Bhuiyan, Mohammad Al Ruman Khan, Mohammad Moin Uddin Chowdhury, Mohammad Miraj Mahmud, Mohammad Nazir Ahmed, Mohammad Mushfiqur Rahman, Mashiur Rahman Bhuiyan, Mustafa Amir, Mustafa Jamal Naser, SU Ahmed, Syed Mahmudul Haque, and Syed Samiul Haque. In addition, many others are listed for purchasing various properties, including flats, villas, and other real estate, in amounts ranging from one to three properties.

Money laundering activities also detected in Canada, Malaysia, and Singapore-

Muhammad Aziz Khan, owner of Summit Group, is not only the wealthiest person in Bangladesh but also ranks among the richest individuals in Singapore. According to the globally renowned magazine Forbes, Khan holds the 41st spot on Singapore's list of wealthiest people, with a net worth of $1.12 billion. However, Bangladesh Bank has no record of him legally transferring this money from Bangladesh. To date, the central bank has approved 24 ventures of 20 companies in Bangladesh, allowing them to invest a total of $69.5 million (approximately $70 million) abroad. This raises the question: how did Aziz Khan amass such vast wealth to become one of Singapore’s richest individuals?

Awami League leader Md. Abdus Sobhan Golap is reported to own nine houses in New York, while former Foreign Minister Hasan Mahmud possesses a property in Belgium, along with various other assets. Shamima Sultana Jannati, wife of former MP Shafiqul Islam Shimul, owns a house in Scarborough, Toronto, Canada. Additionally, Abdul Hannan Ratan, a controversial loan defaulter and former Brahmanbaria District Awami League Organizing Secretary, is said to have three properties in Canada. Muhammad Mohsin of Saad Musa Group is also reported to own a house in the United States. Information about these assets, among others, has surfaced in the media over time. Furthermore, former army chief General (retd.) Aziz Ahmed, former Inspector General of Police (IGP) Benazir Ahmed, former DB chief Harun Or Rashid, and several others are also under scrutiny regarding their foreign assets.

Following the exposure of the casino scandal, expelled Jubo League leader Khaled Mahmud Bhuiyan sought legal assistance from Thailand, Malaysia, and Singapore regarding the laundering of Tk 55.8 million. Similarly, requests for legal assistance were made to Singapore and Malaysia concerning the laundering of Tk 120 million by Selim Pradhan, director of Japan Bangladesh Security and Printing in the United States, Tk 43.4 million by Lokman Hossain Bhuiyan, Tk 30 million by expelled Jubo League leader Ismail Chowdhury Samrat, and Tk 44.7 million by Mominul Haque Saeed. However, it is reported that these requests for assistance went unanswered.

What the bankers, analysts and economists are saying?

Faruk Moinuddin, former Managing Director of Trust Bank and current Vice Chairman of BRAC Bank, spoke to Kaler Kantho about the reasons behind money laundering and the challenges in recovering laundered funds. He stated, "A major reason for money laundering is the non-compliance of banks. It is difficult to launder money through banks that are compliant. The sensitive software that compliant banks use for imports strictly monitors under and over invoicing. It seems that more money is laundered through banks that have provided assistance intentionally. And legal steps must be taken to return the laundered money. In addition, communication can be increased through personal and diplomatic channels. Many of the top levels of the interim government have good connections with the outside world. That opportunity can be used to return the money."

Dr. Mashrur Riaz, a former economist at the World Bank and chairman of the research organization Policy Exchange, discussed the issue of money laundering in the country, stating, "There is no doubt that money has been laundered. The money was mainly laundered through banks that were under political influence. They took loans from those banks and spent it. Added to this is the issue of corruption in the work and procurement of government development projects in the last 10 years. Not only in mega projects, but there has been widespread corruption in projects worth 100 or 200 crore taka. This money was mainly laundered."

He further commented that the current government has taken responsibility and placed special emphasis on the issue. "When the money will be returned is another matter. However, I think the steps they have taken so far are on the right track. There is good supervision under the leadership of Bangladesh Bank. They are also talking to foreign partners and the government. However, it is difficult to say right now when the money will be returned," he said.

(Source: Kaler Kantho)

Translated by Mazdud