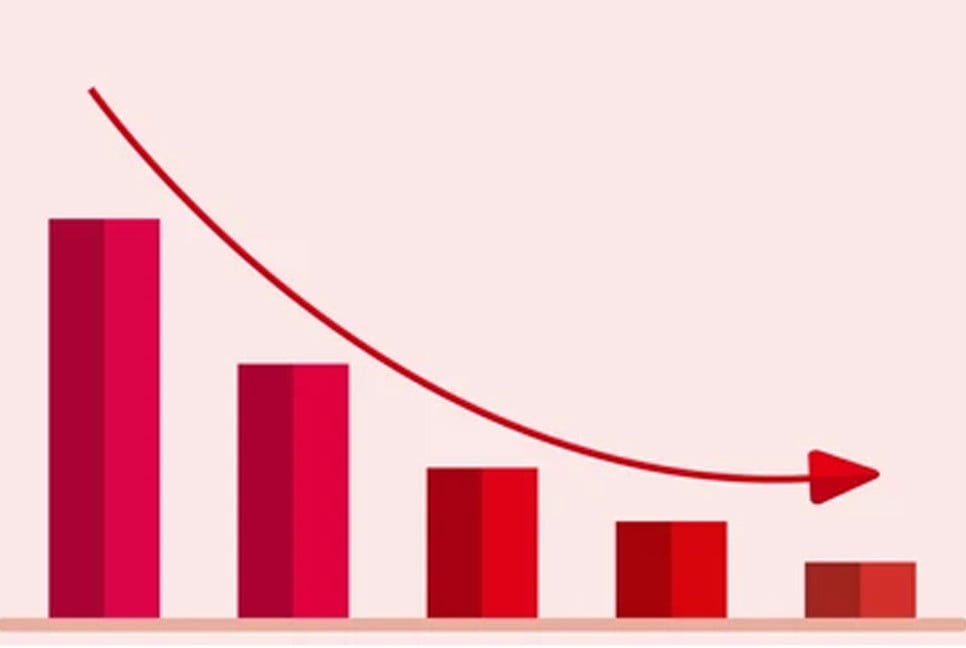

Private investments are declining every day.

Despite facing no problem, several Banks didn’t disburse any loans to the private sector during the last eight months. Besides the loan problems, businessmen cannot issue an LC (Letter of Credit).

Hence, no job opportunities were created during the period. On the contrary, around 250 garment factories were shut in the last three months.

Facing the LC and dollar crisis, many factory owners have closed their mills.

It was known that the amount of loans and investments in the private sector is declining gradually every month, resulting in a negative impact on the employment ecosystem.

Sources in the Bangladesh Bank confirmed that the amount of private investment in the banking sector has now fallen to its lowest level.

In January, the loan growth was 7.15 percent, with a fall of 0.13 percent compared to December. The latest data shows the loan growth below 7 percent, which is the lowest count in recent months.

The indicators show a continuous decline in loan growth.

Although loan growth fell to 7 percent in 2021 due to the COVID-19 pandemic, growth was in double digits at other times.

As the deposit growth in the banking sector has decreased to below 7.5 percent, banks have a lesser amount of investable funds. Many banks were left with no money to disburse loans to the private sector.

According to Bangladesh Bank data, the loan balance of the private sector stood at 16 lakh 80 thousand and 110 crore taka in January last year, which declined to 15 lakh 67 thousand and 943 crore taka at the end of the month.

The current growth is much lower than the average interest rate. Currently, the average interest rate on bank loans is about 12 percent. At the same time last year, it was below 8 percent. In May 2021, loan growth once fell below 8 percent.

In the post-pandemic month, the growth rate was 7.55 percent. In the 2007-08 fiscal year, the highest credit growth in the private sector was 25.18 percent. The next fiscal year, the growth was 24.24 percent.

The growth rate remained in double digits until November 2019, with a drop to 9.87 percent.

All of a sudden, the government’s debt from the banking sector started to rise. The government has borrowed a total of 38 thousand and 510 crore taka as of March 10 of this fiscal year a sudden rise from 13 thousand and 571 crore taka in January.

In other words, the amount of government debt from the banking sector has doubled in just 40 days ending on March 10, compared to the first seven months of the current fiscal year.

Due to the instability, factories in a row are being shut down. More than a hundred factories have been closed in the last eight months in Savar, Ashulia, Dhamrai and Gazipur in Dhaka.

Last January, the Keya Group announced the closure of six of its factories.

The closure hits the ready-made garments (RMG) and textile sector hard as most of the factored that were closed are from this genre. As a result, the unemployment crisis increases.

Eminent economists and bankers say that the private sector is the key part of a country’s economic growth. “To ensure employment, we have to focus on the private sector.”

“The production, marketing, and service sectors of industry are all dependent on the private sector. If the current negative trend in investment conditions continues, the situation of business and industries will worsen in the future,” they continued, adding that businessmen will find themselves in a more delicate situation with the increased defaulted loans.

Managing Director of Mutual Trust Bank Limited Syed Mahbubur Rahman said while answering a question, “Everyone is worried about various types of uncertainty and the law and order situation.”

“Due to the uncertainty in the country, no businessmen are interested in new investments,” he continued.

“However, despite the liquidity crisis, banks are still disbursing loans if they find good projects,” he continued, adding that everyone is more focused on maintaining their existing businesses.” The banking professional found this as the reason behind the decline in the private sector loan growth.

Translated by AM