The first thing I would like to say about money laundering is that there is no opportunity to take large sums of money out of Bangladesh. I know this firsthand from my experience at the Bangladesh Bank. While I am aware of what I have observed as a consultant or economist, the individuals directly involved in this matter possess greater expertise than I do.

What they told me was that the money launderers would carry part of their illicit funds in briefcases filled with cash dollars. Essentially, it was the cash dollars that were leaving the market. It's possible to carry several hundred thousand dollars in a briefcase. Those involved in money laundering didn’t transfer billions at once; such a thing isn’t feasible.

This group operated on a regular basis, often moving dollars this way every week. In fact, many of these money launderers are seen arriving in New York and purchasing properties with cash.

It's simple. They are not going through any mortgage or other methods. There are certainly many other ways to launder money.

Now, if I talk about the possibility of recovering the money, my view is that the chances are very slim. Those who laundered the money have already ensured its safety.

They have bought a house, and that house can't be taken back. For example, many have bought properties in Singapore, Cyprus, Dubai, or several other countries. The governments of those countries actually encourage the transfer of dollars in this way. They want to increase the flow of dollars into their economies because it benefits them. This boosts their foreign currency reserves.

They have openly declared that they will offer incentives for investment. Now, they will not just give away those benefits for nothing. If we want to bring the money back, it would hurt their interests. Why would they allow that?

It won’t happen this way.

However, there is one way, and that is the G2G (government-to-government) approach.

Through diplomatic channels, governments can negotiate to recover a portion of the illicit funds.

It will be essential to convince the foreign government that the money was obtained illegally and wrongfully taken. If the foreign government is sympathetic, they may, under certain circumstances, agree to return part of the laundered money by exploiting legal loopholes.

However, beyond this, the money launderers face no risk regarding their investments in those countries, as the law in those nations offers them protection.

If someone takes money to Singapore, the country's leader may be so pleased that he might even invite them for dinner.

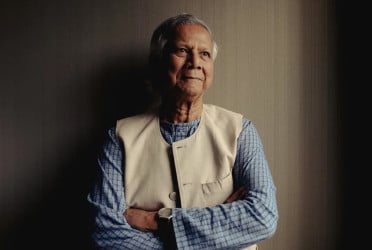

However, the situation could shift if someone like Professor Yunus intervenes, saying, "A person like this has brought the money through such means; we need your help. Keep a portion, and return the rest to us." This approach could potentially work.

In essence, leveraging Dr Yunus's reputation could help facilitate the recovery of laundered funds.

Author: Former Chief Economist, Bangladesh Bank

Translated by ARK/Bd-Pratidin English