Sri Lanka will hold a presidential election on Sept. 21 that will likely be a test of confidence in President Ranil Wickremesinghe’s efforts to resolve the country’s worst economic crisis.

The date was announced by the independent elections commission Friday, which said nominations will be accepted on Aug. 15.

Wickremesinghe is expected to run while his main rivals will be opposition leader Sajith Premadasa and Anura Dissanayake, who is the leader of a leftist political party that has gained popularity after the economic debacle.

It will be the first election in the South Asian island nation after it declared bankruptcy in 2022 and suspended repayments on some $83 billion in domestic and foreign loans.

That followed a severe foreign exchange crisis that led to a severe shortage of essentials such as food, medicine, fuel and cooking gas, and extended power outages.

The election is largely seen as a crucial vote for the island nation’s efforts to conclude a critical debt restructuring program and as well as completing the financial reforms agreed under a bailout program by the International Monetary Fund.

The country’s economic upheaval led to a political crisis that forced then-President Gotabaya Rajapaksa to resign in 2022. Parliament then elected the then-Prime Minister Wickremesinghe as president.

Under Wickremesinghe, Sri Lanka has been negotiating with the international creditors to restructure the staggering debts and to put the economy back on the track. The IMF has also approved a four-year bailout program last March to help Sri Lanka.

Last month, Wickremesinghe announced that his government has struck a debt restructuring deal with countries including India, France, Japan and China — marking a key step in the country’s economic recovery after defaulting on debt repayment in 2022.

The economic situation has improved under Wickremesinghe and severe shortages of food, fuel and medicine have largely abated. But public dissatisfaction has grown over the government’s effort to increase revenue by raising electricity bills and imposing heavy new income taxes on professionals and businesses, as part of the government’s efforts to meet the IMF conditions.

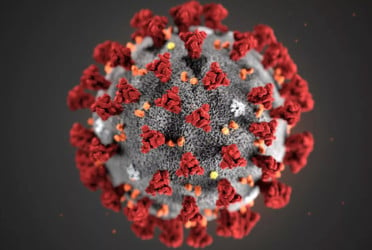

Sri Lanka’s crisis was largely the result of staggering economic mismanagement combined with fallout from the COVID-19 pandemic, which along with 2019 terrorism attacks devastated its important tourism industry. The coronavirus crisis also disrupted the flow of remittances from Sri Lankans working abroad.

Additionally, the then-government slashed taxes in 2019, depleting the treasury just as the virus hit. Foreign exchange reserves plummeted, leaving Sri Lanka unable to pay for imports or defend its beleaguered currency, the rupee.

Under the agreements with its creditors, Sri Lanka will be able to defer all bilateral loan instalment payments until 2028. Furthermore, Sri Lanka will be able to repay all the loans on concessional terms, with an extended period until 2043. The agreements would cover $10 billion of debt.

By 2022, Sri Lanka had to repay about $6 billion in foreign debt every year, amounting to about 9.2% of gross domestic product. The agreement would enable Sri Lanka to maintain debt payments at less than 4.5% of GDP between 2027 and 2032.

Bd pratidin English/Lutful Hoque