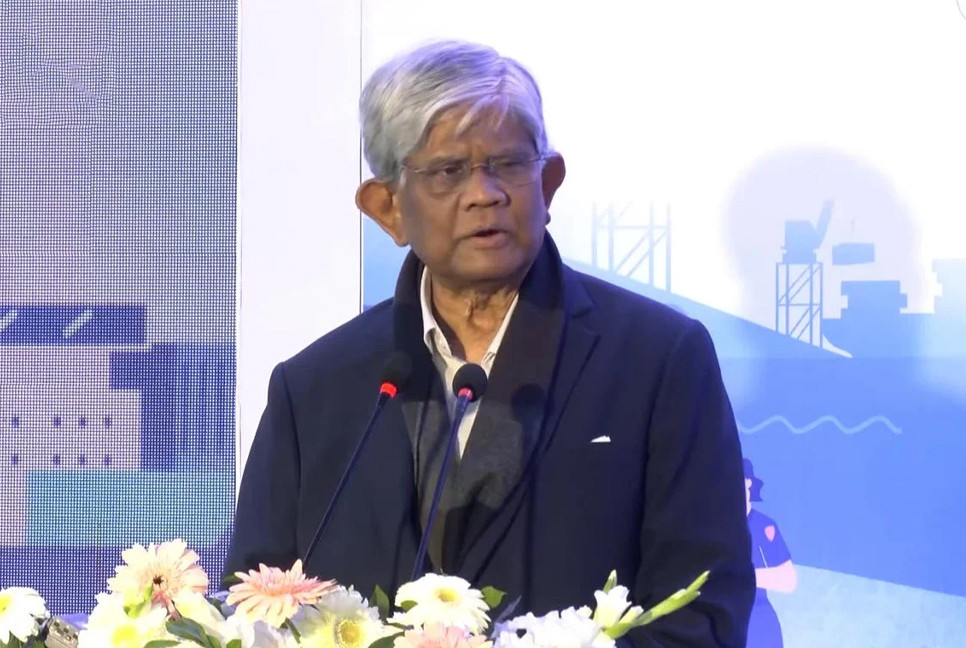

Chairman of the National Board of Revenue (NBR) Md Abdur Rahman Khan on Monday requested the Finance Adviser to reduce the budget size and give some relaxation to the mass people.

“I have requested (Finance Adviser), sir please cut short the budget size and give some relief to people,” he said while speaking at the pre-budget meeting with Economic Reports’ Forum (ERF) held at Revenue Building, reports UNB.

He also said, “Bangladesh’s next budget would be a business-friendly beautiful one. We might lose some revenue due to this.”

However, the NBR chairman said, “Taxpayers who were previously paying a reduced rate would have to pay the regular rate, more or less, from the next fiscal year. We will propose it to the policymakers.It would bring good for everyone.”

Abdur Rahman Khan stated, “The number of quality taxpayers is very negligible in the country.We had taken aggressive policy to increase the tax collection.”

He said that work on increasing the operational efficiency has been taken to catch the tax evaders through improving professional excellence, and put emphasis on containing tax evasion in the country that has become a normal phenomenon.

Talking about the Value Added Tax (VAT), Abdur Rahman Khan said that it is now in a total indiscipline situation.

He said that if input VAT credit and standard VAT rate can be imposed properly, then for many business entities the rate would be less than one percent.

The NBR chief added that the VAT Law, introduced in 2012, was significantly distorted over time and later amended in 2019 to address these distortions.

“The power of VAT was accounting based and invoice based one, we have destroyed that, as a result it is not growing right now, we have uprooted the main strength of VAT, we want to return the discipline of VAT,” he said.

When the issue of wealth tax was placed, the NBR chairman said that it was in the country in 1963, later it was scrapped in 1999.

“If we can digitize the total system, bring the valuation of assets under a model, then it will definitely reduce the discrimination of wealth in the country, it will also be an extra source of revenue,” he further added.

He also hinted that slowly the government would go for wealth tax getting out from the surcharge on wealth if the valuation of land and building can be established on a non-debated platform.

Bd-pratidin English/ Afia