There is a positive trend in remittance inflows, with export revenues showing approximately 8% growth. Foreign reserves have also remained stable. However, the economy as a whole remains fragile—this is beyond question.

The most significant obstacle to reviving economic momentum is uncertainty, both political and economic. Presently, the country faces a state of political uncertainty, which must be resolved before addressing economic instability. However, achieving complete stability overnight is unrealistic. In the meantime, the government must implement critical economic measures to tackle systemic issues.

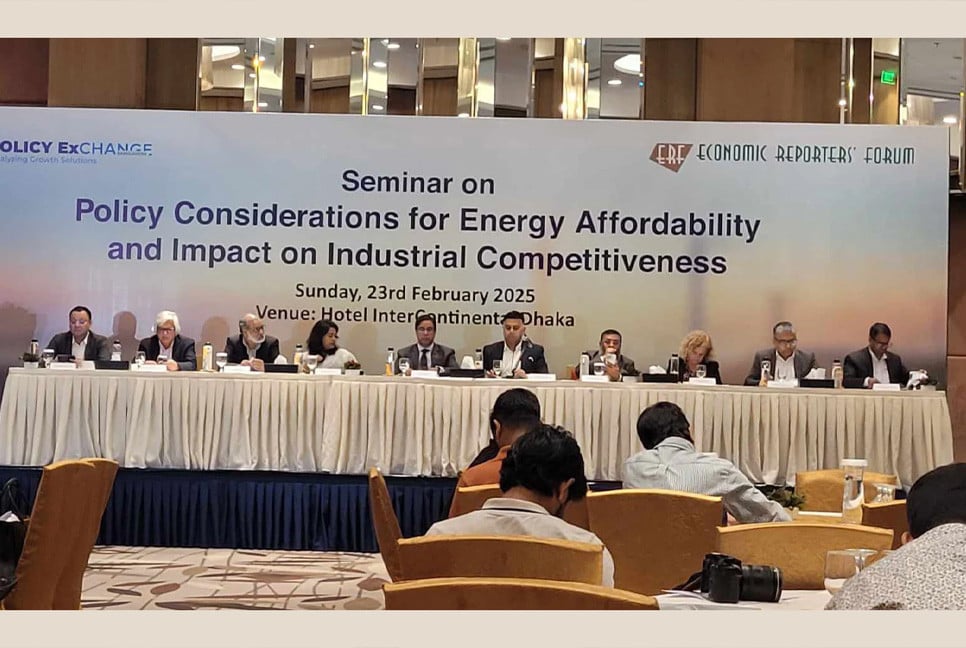

Challenges in the banking, energy, and financial sectors need urgent attention. Regulatory reforms, particularly within the National Board of Revenue (NBR) and the Bangladesh Investment Development Authority (BIDA), must yield results. A specific economic action plan, integrated into the upcoming budget, is essential to navigate through political instability and drive the economy forward.

The forthcoming budget should include concrete measures to control inflation and rectify past inefficiencies in fiscal policies. Wasteful expenditures and administrative inefficiencies must be addressed, ensuring a clear and actionable framework for economic revival.

Structural reforms in the financial and energy sectors must be implemented within a specified timeline. For instance, weaker banking institutions must be restructured, and gas supply issues must be resolved by year-end. To achieve these goals, dialogue and consensus with political parties are crucial.

Economic programmes should be designed to gain bipartisan support, ensuring continuity irrespective of government changes. Such assurances will restore investor confidence and foster a favourable investment climate.

Investors seek guarantees regarding electricity availability in summer and solutions to the gas crisis. A robust and reliable plan to address these concerns will encourage investment, which, in turn, will rejuvenate the economy.

Reforms in the financial sector, including addressing issues within Islamic banks and recovering non-performing loans, must continue with bipartisan backing. Investors are currently observing the situation; any positive indications will encourage them to increase investments. Enhanced investment will revitalise economic activity and bring stability.

The author is a former Chief Economist at the World Bank