On November amongst the last eight months foreigners including travellers or expatriates in Bangladesh have spent a total taka 204 crore on their credit cards. It is the second highest spending of foreigners in the country following taka 226 crore record of March 2023.

On contrary, Bangladeshis across globe have decreased their spending on credit cards throughout the last year. On last October Bangladeshis have spent taka 499 crore, which decreased by taka 61 crore or 13.62 percent in next month.

In November, transactions within the country amounted to taka 2,793 crore, compared to 2,866 crore taka in the previous month. Accordingly, transactions within the country decreased by 73 crore taka or 2.54 percent in a month.

Overall, Bangladeshi credit card spending abroad decreased in May due to a decrease in spending, mainly in neighboring India, the United States, the United Arab Emirates (UAE), Australia and Ireland. Although Bangladeshi credit card transactions decreased in the United States in November, the country is at the top of the spending list. This information has emerged in the updated report of Bangladesh Bank (BB).

According to the central bank report, credit cards are mainly used in the country in 11 sectors including departmental store, retail purchases, service billings, cash withdrawals, medical stores, fashion stores, money transfers, transportation expenses, various business and professional services, and paying government bills. Among these sectors, except for cash withdrawals, credit card holders spent less in all other sectors in November.

In November, taka 1,334 crore was spent at department stores across the country. In the previous month, October, taka 1,400 crore was spent through credit cards in this sector. In addition, in other sectors, taka 406 crore was spent on retail purchases, taka 246 crore on paying bills for various services, taka 196 crore on cash withdrawals, taka 164 crore on medicines and pharmacies, taka 148 crore on clothing purchases, taka 76 crore on money transfers, taka 99 crore on transportation, taka 79 crore on various business and professional services, and taka 43 crore on paying bills for government services.

Industry insiders say that after the change in the political landscape, many people are denied visiting to India. Many others do not want to go through this instability. This is why Bangladeshis’ credit card usage in India has decreased.

In addition, Bangladeshis have traveled less in November compared to October in some other countries. Therefore, credit card spending in those countries has decreased. On the other hand, as Bangladeshis traveled more in November, their credit card spending has increased.

The report shows that Bangladeshi credit card holders in the United States (US) spent taka 68 crore in November. The previous month, in October, it was taka 84 crore, decreasing by taka 16 crore or 19 percent.

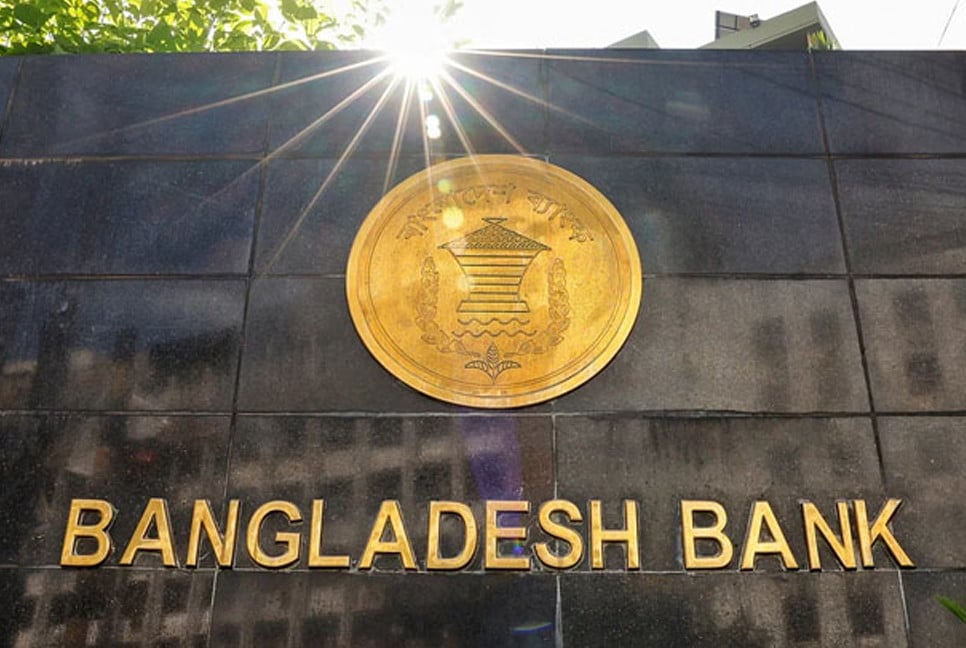

Bangladesh Bank has prepared the report based on data from 44 banks and 1 financial institution issuing credit cards in the country. The report is prepared monthly basis. The financial sector regulator reports on credit card usage by Bangladeshi citizens inside and outside the country and by foreign citizens inside the country.

The report also shows that Bangladeshi credit card usage decreased significantly in India and the United Arab Emirates in November. In India, credit card usage decreased by taka 7 crore or about 13 percent in November compared to October. In October, Bangladeshis in India spent taka 54 crore on credit cards, which decreased to taka 47 crore in November.

During the time, the spending in Arab Emirates has decreased by taka 4 crore or 20 percent. In October, Bangladeshis spent taka 20 crore on credit cards in the Emirates, but it decreased to taka 16 crore in November.

In addition, in Australia, Bangladeshi credit card users spent taka two crore less in November than in October, and taka one crore less in Ireland. The use of credit cards has also decreased in the country as well as abroad.

In October, citizens of this country spent tka 2,866 crore on credit cards within the country, which decreased to taka 2,793 crore in November. Accordingly, credit card spending within the country decreased by taka 73 crore or 2.54 percent in a month.

Cashless medium is becoming popular day by day around the world. Bangladesh Bank is planning to make three-fourths of the overall transactions in the country cashless by 2027. As part of this plan, various financial and non-financial banks are using various apps and other electronic media. Cards are undeniable for increasing the standard of living and making it digital. Customers are also making more purchases than before through cash recycling machines (CRMs) and point of sales (POS).

Translated by Afsar Munna