As the government walks in line with the International Monetary Fund’s (IMF) conditions, the amount of non-performing loans (NPLs) increases, turning businessmen into defaulter in comparatively shorter period.

Businessmen are not taking this positively and they believe that at least six-month grace period should be given before classifying as NPLs.

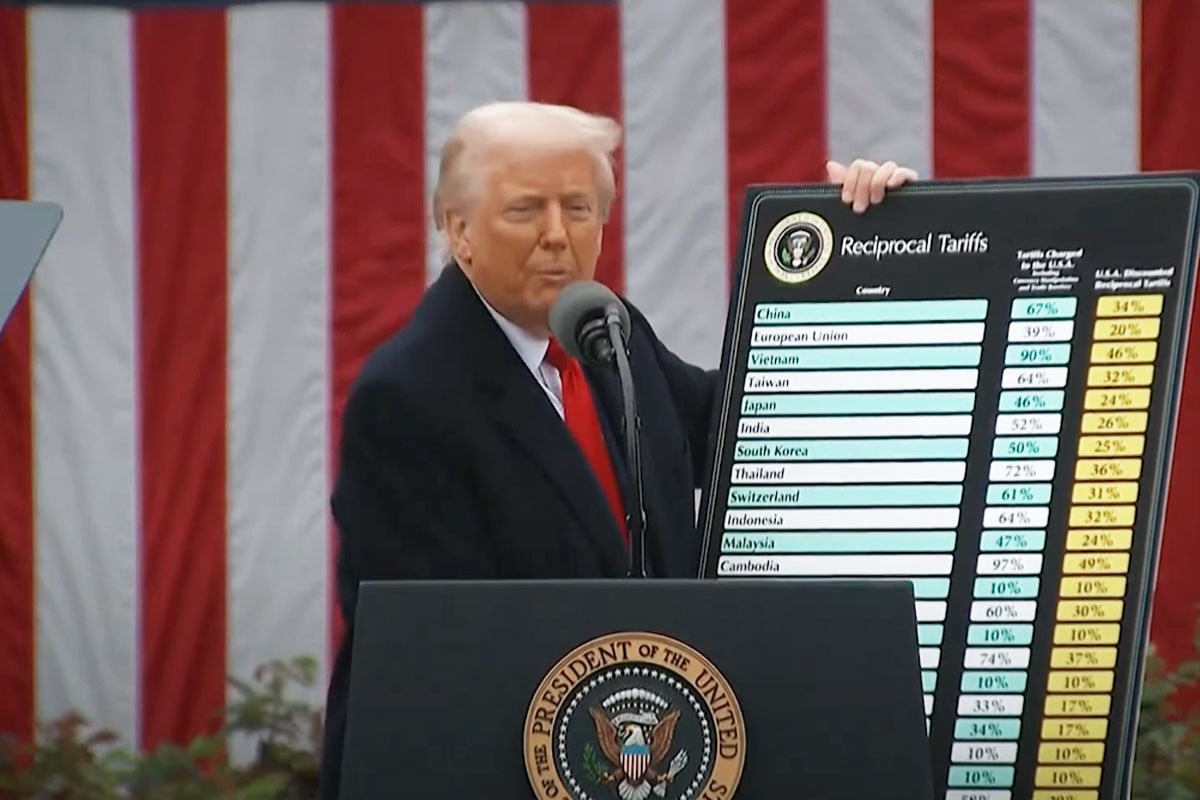

But, the IMF says after three months of being overdue, all types of loans will be considered as NPLs.

Here is the objection of the businessmen, resulting in a pent-up anger and dissatisfaction. Many have been named as defaulter, as IMF’s condition is being followed.

Therefore, NPLs are now at an all-time high. Out of the total loans of 16,82,821 crore taka, 2,85,000 crore taka is defaulted, which is 17 percent of the loans disbursed.

However, the businessmen demanded for returning previous rules of six months grace period.

Similarly, under the exit policy, they have asked for a one and a half percent down payment, a two-year grace period and 10 years to repay large industrial loans.

Concerned people believe that a one percent down payment, a two-year grace period and 15 years are needed to repay small and medium industrial loans.

BKMEA president Mohammad Hatem said: “Bangladesh Bank (BB) has recently issued a notification, through which the process of strangling businessmen has been completed. It has been given a condition of NPLs if they fail to pay three installments from last September.”

He stressed that again, from next March (2025), NPLs will be made only if they fail to pay one installment (three months).

He furthered that the increase in the policy interest rate means an increase in the interest rate on bank loans. Now, let alone new investment, the businessmen are struggling to survive.

When the interest rate of the bank increases, all the calculations are turned upside down, as the amount of installments increases and the profit rate decreases.

According to the Bank Company Act, a loan is considered defaulted if it is overdue for six months. Without making any changes in the law, BB’s directives in 2019 provided the opportunity to show the defaulters strategically less.

The finance minister AHM Mustafa Kamal said the term loan will get an additional six months for the outstanding accounts.

This means that the default will be calculated six months after the last date of installment payment. In fact, NPLs occurs after one year under this rule. NPLs are being calculated three months after the September quarter of last year (2024).

Apart from this, court is unlikely to issue stay orders like before. The central bank is not providing any special privileges in bulk. Due to the tightening of the rules, defaulted loans have increased significantly to Tk 2,84,977 crore by the end of last September, compared to Tk 1,45,633 crore in December.

Last Sunday, a 13-member delegation of several organizations led by the Bangladesh Chamber of Industries (BCI) met with Bangladesh Bank Governor Dr Ahsan H Mansur and made placed their demands. They said in the meeting that they are not interested in making new investments now.

Although five months have passed since the fall of the autocratic Awami League government, the normal environment for business and commerce in the country has not yet returned. Rather, the deterioration of law and order and political instability caused by various issues including reforms and elections has created various types of risks. This is causing businessmen, industrialists and entrepreneurs to lose interest in new investments. Businessmen are trying to wind down their businesses due to the economic downturn.

After the meeting with the governor, Bangladesh Chamber of Industries (BCI) President Anwar-Ul-Alam Chowdhury told reporters that due to high inflation in the country, sales of all institutions have decreased, high interest rates on loans, and increase in electricity and gas prices - all of which prevent any institution from operating at its full capacity. Production has decreased by 30 to 40 percent. Gas prices are being increased with new gas connections.

“Again, tax and VAT have been increased on various products on the recommendation of the IMF. In the current situation, the challenge now is for industrial institutions to survive.”

He said that other businessmen are not responsible for intentional loan defaults. Other banks, including Bangladesh Bank, have no chance of avoiding liability. Industries will die if they do not get cash incentives.

He said: “The single loan exposure limit of banks has been reduced to 25 percent. I think it should be increased to 35 percent as before. So, I have proposed to keep the period for six months to avoid default.”

When asked about how an institution will pay the bank’s liabilities after taking the exit facility, BCI president told reporters: “A person has multiple institutions. Not all institutions go bad at the same time. To pay the liabilities of the institution that has gone bad, he will pay the liabilities of the bank through the income of another good institution.”

BGAPMEA, an organization of entrepreneurs in the downstream industry sector, president Md Shahriar was present at the meeting. He said: “After the anti-discrimination student movement, a new sun has risen to everyone. We want everyone to work for the country. But we are worried about what we are seeing during the current government. Especially, the price of gas will be increased to 75 taka. Yet we are talking about creating competitiveness.”

“If such a situation continues, we will not be able to survive in the global market,” he furthered.

Bangladesh Bank is introducing new rules for classifying loans in accordance with the terms of the IMF’s $4.7 billion loan. According to the new rules, all types of loans will be classified as defaulted loans after they have been overdue for three months from April this year.

In the current situation, the CMSE sector has suffered the most. Businessmen have also suggested taking measures to sustain this sector. According to them, a special fund and low interest rates can be arranged for the CMSE sector. A district or a cluster can be piloted in this sector and financed using a digital platform.

Business leaders said that if the new rules for defaulted loans are introduced in April, many institutions will close. On top of that, they see the new VAT imposition and increase in workers' salaries and allowances as obstacles to business.

BGMEA Administrator Md Anwar Hossain said against the LC complications and demanded for reducing interest rate.

Business leaders also demanded the inclusion of their representative in the Bank Reform Committee and the improvement of the supply system by focusing on the agro-processing industry.

On the other hand, with the pressure of IMF, National Board of Revenue (NBR) issued ordinances raising VAT and supplementary duty on 67 goods and services including the internet, LPG, medicine, biscuit, tomato sauce, fruit juice, cigarette, detergent, soup, and mobile services.

Besides, the threshold for turnover listing and VAT registration has been reduced. This will also require small and medium businesses to comply with VAT regulations, which is expected to increase business operating costs.

Source: Kaler Kantho

Bd-Pratidin English/ AM