Resentment among businessmen is mounting as they feel increasingly cornered by the challenges facing the economy. With no clear guidance to revive trade and business, many have turned to Bangladesh Bank Governor Ahsan H. Mansur, presenting a nine-point set of demands aimed at easing their burden.

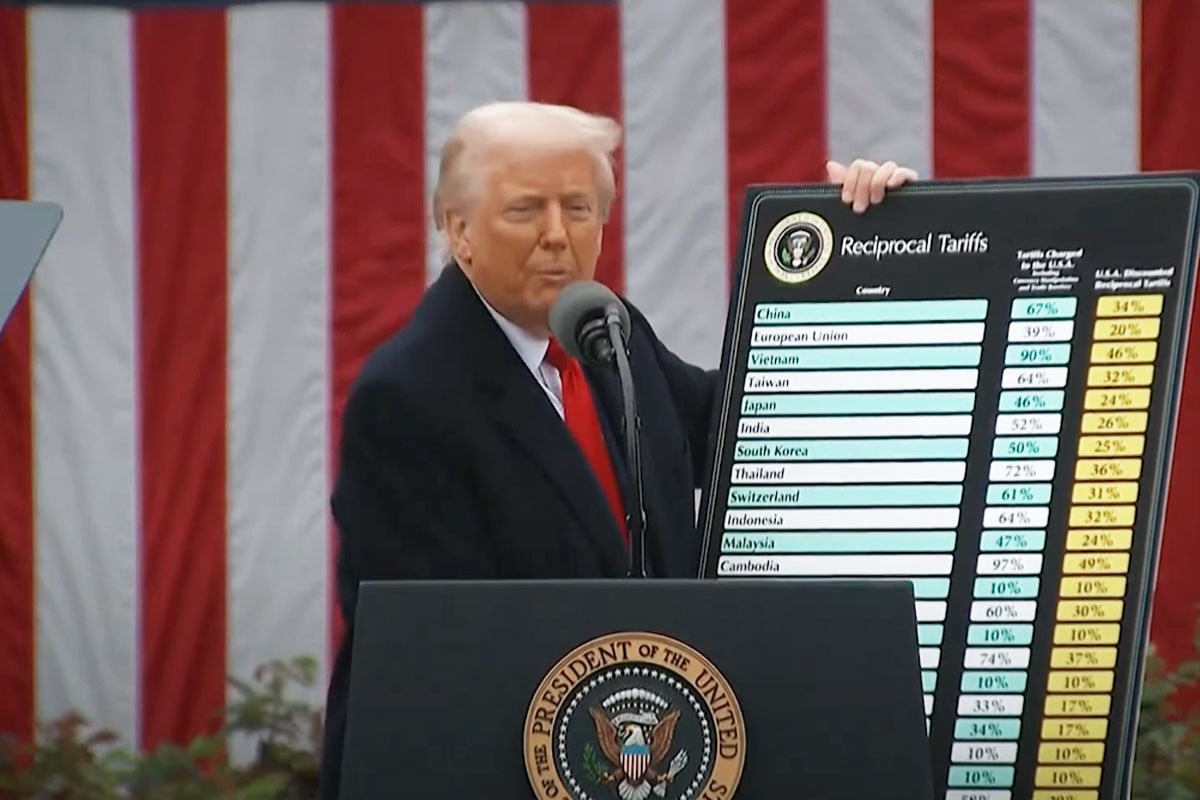

Businessmen cite numerous issues hindering growth, including a slowdown in sales due to high inflation, reduced investments caused by steep loan interest rates, and limited issuance of letters of credit (LCs). Private sector credit growth has fallen to 7.66 percent. At the same time, rising gas prices, restricted new connections, and increased taxes—largely implemented on the advice of the International Monetary Fund (IMF)—have made it nearly impossible to sustain industrial operations.

In a meeting on Sunday, a delegation led by Bangladesh Chamber of Industries (BCI) President Anwar-Ul Alam Chowdhury Parvez presented their concerns and demands to the governor. They requested the implementation of an exit policy for struggling industries, proposing 12-year repayment terms with a one-year moratorium for large industries and 15-year repayment terms with a one-year moratorium and a 1 percent down payment for small and medium enterprises (SMEs).

Businessmen also called for a more flexible approach to loan defaults. They proposed extending the default window to six or nine months instead of the current three months. For large industrial loans, they suggested repayment terms of 10 years with a 1.5 percent down payment and a two-year grace period, while for SME loans, they sought 15-year repayment terms with a 1 percent down payment and a two-year grace period. Additionally, they urged the governor to allow the sale of mortgaged properties to repay loans, a measure they believe could help alleviate their financial burden.

Delays in the disbursement of incentive funds were another point of contention. Businessmen expressed frustration over the protracted audit process, which takes nine to 12 months, followed by an additional eight to 12 months to receive payment. They suggested expediting the process to within two to three months. The businessmen also proposed restoring the single borrower exposure limit to 25 percent, arguing that the current limits of 15 percent for funded and 10 percent for unfunded loans are inadequate.

Concerns over the high loan interest rates, which exceed 15 percent, were also raised. Businessmen urged measures to reduce these rates and to provide long-term financing options for the manufacturing sector to foster industrial growth. They emphasized the need for targeted support to the Cottage, Micro, Small, and Medium Enterprises (CMSE) sector, which they believe has been hit hardest. Suggestions included the creation of a special fund with lower interest rates and financing specific districts or clusters through digital platforms on a pilot basis.

Former FBCCI President Jashim Uddin criticized the policy of combating inflation by raising interest rates. He argued that more than 80 percent of economic activities occur outside the banking system and that 70 percent of people do not use banks. This, he said, makes it unlikely that raising interest rates will effectively control inflation. He also pointed out that higher interest rates increase production costs, which, in turn, push inflation higher. Bangladesh’s heavy reliance on imported raw materials, capital equipment, and fuel further complicates the situation, as these costs are directly impacted by high interest rates.

Abdul Haque, President of the Bangladesh Reconditioned Vehicles Importers and Dealers Association (BARVIDA), shared his disappointment with recent government decisions, particularly the increase in VAT and taxes. He warned that these measures would severely impact businesses and people’s lifestyles. While corporatization of institutions, as suggested by the governor, is a good long-term strategy, Haque noted that implementing such changes quickly is unrealistic.

Haque also expressed skepticism about the IMF-driven reduction of the loan default period from 180 days to 90 days. The governor assured him that the matter would be reviewed, but no definitive timeline or assurance was provided. Businessmen also pressed for clarity regarding group identity rules. They noted that, unlike international practices, if three or four directors are common across multiple companies in Bangladesh, those companies are treated as a group, even if they are not registered as such. This creates liabilities for directors even if they leave a particular company.

Governor Ahsan H. Mansur acknowledged the concerns raised and assured the delegation of his commitment to exploring their proposals. While he expressed a willingness to consider reducing loan interest rates, he refrained from providing a concrete plan or timeline.

Businessmen remain cautiously optimistic but are wary of continued inaction. Without decisive measures to address high inflation, declining sales, and restrictive financial policies, they fear the situation will only worsen, leaving them further backed against the wall.

Translated by Jisan Al Jubair

Bd-pratidin English