The International Monetary Fund (IMF) expects steady global economic growth and ongoing disinflation in 2025, IMF Managing Director Kristalina Georgieva revealed ahead of the updated World Economic Outlook release on January 17, reports Reuters.

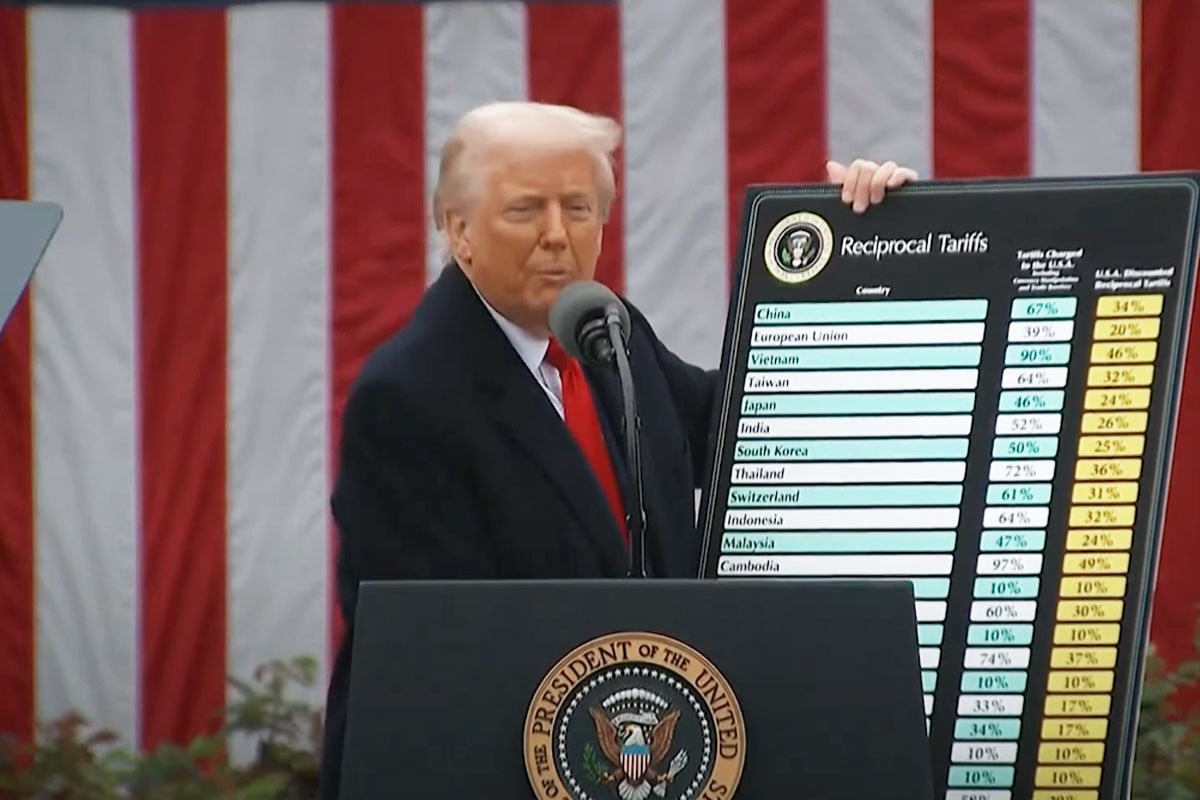

Georgieva highlighted that the U.S. economy is outperforming expectations, supported by stable inflation nearing the Federal Reserve's target and a resilient labor market. However, uncertainty surrounding President-elect Donald Trump's trade policies poses risks to global economic stability, contributing to elevated long-term interest rates.

Interest rates are anticipated to remain "somewhat higher for quite some time," with the Fed likely to delay further rate cuts until more data becomes available.

The IMF last updated its forecasts in October, leaving 2024 global growth at 3.2% and slightly lowering its 2025 projection to 3.1%. It warned that medium-term global growth would lag behind pre-pandemic trends due to challenges like tighter monetary policies, trade risks, and geopolitical tensions.

Regionally, growth is projected to slow in the European Union, weaken slightly in India, and face deflationary pressures in China. Brazil continues to grapple with inflation, while lower-income countries remain vulnerable to potential shocks.

Georgieva underscored the need for fiscal restraint and reforms to foster sustainable growth, cautioning that countries "cannot borrow their way out" of economic challenges. The IMF also noted the risks of a strong U.S. dollar driving up funding costs for emerging markets and low-income nations.

Despite these challenges, Georgieva emphasized the resilience of the global economy, which has avoided recession despite higher interest rates. However, she warned that medium-term growth prospects are the lowest in decades, urging policymakers to carefully balance fiscal discipline and growth strategies.

Bd-pratidin English/ Jisan