The country’s common people are already grappling with the unchecked prices of daily essentials. The additional burden of raised VAT will deepen their misery now.

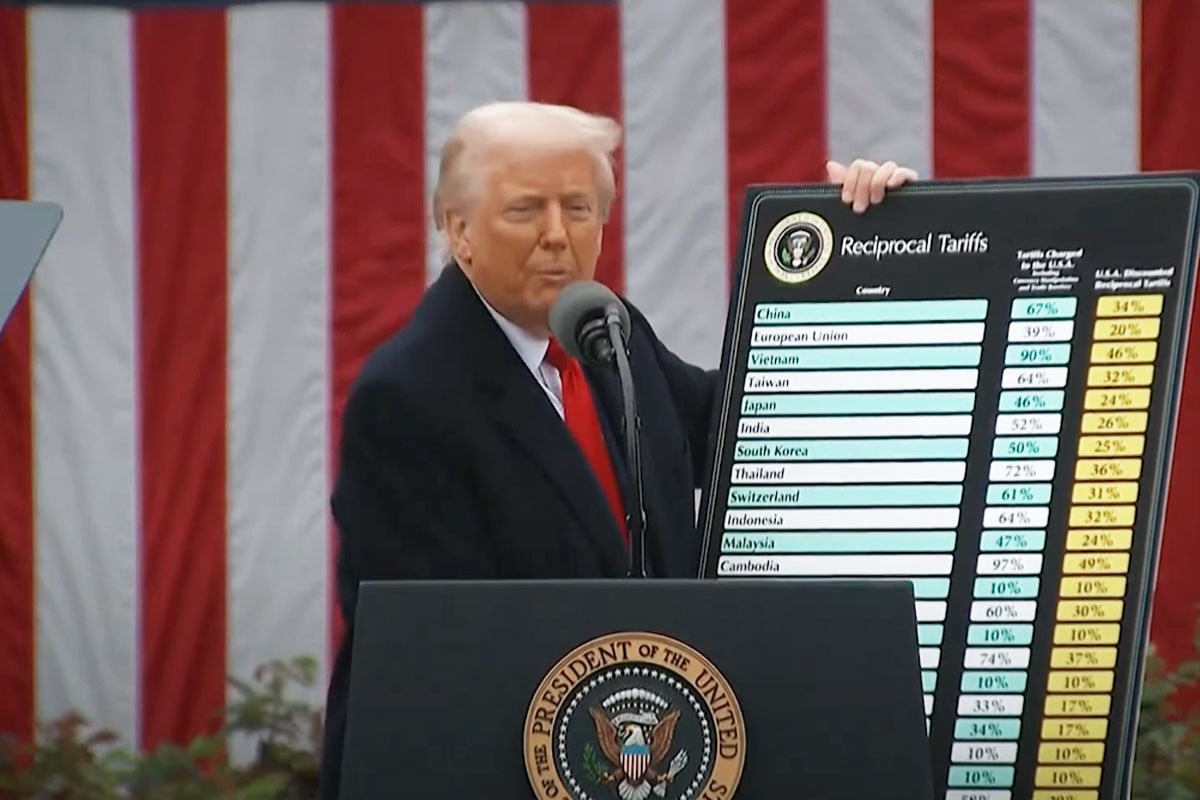

Due to the pressure from IMF, the interim government has raised Value Added Tax (VAT) on goods and services, along with supplementary and excise duties, midway through the current fiscal year. Consequently, the prices of more than a hundred products and services are likely to increase. This will further cut down the purchasing power of the common people.

The rise in supplementary duty on mobile phone services will also increase the cost of communicating and using the internet. In addition, the price of clothing may rise, and dining at restaurants could become more expensive.

Economists and businesspeople warn that these changes will push businesses into new economic problems.

Dr. Md. Aynul Islam, former general secretary of the Bangladesh Economic Association and professor of economics at Jagannath University, said, “The pressure of inflation has not yet eased. People are already struggling with the high prices of daily goods. Adding such raised VATs at this moment will negatively affect the economy. It will put even more pressure on people and increase inflation. The impact will be felt in the prices of over a hundred goods and services. The discomfort and suffering of the people will grow. This decision should not have been made. What the economic adviser is saying does not reflect the reality of the economy.”

The Dhaka Chamber of Commerce and Industry (DCCI) expressed deep concern about this decision. The chamber remarked that it will adversely affect the country’s overall business activities, as well as local and foreign investments. The rise in production costs will lead to increased prices for goods, higher inflation, and reduced employment opportunities.

Moreover, the DCCI emphasised the importance of maintaining a stable, investment-friendly environment with long-term tax benefits and policy continuity to expand business and investment.

They noted that the increase in VAT and taxes will challenge the overall economy and reduce competitiveness. Therefore, the DCCI believes the government, private sector, and relevant stakeholders must collaborate to create a business-friendly environment to address the existing economic challenges.

Imran Hasan, secretary general of the Bangladesh Restaurant Owners Association, stated, “People are likely to pay VAT when rates are low. But when the rates are high, consumers try to avoid VAT. Currently, about 5,25,000 businesses are VAT-registered, but only 3,50,000 businesses pay VAT regularly.”

He also highlighted that reducing VAT rates increases VAT collection, citing that when VAT was reduced from 15 per cent to 5 per cent, VAT collection increased by 19 per cent.

In most countries, income tax is the main source of revenue. He argued that VAT should not be the primary revenue source without expanding the tax base.

He also criticised the decision to impose arbitrary tax burdens on the public, like the East India Company exploited the people in the previous centuries. He remarked that following the IMF’s conditions is not a comprehensive solution for the country’s people.

Bd-pratidin English/Fariha Nowshin Chinika