The Anti-Corruption Commission (ACC) and the Criminal Investigation Department (CID) of Police have started investigating the money laundering of the controversial business conglomerate Meghna Group.

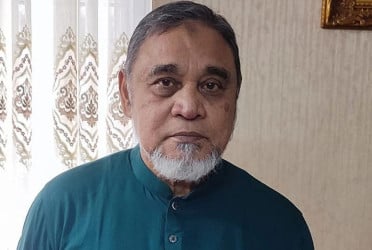

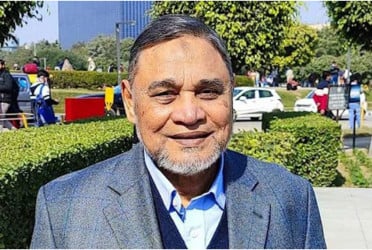

According to the ACC and CID, huge money laundering information has been collected against Meghna Group owner Mostafa Kamal, who is involved in market manipulation by syndicating and creating an artificial crisis of consumer goods. The money laundering of Meghna Group is being investigated. Scrutinize of the received data is underway. After the verification of the information, legal action will be taken. Surprisingly, the Bangladesh Financial Intelligence Unit (BFIU) is playing a silent role in the money laundering investigation against the Meghna Group.

Sources said an important intelligence agency summited a report to the National Board of Revenue (NBR) which mentioned that Meghna Group has smuggled about Tk 80,000 crore in the guise of importing goods. The intelligence agency has made five recommendations to the NBR to investigate and take action against 70 companies of the Meghna Group. According to the report, the intelligence agency found embezzlement of Tk 1,500 crore of Bangladesh National Insurance Company and revenue evasion of about Tk 1,000 crore.

The intelligence report, which has recently been sent to NBR, made five recommendations to take proper action against Meghna Group owner Mostafa Kamal. It said Mostafa Kamal has embezzled huge amount of money as the chairman of Bangladesh National Insurance Company by refund Letters of Credit (LCs) in the name of various companies of Meghna Group. It is alleged that he, later, smuggled the money abroad. The intelligence agency suggested a detailed investigation into the money embezzlement and laundering from the insurance company.

The five recommendations of the intelligence report are as follows: 1. Year and category-wise amount of paid insurance claims against 70 companies of Meghna Group, 2. The amount of premium and the number of issued cover notes, policies and premium, 3. List of cancelled and returned premium amounts against issued policies, 4. Amount of insurance claims collected from general insurance or foreign reinsurance companies, 5. The intelligence agency has asked to verify the bank account of insurance claim payment checks. The same report also said Mostafa Kamal embezzled Tk 1,519 crore from the National Insurance by not taking mandatory insurance policy against dutiable goods, naval vessels and motor vehicles of the Meghna Group, and more than Tk 1,000 crore of the government by evading VAT, stamp duty and bank commission in the 21 years from 2000 to 2020 showing under invoice of Tk 79 thousand 762 crore in import.

Mostafa Kamal has chosen the path of importing at low cost by dodging government revenue to earn huge money within a short time. He used to show less cost than the actual price of the imported goods through under-invoicing. As a result, he could have made more profit by purchasing goods at a much lower price than competing companies. On the other hand, the government has been deprived of revenue.

A businessman or group can profit more through under-invoicing. For example, a businessman bought a product at the cost of $1,000. But, he has shown $100 as its price. As a result, the government will get revenue of $100 and will be deprived of revenue from $900. On the other hand, the importer has sold the product adding revenue with the actual price of $1,000. Through under-invoicing, an importer can earn more profit in a short time by dodging the government.

The intelligence agency in its report said Meghna Group has imported dutiable goods worth Tk 1 lakh 28 thousand 131 crore 33 lakh 21 thousand 126 during the period. However, according to the LCs, the invoice value of these imported goods was Tk 48 thousand 368 crore 42 lakh 42 thousand 311. As such, the company has taken additional benefits of Tk 79 thousand 762 crore 90 lakh 78 thousand 815 under the guise of import.

After analysis of the intelligence report, it was found that a huge amount of money has been plundered every year. The trend of under-invoicing by Meghna Group has increased since 2013. However, the amount has declined in 2020 due to the significant decrease in imports impacted by Covid-19 pandemic. In 2020, the difference between LCs and dutiable import value was Tk 264 crore. The amount was from Tk 1,200 crore to Tk 1,600 crore in the three previous years.

Meghna Group has not paid the policies of the insurance companies through under-invoicing. According to the intelligence report, it was mandatory to implement the policy against dutiable value. The policy rate was 0.90 per cent. But Tk 1 thousand 153 crores 18 lakh 19 thousand 890 has been dodged in the policy against the dutiable Tk 1 lakh 28 thousand 131 crore 33 lakh 21 thousand 126.

Apart from this, Tk 300 crore of the insurance policies has been embezzled which was mandatory against the 60-70 naval vessels, and 1,000-1,200 motor vehicles of the various companies under the Meghna Group. Besides, Meghna Group has not paid Tk 638 crore 10 lakh 32 thousand 630 of bank commission and Tk 25 crore 52 lakh 41 thousand 305 of 4 per cent stamp duty against the insurance policies. The government is supposed to get 15 per cent of bank commission as VAT (Value Added Tax). The group has evaded Tk 95 crore 71 lakh 54 thousand 984 of VAT. It also embezzled Tk 405 crore of the government by evading VAT and stamp duty in various sectors, according to the report.

The intelligence report also said Mostafa Kamal has embezzled huge amount of money from the insurance company through refund LCs in the name of various companies of Meghna Group. He, later, smuggled the money abroad. The intelligence agency has requested the NBR to investigate these issues as it has apprehension of embezzlement of huge amounts of National Insurance money alongside evasion of government revenue.

Bangladesh National Insurance Company Limited was established in 1995. Its founding entrepreneur directors were -- Md. Zakaria, his brother M F Kamal, their sister Beauty Akter, brother-in-law Mostafa Kamal and Baset Mojumder. Currently, Mostafa Kamal is playing the role of the chairman of this insurance company while Md. Sana Ullah is the Chief Executive Officer (CEO). Until 2000, the company managed its business operations well. Later, conflicts of interest arose among its directors. As a result of this conflict of interest, the Meghna Group of Industries split into two.

bd-pratidin/GR