The interim government is planning to increase the foreign exchange reserves even its made possible by the means of borrowing it. The most painful crisis in the macroeconomic level at present are the reserves of foreign exchange and the high price appreciation. Hence, the initiative to reduce the price of commodities in order to relax the pressure of price appreciation has been taken. The process of market monitoring with the presence of students’ representatives has started. In addition, due to the change of political scenario, the practice of extortion is almost stopped in the transport sector.

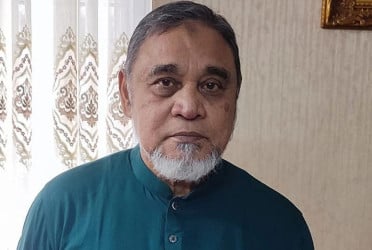

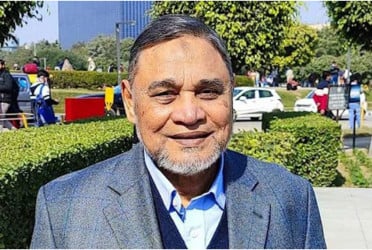

With a view to increase the foreign exchange reserve, the government has urged the IMF to release the residual installments of $ 4.7 billion. Additionally, Bangladesh Bank is looking forward to asking for another $ 3 billion from the IMF. The above information was already revealed by the central bank governor Dr. Ahsan H Mansur to the media.

Last week in his office in the secretariat, the central bank governor Ahsan H. Mansur, finance secretary Khairuzzaman Majumdar and other related stakeholders held several meetings with finance adviser Salehuddin Ahmed in this regard. The meeting was mainly to find ways to revive the battered economy.

It is said that these decisions were taken in that meeting. Finance Adviser held a meeting with the representatives of World Bank, IFC, DFID at the Economic Relations Department (ERD) in Sher-e-Bangla Nagar on Thursday. These issues were discussed in that meeting. According to sources, as per the plan of the finance department and Bangladesh Bank, the country's economy has suffered a lot due to the recent political unrest and agitations including vandalism. However, the extent of the damage has not yet been determined. However, the long-standing dollar crisis has intensified. As a result, the foreign exchange reserves must be strengthened to heal the wounds of the distressed economy. For this reason, it is planned to increase the reserve with more loans from development partners along with expatriate income, export income within the next one year.

Although the foreign debt burden during the tenure of the previous government broke the all-time record and exceeded Tk 18 lakh crore, an additional $1.5 billion has been sought from the World Bank, along with another $1 billion from the Asian Development Bank (ADB) and the Japan International Cooperation Agency (JICA), finance sources said. Another $1 billion will be sought from China and Japan. Meanwhile, according to the data of Bangladesh Bank, the foreign exchange reserves fell to 20.48 billion dollars as of August 21, which was 29.42 billion dollars at the same time last year. Analysts believe that it is possible to meet the import cost of t three months with the current reserves. To deal with the situation, the central bank bought more than 200 million dollars from the interbank market in three days after Ahsan H. Mansoor took over as Bangladesh Bank governor. The central bank aims to buy $1 billion per month from local banks. The central bank expects the situation to improve within a few months.

(The report was published on print and online versions of The Bangladesh Pratidin on August 30 and rewritten in English by Lutful Hoque Khan)