Despite various initiatives, Bangladesh's dollar market remains disordered, with supply failing to meet demand and dollars available only at higher rates outside the banking system. Efforts by the International Monetary Fund (IMF) and traders to establish a unified dollar rate have yet to yield results, as the government struggles to implement this policy.

Currency market experts argue that the only solution to the ongoing crisis is to implement a single dollar rate and increase the supply of dollars. Bangladesh Bank's foreign exchange reserves stand at approximately $18 billion, but the pressure to repay foreign debt is expected to more than double next year, maintaining high demand for dollars.

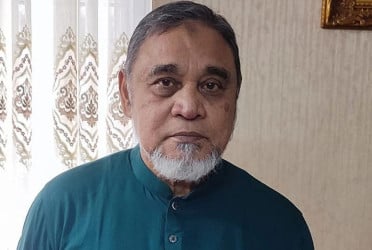

Experts warn that without increased supply and improved governance in the sector, the crisis will only worsen. Zahid Hussain, former lead economist of the World Bank's Dhaka office, emphasized that the market cannot stabilize with varying rates. "A single rate must be implemented, and dollar smuggling must be prevented," he told Bangladesh Pratidin.

He also pointed out the issue of significant export income not being repatriated, a matter known to both the government and Bangladesh Bank.

The rising prices of other foreign currencies, including the euro, compound the situation. Experts suggest that the government should focus on increasing export income and remittance flows to alleviate the crisis. Hussain stressed the need for reforms in foreign exchange market management in the upcoming budget to address these persistent issues.

On May 8, taka was devalued by about 7 taka against the dollar under the pressure of the International Monetary Fund (IMF). As a result, the banking sector is expected to sell at 117 taka per dollar. The website of other banks including Bangladesh Bank is also showing the highest dollar rate of Tk 117. But in reality the banks are not getting dollars at this rate. Traders are still unable to fully rely on banks for opening LCs. The dollar crisis is not ending even in the open market. The price is still high.

On Tuesday, dollar also sold at 120-122 taka in the open market. Even if one want to endorse dollars from a bank for foreign travel, it is doing so. But not giving dollars. That is, the banks are not able to pay dollars. The price is high though.

In some cases, there are also cases that when a person wants to take dollars from the bank for traveling abroad, the officials are not able to give the dollars to the customers on demand. Instead, customers are encouraged to collect dollars from the open market. It has been happening for a long time.

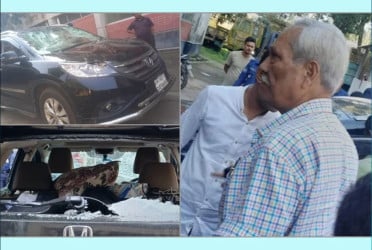

On Tuesday too, such an incident happened in the main branch of a first generation private bank. A buying house businessman named Babul Sarkar (nickname) was looking for dollars to travel abroad. He needed 3 to 4 thousand dollars. He could not manage it even after visiting several banks.

Earlier, he had faced such an incident in the beginning of this month. At that time, after searching for a week, he approached a senior official of the main branch of a private bank in Motijheel. He expressed his inability to supply dollars from banks at fixed rates. Later, due to the customer's request and personal relationship, the official kept Saju Sarkar in his room and looked for dollars in the curb market. After about two hours of trying, the bank official called a broker of the curb market. Then he was able to pay one and a half thousand dollars at the rate of 121 taka. Such a situation still prevails.

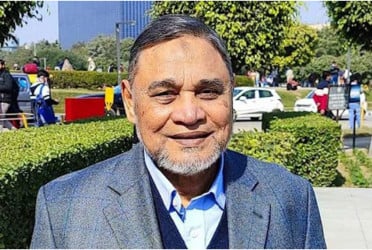

Mohammad Zahidul Islam is a Garment Trader (Buying House). He will go to America on business. He will have to stay there for some time. This requires several dollars. Despite being a businessman himself, he has to gather momentum to collect 5 thousand dollars for the past one month. Although he himself is an exporter. He is also not able to withdraw his earned export income from the bank on time.

Meanwhile, the proposed Foreign Currency and Exchange Management Act-2023 is awaiting passage in Parliament. There is also pressure from the IMF in passing this law. The budget session is going to be held next month. It is definitely the budget session. As a result, the passage of this law will be further delayed, the officials of the finance department think.

In this context, prominent economist Dr. Hossain Zillur Rahman told Bangladesh Pratidin that it is important to have accountability everywhere. Good governance cannot be established anywhere without strong accountability. He thinks that the foreign exchange market is no exception.

(The report was published on print and online versions of The Bangladesh Pratidin on May 29 and rewritten in English by Tanvir Raihan)