The Adani Group in a statement has said that the electricity supplied from its Godda will significantly improve the situation in Bangladesh as it will replace expensive power generated from liquid fuel, bringing down the average cost of power purchased, reports UNB.

“The Godda Power Plant is a strategic asset in the India-Bangladesh’s long-standing relationship,” said Mr SB Khyalia, CEO, Adani Power Limited.

He said it will ease the power supply in Bangladesh, making its industries and ecosystem more competitive.

Adani Power Limited (APL), a part of the diversified Adani Group, announced the commissioning of its first 800 MW ultra-super-critical thermal power generation unit at Godda in the Jharkhand district of India and supplying Bangladesh with 748 MW of power.

In November 2017, Bangladesh Power Development Board (BPDB) executed a long-term Power Purchase Agreement (PPA) with APL’s wholly-owned subsidiary Adani Power Jharkhand Limited (APJL) to procure 1,496 MW net capacity power from 2X800 MW ultra-supercritical power project at Godda. India’s largest power producer in the private sector is expected to commission its second 800 MW unit soon, said the Adani statement.

Though an official statement was released from Adami power about the commercial operation, no statement from the Bangladesh Power Development Board (BPDB) was issued.

BPDB officials said that although commercial operation started from Adani Power, the issue of the tariff was not settled yet.

“After objection from the Bangladesh side, Adani Power offered to lower the coal price, but still it is not complying with Bangladesh’s stand,” said a top official of BPDB, preferring anonymity to discuss the sensitive issue.

He mentioned that Adani is using GAR (gross as received) of ICI-5000 coal which is lower quality coal, but wants to quote the price GAR of ICI -6500. ICI is the Indonesian Coal Index. ICI 6500 indicates a higher calorific value of the coal. A higher calorific value means more energy can be produced using less coal.

“For instance the price of an ICI-6500 is $179.84, while the price of ICI-5000 is $95.50. In this case, Adani is seeking to quote the coal price at $179.84 which is not acceptable to Bangladesh,” he added.

He also mentioned that following the recent discussions between Adani and BPDB in Bangladesh, Adani has agreed to lower the price and wanted to keep it between the tariffs of Payra power plant and Rampal power plants.

“But they don’t stick to a certain formula of coal pricing which is problematic for Bangladesh as every month BPDB will have to negotiate with Adani on the tariff issue which is not desirable for Bangladesh,” said the senior official of the BPDB.

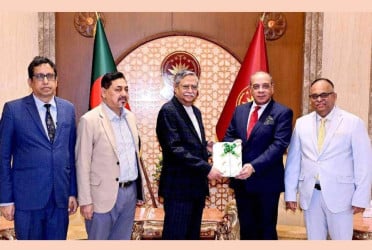

Earlier, a high level team of Adani Group came to Dhaka on February 23 and discussed resolving the issues on "coal pricing mechanism of the power purchase agreement”.

Both the sides heard each other and they presented their points in favour of their respective sides on the issue. Adani's representative informed them that they would communicate BPDB's stance on the coal pricing mechanism of the PPA to their top management and they will sit in more follow-up meetings.

They visited Dhaka as the Bangladesh government sought a revision to the power purchase agreement (PPA) it signed with Adani Power Ltd for importing electricity over a 25-year period from the thermal power plant in Jharkhand, India.

The cost incurred to import the coal, including transport from port to plant, will ultimately be borne by Bangladesh, with the price factored into the PPA's tariff structure.

Bd-pratidin English/Tanvir Raihan