Almost nine out of 10 Japanese companies expect U.S. President Donald Trump's policies to negatively affect business, a Reuters survey showed on Thursday, the clearest sign yet of mounting worry in the United States' top foreign direct investor.

The results of the survey show how the prospect of higher tariffs and increased trade friction between the United States and China has clouded the outlook for companies in the world's fourth-largest economy.

Japan, a key U.S. ally yet heavily reliant on China, faces concerns over Trump's policies. About 86 percent of firms see a negative impact, mainly due to trade strategies and rising U.S.-China tensions. In December, 73 percent viewed Trump’s second term as harmful to business.

"Ratcheting up protectionism has nothing but a negative effect on the global economy," a manager at an information services firm wrote in the survey.

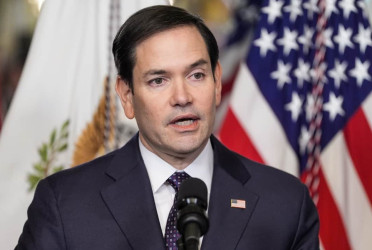

Trump has imposed tariffs on steel, aluminum, and Chinese goods while threatening Canada and Mexico with steep duties. He also plans reciprocal tariffs and measures against non-tariff barriers. Despite Japan's zero car tariffs, the U.S. claims market access issues.

On Tuesday, Trump warned of 25 percent auto tariffs by April 2.

"If the auto industry took a hit from tariffs worldwide, semiconductor sales may be affected as well," an official at an electronics company said, underlining a potential ripple effect.

Deregulation seen positively

Among the firms that saw Trump's policy measures as positive, 37 percent picked deregulation and tax cuts as the most beneficial factor, while another 37 percent chose his policy to help boost fossil fuel production.

Asked about their plans for business operations and investments in the United States, 16 percent said they were taking a more cautious stance, while 80 percent said they had no plans for change.

During his first in-person meeting with Japanese Prime Minister Shigeru Ishiba this month, Trump pushed Japan to invest in U.S. energy and technology and sought a way out of a dispute over Nippon Steel's $14.9 billion bid for U.S. Steel.

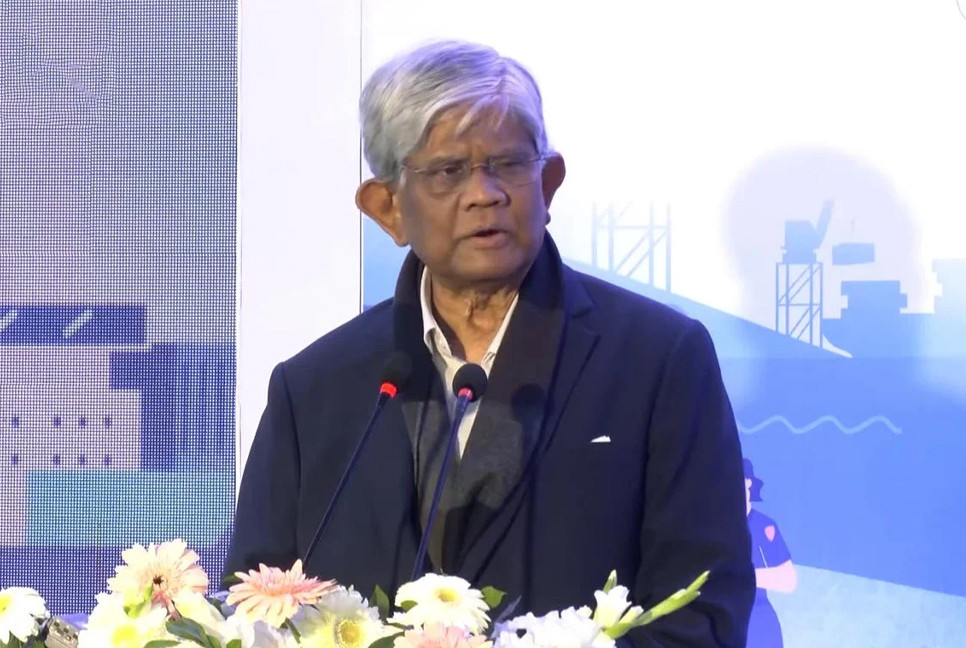

Trump said Nippon Steel was now looking at an "investment, not a purchase", and he was fine with that. Japan's top government spokesperson Yoshimasa Hayashi later said the Japanese steelmaker was considering proposing a bold change in plan from its previous approach of seeking an acquisition.

The survey was conducted by Nikkei Research for Reuters for 11 days to February 14. Nikkei Research reached out to 505 companies and 233 responded on condition of anonymity.

Rate hike impact

Regarding the Bank of Japan's recent rate hike, 61 percent of respondents found it appropriate, while 25 percent saw it as premature, and 15 percent felt it was overdue. The BOJ raised rates to 0.5 percent in January, anticipating sustained 2 percent inflation.

"The yen's excessive weakness caused the continued outflow of national wealth. To arrest the trend, further interest rate hikes are in order," a manager at a wholesaler said.

"That would prompt those companies that cannot survive in a 'world with interest rates', which ought to be a normal state, to bow out or transform themselves."

Asked about the ideal timing for the next rate hike, 24 percent picked the July-September quarter this year and another 24 percent selected "next year or later", while yet another 24 percent indicated that rate hikes were not desirable at any time.

The central bank's hawkish board member Naoki Tamura said this month that the BOJ must raise interest rates to at least 1 percent by the second half of the fiscal year beginning April.

About 44 percent of survey respondents said an interest rate increase of 1 percent would adversely affect their capital spending, while 21 percent said rate hikes beyond 1.5 percent would have that effect.

"In parallel with rate hikes, we want the government to expand measures to facilitate capital spending," an official at a rubber manufacturer said.

Source: Reuters

Bd-pratidin English/Fariha Nowshin Chinika