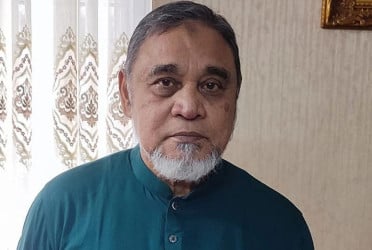

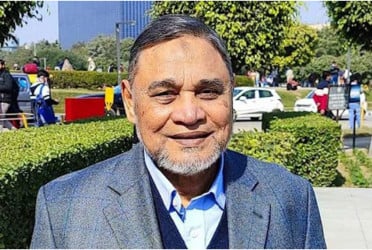

Barrister Suhan Khan, a Supreme Court lawyer and an expert in company law, has said that the strict definition and application of 'loan defaulters' in the Bank Company Act is contradictory to its fundamental principle. This is because it has a negative impact on the companies from which loans have been extracted.

While talking to Bangladesh Pratidin on Tuesday, he stated that the fundamental principle of company law, which was established because of Salomon v. Salomon & Co. Ltd. (1897) case, is that- a company is the legal entity that is separated from its shareholders. This theory is known as the “Corporate Veil” and it is recognized all over the world.

Suhan said, “Even though the court supports this principle fully, it also has the power to overturn it in certain situations”.

This step is usually taken in order to make sure that abuse of this principle (i.e. corporate veil) is prevented. However, the strict definition and application of “loan defaulters” as mentioned in the Banking Companies Act of Bangladesh, 1991, is quite contradictory to this fundamental principle. If a company of a group fails to repay its loan because of this law and its extreme application, then the Credit Information Bureau (CIB) report of all directors, shareholders, and associated companies will be impacted negatively. This effectively disregards the separate legal personality of each company.

According to Suhan Khan, this kind of practice can be extremely harmful because the failure of a single entity or person affects the ability of all the other companies that are linked together. It also has long-term negative consequences that are harmful for both business and financial institutions and it can ultimately hinder the economic growth of a country.

He further stated, “The central bank and the court need to reconsider this strict law and align it with the fundamental principles of corporate veil urgently. This will ensure justice, boost investors’ confidence and make the business environment of Bangladesh more stable. However, it must also be noted that if any businessman uses his company for defrauding banks, and financial institutions and misappropriating loan funds; then the court may have the authority not to abide by the principles of the corporate veil.

bd-pratidin/Rafit