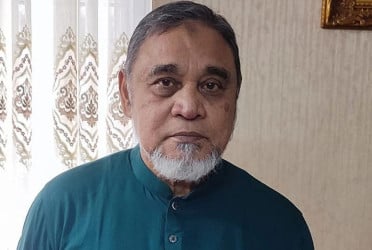

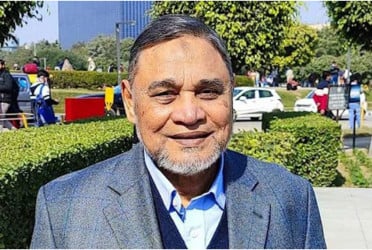

Due to the imposed rigidity on imports besides the rises of dollar price, many businessmen are facing disruption while importing goods and raw materials. Hence, they (businessmen) fail to pay the loans, said M Masrur Reaz, chairman and chief executive officer (CEO) of private research institution Policy Exchange Bangladesh.

While talking to Bangladesh Pratidin, Masrur Reaz said the dollar has been depreciated about 37 per cent in the last two and a half years. Besides, various restrictions have been imposed on imports. It had a negative impact on those who sell imported products and those who manufacture products out of imported raw materials. Now they are under pressure.

The dollar price has increased by about 37 per cent. On the other hand, businessmen were unable to import raw materials timely, resulting in an obstacle in manufacturing products. Businessmen didn’t get products on demand. And it happened in the time of overcoming COVID-19's effect on the economy. Because of these things, the import of raw materials has been disrupted. They cannot pay the loan on time, he added.

The renowned economist and former World Bank official also said Bangladesh Bank has to continue its effort to control the dollar price. It has to allow more LC (Letter of Credit) on a priority basis maintaining the Balance of Payment (BoP).

bd-pratidin/Munna

.jpg)