A large quantity of gold is entering Bangladesh from Middle Eastern countries and being smuggled into India through 30 border districts. Since Bangladesh has become a safe transit route for smuggling, both domestic and international smuggling networks are using it. This is causing the country to lose $22 billion in foreign reserves and tax revenue of Tk10,000 crore.

In this situation, stakeholders are urging the government to stop gold smuggling to bring order to the financial sector. They have said that gold smuggling is destroying the economy, and there is no alternative to stopping it to protect the financial system. For this, the highest level of monitoring by law enforcement agencies is required.

The Bangladesh Jewelers Association (BAJUS) has called for forming a separate monitoring cell to prevent smuggling, alongside strict surveillance by intelligence agencies to solve this problem.

Dr. Sazzad Zahir, Executive Director of the private research organisation Economic Research Group (ERG), and a noted economist, said, "The government is losing revenue due to gold smuggling. The Bangladesh Financial Intelligence Unit (BFIU) must investigate why this smuggling is happening. People say that gold from outside is going across the border. The authorities need to find out who is benefiting from this and take action, as smuggling is essentially a form of trade exchange."

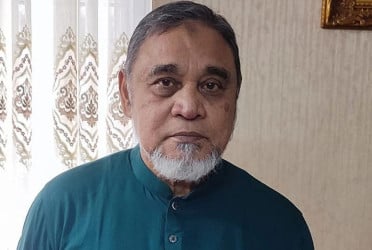

Dr. Mahfuz Kabir, Research Director at the state-run Bangladesh Institute of International and Strategic Studies (BIISS), said, "The current interim government has taken many initiatives to establish good governance in the country. Passenger services at airports have improved. However, gold smuggled through airports is being seized every day. It's unfortunate that gold smuggling is happening under the current government."

Anwar Hossain, a spokesperson and executive committee member of BAJUS, said, "Most jewelry traders in the country operate their businesses with honesty and integrity. But the existing legal framework is against the jewelry industry. Those who want to run their business honestly are facing harsh realities. Even though there is a policy, it has yet to be properly implemented. We request the current government to take effective measures to promote the jewelry industry."

According to the latest data from the Bangladesh Bank, remittances of $2.22 billion were sent by expatriates in August. Last year, in August, remittances of $1.5994 billion were sent to the country.

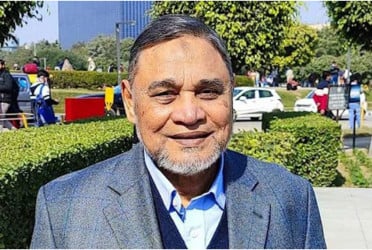

Abdul Awal Mintoo, former president of the Federation of Bangladesh Chambers of Commerce and Industry (FBCCI), said, "As money is laundered through hundi, smuggling, including gold smuggling, increases. Why are Tk91,000 crore worth of gold and diamonds being smuggled? Law enforcement agencies must give this issue top priority and investigate thoroughly."

Dr. Fahmida Khatun, Executive Director of the private research organization Centre for Policy Dialogue (CPD), said, "The BFIU needs to be active in catching smugglers. We also need to investigate how gold is coming through smuggling routes and close those routes. There is no alternative to stopping smuggling to bring discipline to the financial sector."

According to the National Board of Revenue (NBR) and Border Guard Bangladesh (BGB), gold worth Tk1.0189 billion was seized in 2023. From 2014 to 2023, BGB seized 925 kg of gold from border areas. Over the last 10 years, the Customs Intelligence, Customs House, BGB, police, and Airport Armed Police Battalion (APBn) conducted operations across the country and seized 2,583 kg of gold.

According to intelligence agencies, if this gold had been imported through official channels, Bangladesh Bank’s reserves would have increased by $22 billion, and the government could have collected nearly Tk10,000 crore in revenue. According to statistics from Dhaka Customs House, under the baggage rule, 2.775 tons of gold were imported through Hazrat Shahjalal International Airport in 2020, 25.689 tons in 2021, 35.733 tons in 2022, and 31.468 tons in 2023.

Under Section 2 of the Anti-Money Laundering Act, gold smuggling is considered an offense related to money laundering. The law provides for a prison term of up to 12 years and a fine of Tk 2 million.

In this regard, Md. Anisur Rahman, Director of BFIU, said, "We are working with various intelligence agencies to stop gold smuggling because smuggling harms the country in two ways. First, money does not come through legal channels, and second, the government loses revenue. Therefore, we want gold smuggling to stop."

Source: Kaler Kantho