The country’s economy has recovered slightly in the last few months and moving forward in slow motion which was plunged due to the Russian invasion of Ukraine and the Covid-19 pandemic.

According to economists, various effective initiatives taken by the government have helped to recover the economy. Of these, restriction of import has played a big role. Besides, export earnings and remittances have also contributed to the economy. Bangladesh earned a record remittance in August which helped to reduce the ongoing dollar crisis in the state exchequer.

Bangladesh’s economy progressed quickly in the last decade from 2011-2022. According to the World Bank and IMF, Bangladesh’s economic growth in the last decade was considered like a speeding horse. World-renowned economist Kaushik Bose called Bangladesh the ‘Asian Tiger’.

During the last decade, the country’s economy achieved incredible success. The income of the people increased. Poverty alleviation happened fast. All kinds of domestic production increased. Foreign exchange reserves reached about $ 50 billion.

However, the impact of the Covid-19 pandemic stopped the momentum. Despite this, Bangladesh was moving forward in all indexes. Later, the Russia-Ukraine war changed all calculations. Almost all indicators of macroeconomics go into a negative trend.

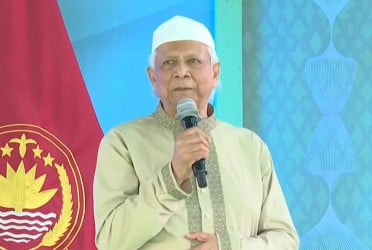

Former adviser to the caretaker government Dr AB Mirza Azizul Islam told Bangladesh Pratidin that export and remittance increasing in the country. It's a matter of quiet relaxation. But the inflation pressure should be reduced by any means. For this, the prices of goods should be controlled as much as possible.

According to the sources, export earnings and remittances have started to pick up again. The country has earned above $4.6 billion by exporting various products in August which is 6.18 per cent more than the same period of the last year.

On the other hand, Bangladesh earned 8.59 billion foreign currencies by exporting goods in the first two months (July-August) of the current fiscal year which is 25.31 per cent higher than the same period of the last fiscal.

If this trend is continued, it is expected that the country's economic crisis will end quickly.

The main problem of the economy is inflation. This pressure is being released slowly. Economists hoped that the recent hike in daily essentials and inflation will be reduced in the upcoming days.

According to the Bangladesh Bureau of Statistics (BBS), overall inflation in July was 7.48 per cent, which was 7.56 per cent in June. Food inflation was 8.19 per cent in July. Although the government took various measures and punished many banks and bankers for manipulation, the dollar market did not normalize. But the price of the dollar has come down a lot in the kerb market.

In order to stabilize the dollar market, Bangladesh Bank has already instructed all banks to sell inter-bank dollars. Besides, instructions have also been given to quickly bring the export value or export proceeds stuck abroad.

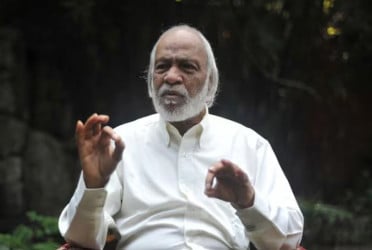

Former Bangladesh Bank governor Dr Salehuddin Ahmed said each dollar is now being sold at Tk 95 in the banking channel. Banks can sell dollars at a maximum of Tk 96. Good results can be obtained if these decisions are implemented properly.

“First of all, accountability must be ensured. At the same time, export income should be increased. The dollar crisis is mainly due to the widening trade deficit. Also, there is manipulation by some people, it must be stopped,” he said.

The Reserve of a country increases by remittance and export earnings. It also increases if the government can cut import costs. Bangladesh Bank will have to do these in an effective way, added Salehuddin Ahmed.

@The article was published on print and online versions of Bangladesh Pratidin on September 10, 2022 and has been rewritten in English by Tanvir Raihan and Golam Rosul.