Bangladesh Economic Zones Authority (BEZA) has been established to provide all kinds of facilities to investors to set up factories and ease the business process. For this, BEZA has undertaken the project of formation of Special Economic Zones and Economic Zones. BEZA started its journey in 2010 by making a special law for this work.

The BEZA is supposed to provide 125 types of services including land acquisition, land registration, environmental clearance, construction approval, electricity, gas and water connection under a one-stop service for factory set-up and business operation. But in reality, businessmen even don’t get 20 types of services. Rather, investors are still being harassed to get these services.

Investments in economic zones are supposed to be tax-exempt. On the contrary, VAT law has been enacted after the completion of agreements of many economic zones. The VAT law is above other general laws and agreements. As a result, VAT has been levied on the entrepreneur's land after the agreement. Investors are being forced to pay an additional 15 per cent VAT on the value of leased land, although they have been demanding the VAT exemption for a long time.

Meanwhile, BEZA Executive Chairman Ashik Chowdhury has recently at a function said there is no logic to set up 100 Special Economic Zones. The government is withdrawing its target. The number of speedy implementable economic zones will be 5-10 after ensuring the facilities of electricity, gas and infrastructures. The BEZA will give a timeline for when the infrastructure in the Special Economic Zones will be ensured.

In 2010, the then government announced that a total of 100 economic zones would be set up all over the country. The BEZA started to work in 2015 targeting its goal. The question arisen how many economic zones have been established after 15 years? Only 10 per cent work of this mega plan of the government has been completed after one decade.

Local and foreign investors were invited to these economic zones through gala events. Many investors have become disappointed as they have not got electricity, water, and gas connections for years after the initial investment to set up the factories. Many foreign investors have also returned to their respective countries although they came here with much interest.

On the other hand, local investors can’t go into production in time as they are not getting desired services from the BEZA and VAT law complexities. Many industrial entrepreneurs are afraid of facing losses before launching the factory.

It is known that the BEZA board has approved a total of 97 economic zones in the last decade. Of these, the government will establish 68 economic zones and the private sector will set up 29 economic zones by 2030. Later, the timeline was extended till 2041 saying much time is needed to implement the large number of economic zones. It is very common to take time as the land acquisition process is quite complex and time-consuming. A total of 10 economic zones have been established in the country so far. But the fate of these economic zones is uncertain after the fall of the Sheikh Hasina government on August 5.

Of 10 economic zones, the government is operating two economic zones -Bangabandhu Sheikh Mujib Shilpa Nagar (BSMSN) in Chattogram and Srihatta Economic Zone in Sylhet. The private sector has been operating the rest of the eight economic zones. These are the City Economic Zone, Meghna Industrial Economic Zone, Meghna Economic Zone, Hossaindi Economic Zone, Abdul Monem Economic Zone, Bay Economic Zone, Aman Economic Zone, and East West Special Economic Zone.

According to BEZA, 13 companies are producing goods in the two state-run economic zones. Of these, 11 factories have been set up at BSMSN and two factories at Srihatta Economic Zone.

In that programme of the Centre for Policy Dialogue (CPD), Ashik Chowdhury said, “We are trying to develop five things to increase foreign investment. At first, we are trying to increase quality of services. We are also trying to merge BIDA, BEZA, BEPZA and High Tech Parks. Opinions from the businessmen are being taken in this regard.

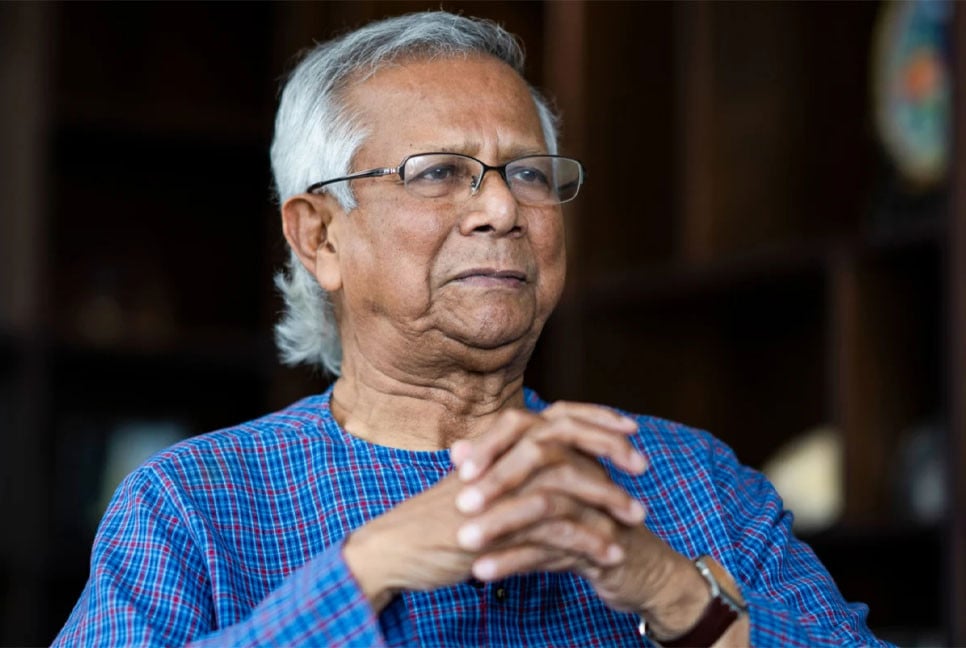

Lutfe Siddiqui, special envoy on international affairs to Chief Adviser Professor Muhammad Yunus, said a Business Regulatory Reform Commission will be formed if necessary. He assured that there are no conflicts of interest at the highest levels of government, and changes to government procedures are being made to resolve issues swiftly through dialogue.

Foreign Investors' Chamber of Commerce and Industry (FICCI) President Zaved Akhtar emphasized the need to boost credibility to attract foreign investments. He pointed out that foreign investments bring not just money but also knowledge and technology. Policy is required to protect this knowledge and technology. Without such policies, investment will not come. He also criticized the practice of altering tax rates annually, which creates uncertainty for investors.

Anwar-Ul-Alam Chowdhury (Parvez), president of the Bangladesh Chamber of Industries (BCI), suggested that authorities should develop infrastructures in the economic zones before allocating plots to investors. Entrepreneurs alleged that those who received plots in the economic zones still lack utility connections and have had to arrange water supply themselves.

Policy Exchange of Bangladesh Chairman Masrur Riaz at a separate function highlighted that a tax-friendly environment would significantly boost investment. Research shows that a 1 per cent increase in tax rates leads to a 3.5 per cent decrease in foreign investment, while a 20 per cent reduction in tax burdens could increase foreign investment 14 times and revenue more than six times. He emphasized the need for tax and tariff reforms.

Debabrata Roy Chowdhury, Head of Legal at Nestlé Bangladesh said, “In 2022, we invested $2.5 million based on then-prevailing tax rates. However, a change in tax rates within two years forced us to cancel subsequent investment plans, resulting in a loss of employment opportunities and revenue.”

bd-pratidin/GR