Despite recent decreases in global fuel prices, consumers in Bangladesh are seeing little to no benefit. Since March, the country has implemented an automatic pricing mechanism for fuel oil that aligns with international market trends, announcing new prices monthly.

However, energy experts suggest that the correlation between local prices and global fluctuations is not straightforward. Analysts attribute the lack of significant price reductions to the country's crawling peg exchange rate system, which allows the dollar to fluctuate within a limited range. Additionally, rising transportation costs for fuel oil have been cited as a contributing factor to the stagnant prices in the domestic market.

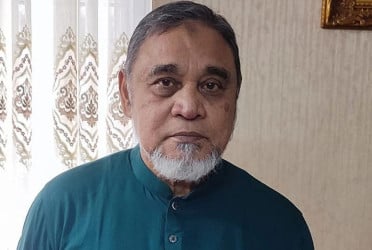

Md. Amin ul Ahsan, Chairman of Bangladesh Petroleum Corporation (BPC) told Bangladesh Pratidin, “Bangladesh government imports 100 percent of oil through BPC. The imported oil is sold with minimum margin or sometimes zero margin. There is a profit for the dealers who pay the price in the international market, the price with the dollar fractionation, the transportation cost, insurance, VAT-tax and duty paid by the government. Petrol pumps have to carry oil to different places including Baghabari, it has cost. They have a formula. This formula is rated by World Bank. This is done as per international practice. This is how the price of oil is determined in the country. Many people think that the price of oil is falling in the international market, but it does not have much impact on the domestic market. But in the context of Bangladesh, I think it is being done on a very fair basis.”

He also said that due to the dollar's crawling peg, we have to pay higher prices for oil imports. Because, now the dollar is available in Bangladesh Bank at 118 taka. But we are not getting any dollar below 120 taka. According to the dollar's crawling peg formula, we have to buy oil at a slightly higher price. It also happened that even though we had money, we had to make late payments because we did not have dollars.

BPC authorities said that even if the price in the world market has decreased, the reason for not having an effect on the consumer level is the change in the value of the dollar against the taka at this time. Last October 1, the price of oil in the world market increased slightly.

Last August 31, the interim government announced the price of fuel oil. For the month of September, the price of diesel and kerosene has been reduced by 1.25 taka per litre. And the price of petrol and octane has decreased by 6 taka. Energy experts and buyers commented that this rate of price reduction is very small.

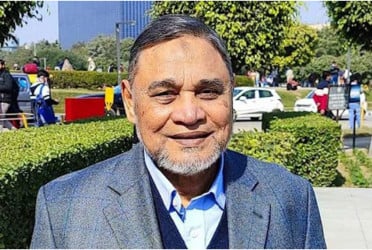

Ghulam Rahman, former President of Consumers Association of Bangladesh (CAB) told Bangladesh Pratidin, “This is something that not supposed to happen. The price of oil is determined through a formula. That is why the price of fuel oil is expected to decrease in Bangladesh as well as in the world market.”

Analysts have identified the dollar exchange rate as the reason why the price in the world market has decreased a lot, but it has not affected the country's market. Generally, the value of money is calculated against the world market price and the dollar in determining the price. The price is now determined every month based on the average price of fuel oil of the previous month. Along with that, there is 32 percent customs-tax, there is transport fare, and 6 percent profit is taken by BPC.

At present, the duty is calculated on the basis of tariff price in case of imported fuel oil. It does not change even if the price of fuel oil increases or decreases. The tariff price is generally considered lower than the purchase price. This reduces the cost of customs duties of BPC. But the private crude oil importers have faced huge losses due to the government's dual policy of charging prices in the public and private sectors for the import of crude oil. For this reason, the entrepreneurs of this sector have demanded that the price of import of crude oil be charged on the same basis in the public and private sectors.

Energy experts said that pricing should be done in the same manner in the public and private sectors. Either the pricing formula should be determined by evaluating the duty on the tariff value, or the pricing formula should be determined by evaluating the duty on the invoice value. The government mainly buys oil from the international market on long-term contracts. Providers are also specific. The price is determined based on the average price of the previous day on which the contract is made. Added to this is the premium for transporting the oil. Oil prices fluctuate. As a result, the price depends on whether the deal is being made when the price is falling.

Bangladesh mainly buys oil from Saudi Arabia and United Arab Emirates. Maraban crude and Arabian light are bought from these two countries. The prices of these two oils are slightly higher than WTI and Brent crude. On the other hand, the oil refining capacity in Bangladesh is only 1.5 million tons. However, the demand is high. An average of 60 lakh tons per year has to be imported. Due to low capacity, Bangladesh has to buy refined oil or diesel. And its price is naturally higher than crude oil in the world market.

(The report was published on print and online versions of The Bangladesh Pratidin on October 7 and rewritten in English by Tanvir Raihan)