Groups of companies or large industrial groups are formed with multiple companies from the country's trade, commerce, and production sectors. These companies have multiple directors. However, if a company director unintentionally becomes a loan defaulter, the entire group of companies falls in danger.

If the Credit Information Bureau (CIB) report of a company director goes against him or her, the whole group of the company suffers most of its negative impact under various rules and regulations.

Businessmen said they are in very much trouble for this reason. They alleged that even credit card loan default incidents have increased disturbance. Many businessmen in the country have become loan defaulters as the price of the US dollar increased to Tk 120 per dollar from Tk 80. Many businessmen have become loan defaulters due to the non-dissolving of cases in the Money Loan Court. In this situation, the government should show generosity to save the mills and factories.

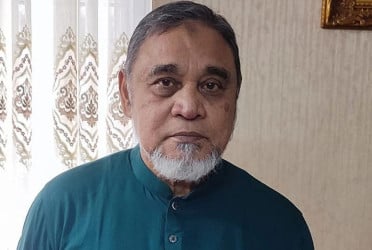

Md. Jashim Uddin, president of the Federation of Bangladesh Chambers of Commerce and Industry (FBCCI), told Bangladesh Pratidin that businessmen have been affected by the world economic crisis due to war and the COVID-19 pandemic. In Bangladesh, real and professional businessmen have been struggling the most. If a sister concern becomes a loan defaulter, the CIB report mentions the group of companies as in bad condition. It means the country’s businessmen are passing the worse situation than the COVID period.

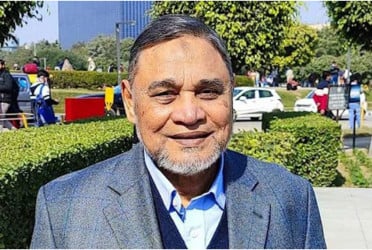

Bengal Group of Industries Vice Chairman Jashim Uddin also said the import costs of the products are increasing in the global market. However, the prices of these products are not being adjusted in the local market. As a result, many businessmen are becoming loan defaulters unwillingly. Considering the current situation, the declaration of default should be deferred for one year. If a unit of a group of companies becomes a defaulter, it should not be identified other units of the group of companies as bad.

Bangladesh Garment Manufacturers and Exporters Association (BGMEA) former President Faruque Hassan said, “If a sister concern of a group of companies becomes loan defaulter, the central bank stops the loan facilities to other sister concerns under this group of company and identified these companies as loan defaulters. This system should be abolished. We have to remember that big companies, business groups and corporate organisations take maximum loans from the country. Personal loans are much less in Bangladesh.”

Stakeholders said the private sector is the lifeline of Bangladesh’s economy. Bangladesh has been elevated to the developing country status by businessmen. The country is on the verge of a middle-income country. Its private sector recruits employees multiple times more than the government every year. A group of companies consists of many organisations. These organisations have been playing a big role in the country’s economy. The whole world including Bangladesh has experienced a severe economic crisis in recent years. Some units of the group of companies have been affected by the COVID-19 pandemic, the Russia-Ukraine war, the depreciation of the taka against the US dollar and the unusual price hike of the raw materials of the industries. However, good units of a group of companies are not able to continue their business activities due to negative CIB reports of bad units of the same group of the company. If a unit of a five-unit group of companies becomes a loan defaulter by the CIB report, rest four units are affected in many ways including importing raw materials by the scheduled banks. In this case, good units of a group of company at risk of closing due to bad units. As a result, tens of thousands of employees might lose their jobs in these industrial units. At the same time, collection of loans will also be difficult for the banks, said the stakeholders.

Law experts said, according to the Bank Company Act, of 1991, if a director or shareholder of a company is in default, it cannot be treated the company as a defaulter as per the company law. Therefore, it is a violation of law for a bad unit to affect other good units of the same group. There is a negative and adverse reaction to the country's economy as commercial banks and Bangladesh Bank do not take this issue into consideration as per the law.

The business concerned apprehended that if the central bank, other banks and non-banking financial institutions do not make the CIB report comfortable for a group of companies, many big companies might shut down at a time. On the other hand, if banking facilities are continued for the good units, the financial condition of the bad units can be good by the profit of good units of the group of companies. The government should consider the matter right now with importance. Otherwise, the country’s banking sector will likely fall at risk due to an increase in loan default.

According to the latest data of the Bangladesh Bank, the country’s total defaulted loans stood at Tk 2 lakh 11 thousand 391 crore as of June this year which is 12.56 per cent of the total Tk 16 lakh 83 thousand 396 crore of distributed loans. This is the highest rate of loan default in the past 16 years.

The central bank data said defaulted loans were Tk 1 lakh 56 thousand 39 crore as of June last year. In the last three months, defaulted loans have increased by Tk 29 thousand 96 crore, which was Tk 1 lakh 82 thousand 295 crore till March 30.

@ The article was published on print and online versions of The Bangladesh Pratidin on October 2, 2024, and has been rewritten in English by Golam Rosul.