The budget of fiscal year 2024-25 admits the matter of economic crisis, however no fruitful techniques to combat the crisis wasn’t visible in tit. According to the experts, the announced budget gave importance in controlling inflation, but the matter of growth has been neglected here. As a result, things like production, investment, employment and manpower haven’t got the desired importance that it should get. Rather, the ongoing investment facilities were cancelled. The tax exemption in economic zones and hi-tech parks has been cancelled and it was allowed only to government hi-tech parks and economic zones. Overall the announced budget can be termed as a hyper-cautious, investment-averse budget to tackle the crisis, with a lack of having bold action.

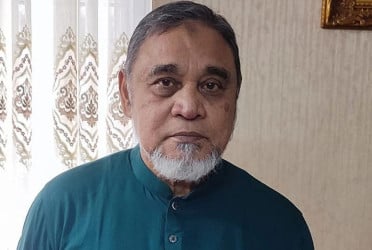

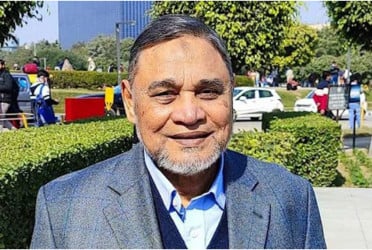

Former Finance Secretary Mahbub Ahmed said that the inflation target set at 6 and a half percent will not be brought down in any way. Instead, what should be done is to take measures to increase growth and investment based on this inflation.

If growth and investment increased, people's income would increase. Then the inflationary pressure would also reduce. The Awami League government had 11 priorities in its last election manifesto, the first of which was controlling the commodity price. After that, there were things like creating employment and smart Bangladesh, increasing investment and capacity building in the financial sector including banks, ensuring healthcare for low-income people. Although the proposed budget mentioned the 11 priorities of the election manifesto, the first budget of the newly elected government did not show clear steps to implement these priorities. A contractionary monetary policy has been adopted to control inflation; There is mention of raising the policy interest rate to 8.5 percent; It is clarified that the interest rate of bank loans is left to the bank-customer relationship; Refers to the adoption of a combination strategy of fiscal policy with contractionary monetary policy etc. The finance minister also mentioned that the size of the budget announced to reduce government expenditure has not increased much. However, on the contrary, the announced budget does not mention what specific initiatives have been taken to increase investment, employment and growth. The finance minister advised to leave the matter to the future.

In the budget speech, the finance minister said, "In the next financial year's budget, we will continue fiscal consolidation, i.e. reduction of budget deficit and austerity, albeit on a limited scale. However, if this approach is adopted in the long run, the pace of growth may slow down; that is why the aim will be to gradually increase government expenditure in the second half of the next financial year. It will be possible if the amount of revenue collection can be increased.”

So it can be said, there will be no growth in this budget, wait for the future. There will be no employment in this budget, wait for the future. This budget will not have a clear commitment to ensure order, transparency, accountability in the financial sector.

Effects of Contractionary Monetary Policy and Fiscal Policy: The adoption of contractionary fiscal policy in the budget will result in: (1) Commercial banks will invest more in government treasury bills to protect the safety of their deposits; (2) interest rates on loans to the private sector will increase further; (3) Increase the domestic debt target to deal with the budget deficit, the private sector will get less credit. This would result in: (1) a shortage of investable capital for the private sector to invest in government treasury bills; (2) raising interest rates on loans will discourage investors from making new investments; and (3) the private sector will not get enough credit as government debt increases. Result: If investment falls, output will fall. Employment will decrease. There will be a negative impact on GDP growth.

Investment-unfriendly budget: The tax structure announced in the proposed budget is also not investment-friendly. The 'tax continuation' facility has been withdrawn from various sectors. In addition, the budget suggests getting out of the culture of enjoying tax exemptions. However, there is a promise of reducing complexity and simplifying the process in product clearance, domestic and foreign investment and job creation, support to export-oriented industries. These are the promises. The one stop service of the Investment Development Authority (BIDA) was mentioned in the budget speech to develop a favorable environment for investment, but in reality this facility has not been fully implemented. 100 economic zones have been mentioned to attract domestic and foreign investment, which is nothing new.

Issues highlighted in the budget: high inflation, shortage of reserves, depreciation of Tk against the dollar came up in the budget speech. It has been said that from July 2022 to May of the current financial year, the value of Tk has lost by 25.5 percent, due to which the cost of import has been increased. As a result, inflation is also increasing. Foreign exchange reserves stood at $39.6 billion in July of FY2022-23. Reserves fell to $24 billion last May. In order to maintain the value of money, about 22 billion dollars had to be released from the reserve to the market. However, the depreciation of the currency could not be reduced.

The Ukraine war has been cited as the cause of the reserve crisis. It has been said that Europe and America also has high inflation because of the war. To control it, central banks there raise policy interest rates. This creates pressure on the economy as a whole. Many foreign investors have withdrawn their capital from the country as interest rates rose in the developed world. On the other hand, new investment did not come. As a result, the government's balance of payments deficit has increased. On top of that, the annual cost of paying interest on foreign debt has exceeded $1 billion. It has also been said that this trend will continue if interest rates are not reduced in the developed world. This means, there is no quick fix to solve the reserve crisis.

Advantages of Budgeting: Despite not having so many advantages, budget has some good sides. One is that the budget has given importance to extraction of underground resources. 100 crores have been allocated for research and development in this sector. Allocation has also been kept in the budget for extraction of mineral resources under the sea. This will help in the exploration of new gas fields. As a result, there are initiatives to reduce the gas crisis in the announced budget. In building Smart Bangladesh, natives and expatriates have been given three-year tax-free benefits in various sectors including artificial intelligence or AI-based solution development, robotic software, digital data, mobile apps, e-learning, animation, IT freelancing. Apart from this, social security programs have been increased in the budget to help marginalized groups. Tariffs on consumer goods have been reduced to protect the middle class from inflation. Social security programs have been expanded for poor people. Moreover, formulation of national logistics policy to support service sector policies will help in attracting foreign investment.

(The report was published on print and online versions of The Bangladesh Pratidin on June 7 and rewritten in English by Lutful Hoque Khan)