Economists suggested not raising any kind of question about bringing back laundered money from abroad terming the question a big obstacle to bringing the dollar into the country.

They said if the government does not make questions about the inbound dollar a big amount of money will return to the country which will help to increase the country’s foreign reserve. If more dollars come to the country, it will help to boost employment and reduce the ongoing dollar crisis.

The country’s economy is passing a trying time due to the shortage of dollars. The government has controlled imports to tackle the crisis. The flow of foreign investment and foreign loans has declined. Bangladesh is paying more than the loan. The ongoing dollar shortage and the high price of the dollar have impacted negatively the country’s production, investment, and trade and commerce. Despite this situation, people are facing various difficulties in bringing dollars from abroad. As a result, people are struggling to meet daily essentials due to price hikes which leads to inflation.

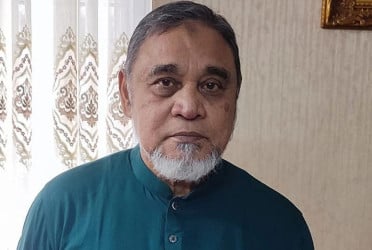

Ahsan H Mansur, executive director of the Policy Research Institute (PRI), has suggested not to raise any questions about bringing dollars from abroad to face the crisis. He said the government should show softness in this regard. Everyone does not bring dollars for terrorism purposes. There is no problem bringing dollars for any purpose except terrorism funding. All concerned of the government knows them very well who bring dollars for terrorism, he added.

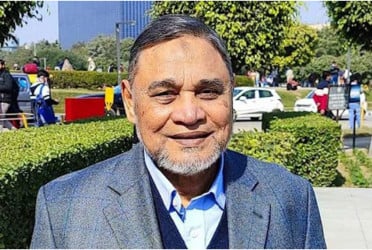

According to the Bangladesh Economic Association (BEA), around 12 lakh crore taka has been siphoned off in the last 50 years after the Liberation War. BEA President Abul Barkat mentioned the huge amount of money laundering in May of 2023 while presenting the alternative budget for the 2023-24 fiscal year.

Abul Barkat said if the government can recover 5 per cent of the laundered money, the amount will be Tk 59, 625 crore. The source of black money and laundered money could be one of the main sources of internal resource recovery, he opined.

At this point, BRAC Bank former chairman Ahsan H Mansur said the government doesn’t want that dollar to come to the country. It (the government) wants to control it. The main target should be to bring back laundered money.

The way should be cleared to bring back dollars from abroad, he emphasized.

Sources said an important portion of the country’s economy comes from foreign investment. Foreign investment had kept an important role in the economy even two years ago. Surprisingly, the flow of foreign investment is declining in the country.

According to a Bangladesh Bank report, the country received Foreign Direct Investment (FDI) worth 324 crore 96 lakh 80 thousand dollars in the 2022-23 fiscal year which was 343 crore 96 lakh 30 thousand dollars during the previous fiscal. The net FDI has declined 5.52 per cent within one year which is a negative side for the job seekers. If investment does not increase, employment won’t increase in the country. At the same time, it can hamper to achievement of the 7.5 per cent GDP growth targeted by the government during the current fiscal year.

Professor Mustafizur Rahman, a distinguished fellow Centre for Policy Dialogue (CPD), said the process of bringing laundered money from abroad is complex. People had to face many questions due to bureaucratic complexities. Besides, the government can’t ensure a one-stop service, quality electricity and gas service. For this reason, the flow of FDI has declined.

He also said the process of bringing dollars to the country will have to be eased and cleared.

Bangladesh Bank Executive Director and Spokesperson Mesbaul Haque said the process of bringing dollars from abroad has already been eased. If any person or organizations face difficulties in bringing dollars, Bangladesh Bank provides all kinds of assistance.

@ The article was published on print and online versions of The Bangladesh Pratidin on February 29, 2024 and has been rewritten in English by Golam Rosul.