The Finance Ministry has implemented a strict zero-tolerance policy concerning fraudulent loans, signaling a crackdown on irregularities within the banking sector. Bangladesh Bank, the country's central bank, is intensifying its oversight of various banks, with a commitment to taking decisive action upon uncovering any discrepancies.

Notably, the directive specifies that no leniency will be afforded for loan repayments deemed irregular.

In a move aimed at ensuring transparency and accountability, Bangladesh Bank has issued a mandate prohibiting individuals from the families of bank board members from assuming the role of Managing Director within the respective banks. This directive has garnered positive reception from economists, who view it as a step towards bolstering financial integrity.

Meanwhile, Bangladesh Bank has recently intervened by blocking a loan proposal amounting to Tk 670 crore from the private sector Southeast Bank, citing potential risks associated with the request. The central bank's decision comes amidst longstanding grievances regarding various irregularities within the banking sector, particularly concerning bank managers.

In response to these concerns, Bangladesh Bank has opted for a stringent zero-tolerance approach, signaling its unwavering commitment to addressing systemic issues within the financial landscape.

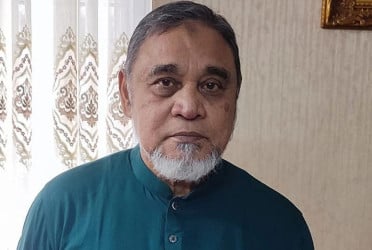

Executive Director of the Bangladesh Bank Md Mezbaul Haque told Bangladesh Pratidin, “The Board of Directors of Southeast Bank has approved a loan proposal of Tk 670 crore to buy shares of a securities company. We have received complaints that the loan was risky. Based on such allegations, the matter is being investigated. If the allegations are proved, no one involved in the distribution of risky loans will be exempted.”

As part of a tough approach to fake and non-transparent loans, Bangladesh Bank has recently blocked a Tk 670 crore loan proposal from the private sector Southeast Bank. The bank took the initiative to lend a large amount to a securities company to buy shares. The loan proposal was also passed in the last board meeting of Southeast Bank. However, Bangladesh Bank blocked the loan proposal due to the lack of clarity in the process of presenting and passing the loan proposal to the bank's board meeting.

The Central Bank's Financial Integrity and Customer Services Department (FICSD) sent a letter in this regard to the Managing Director (MD) of Southeast Bank last Sunday. On that day, Bangladesh Bank conducted a special visit to Southeast Bank.

FICSD Additional Director Mohammad Zakir Hossain headed the Central Bank inspection team. He said in a letter to the MD of Southeast Bank, “Special inspection is being carried out in the Southeast Bank under the powers conferred by Section 44 of the Bank Company Act, 1991. In order to facilitate this ongoing inspection, you are advised not to release any money, that is, not to buy any stock through the securities company, as approved in the agenda number 9 of the 721st Board of Directors meeting of the bank held on February 20, until further instructions.”

Related sources said that the last board meeting of Southeast Bank was on February 20. During that meeting, a proposal was suddenly made to give a loan of 50 crores to a securities company. Within a short period of time, the proposal was modified several times and the loan was increased to Tk 570 crores. At the end of the board meeting, the loan amount was increased by another 100 crores while finalizing the documents.

In all, the amount of loan approved by Southeast Bank against the securities company stands at Tk 670 crores. The loan proposal has been increased from Tk 50 crore to Tk 670 crore through step-by-step revisions and the loan has been approved for the purchase of shares of companies listed in the capital market as well as unlisted companies.

The bank's board of directors approved the large amount of loans without following the norms, which created a controversy within the bank. In the end, the higher authorities of Bangladesh Bank came to know about it through various means. Then the central bank sent a special inspection team to Southeast Bank on an urgent basis on Sunday. As the inspection team stayed in the bank for almost the whole day and discovered the irregularities, a letter was sent to the MD of Southeast Bank earlier in the evening not to release the loan approved by the board.

Alamgir Kabir, chairman of Southeast Bank, told the media about the alleged loan, “If Bangladesh Bank has given any such letter, it is absolutely false. We have appointed the securities company as a panel brokerage house of Southeast Bank. The institution will buy the shares on behalf of the bank. They should buy the shares that we ask them to buy. There is no question of giving a loan here.”

Recently, the Central Bank has identified several irregularities by reviewing the various activities of commercial banks. Among these, the central bank has come to the notice of money being withdrawn from banks in the name of loans at abnormal rates. In addition, many businessmen take loans from banks and swallow them completely. Some are smuggled abroad.

Finance Minister Abul Hasan Mahmud Ali has taken a strong stand after reviewing this situation. The central bank is working on a zero-tolerance policy on defaults and fraudulent loans. Doubtful loans applied by many influential people are not approved.

Apart from this, banks have also been instructed to stop the practice of taking loans on fake documents. Steps have also been taken to prevent the directors of one bank from taking loans from other banks.

Former Chief Economist of Bangladesh Bank and Executive Director of the Institute for Inclusive Finance and Development, Mustafa K Mujeri told Bangladesh Pratidin, “When the loan proposal of Tk 50 crore is increased to Tk 670 crore, then it should be understood that there is trouble here. Bangladesh Bank has done a very good job by blocking that loan proposal. However, the central bank has to take the initiative so that the board of the bank does not get the opportunity to approve such a loan proposal. If there is evidence of involvement in the distribution of these loans, strict punishment should be ensured against the banks; So that they do not dare to distribute such loans.”

(The report was published on print and online versions of The Bangladesh Pratidin on February 29 and rewritten in English by Tanvir Raihan)