Though private sector lender ‘The City Bank’ posted 340 percent profit amid the dollar crisis, the allegation of soaring of dollar rate was surfaced against them as it didn’t release reserved dollars in the capital market despite having opportunity.

Sources in Bangladesh Bank (BB) said on an average of every dollar the bank bagged a profit of Tk 5 to Tk 10 against opening of every LC and hid information of dollar reservation.

Prompting to the incident, the BB served show cause notices to Managing Director (MDs) of six banks, including, The City Bank for making the market instable and bagging an unusual profit taking the chance of dollar crisis on August 17.

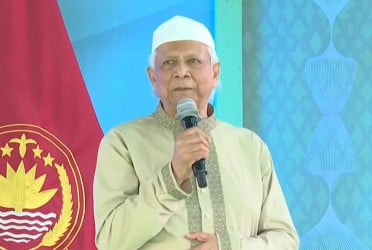

BB Executive Director and Spokesperson Serajul Islam said the MDs were asked to explain responding the show cause notices for posting additional profit through dollar manipulation.

“Every bank will be inspected, besides action will be taken against them once allegations are found true,” he said.

According the BB Policy, the banks can reserve foreign currency upto 20 percent against their regulatory capital. However, the central bank, guardian of all banks, cut the reservation ceiling by five percent from the previous ones due to the dollar crisis hit across the world.

The BB in its vigilance found that the banks posted a huge amount of profit by selling dollar at an excessive rate against the reservation of dollar breaching the rule which caused an increase of inflation in the market.

As per data collected from the BB, it was found that The City Bank posted 340 percent profit which stands at Tk 176 crore to Tk 40 crore from the first six months of the current year compared to the previous occasion by exchanging foreign currency.

With this, 12 banks made a profit of Tk 427 crore against only Tk 465 crore in comparison with the previous year due to price hike of the dollar upto Tk 120 recently,.

Contacted, The City Bank MD and Chief Executive Officer (CEO) Mashrur Arefin said they made a profit of Tk 150 crore exchanging dollar till May this year, however the amount fall Tk seven crore till August.

Acknowledging the manipulation, he said they made some mistakes against their will to pay import cost and sought mercy for that to the BB.

Apprehending the dollar crisis around the issues, the BB gave directives to the banks to sell dollar by making a profit of maximum Tk one which was not complied with.

As a result, the dollar market became instable due to its crisis.

The private sector lenders realised Tk 90 to Tk 95 from big businesses for opening LC against every dollar and Tk 98 from small and medium businesses to make profit ranging from Tk 5 to Tk 10.

Those who (banks) made an unusual profit by selling dollars won’t be able to hoard to their own income sector, the BB said.

Along with the marked banks, other banks having involvement with manipulation will be quizzed.

Mentionable, The City Bank registered with Dhaka and Chattogram Stock Exchanges started its journey on March 27, 1983.

Bd-pratidin English/Salamat