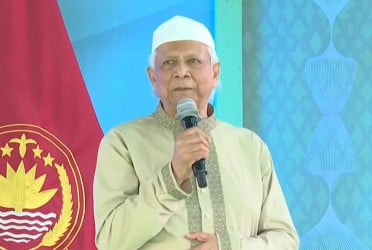

Chairman of Bangladesh Securities and Exchange Commission (BSEC), Professor Shibli Rubaiyat-ul Islam, has said sophisticated software and technologically knowledgeable manpower is required to check share market manipulation, reports UNB.

BSEC is working to install efficient software so that unethical practices in share trading can be flagged immediately, he said.

He made these remarks at a roundtable on “Bangladesh Capital Markets’ Present and Future”, held in a Dhaka hotel on Saturday.

Capital Market Journalists Forum (CMJF) and Bangladesh Merchant Bankers Association (BMBA) jointly organized this program.

Professor Shibli said it takes six months to a year to identify a share market gambler in the existing system.

“We can take action when the stock exchange promptly gives the investigation report. It usually takes six months to a year to scrutinize the evidence and punish the culprit. By this time, the investors have already suffered the consequences”, he added.

Bd-pratidin English/Ishrar Tabassum