Market analysts think due to strict surveillance of Bangladesh Bank over other banks and money exchange organizations, keeping an eye on big LCs and the increasing flow of remittance, the price of dollars may come down under Tk 100.

According to them, the price of dollars depends on the world-situations. The decreasing oil-price in world market, idea of starting alternative currency, selling of wheat and oil from Russia and Ukraine cause the price of dollar falls.

Banker economists said, the monopoly of dollar has been decreased. And it initiated positive effect on export-import. Besides, imposing restrictions on import result in 30% cost-curtail in opening LCs. And to reduce pressure on dollars in foreign trade, Bangladesh decided to use Russian Ruble as alternative currency. Furthermore, Bangladesh is getting advantage in dollar supply due to the price cut of oil.

Bankers said, the country will mitigate the dollar crisis in next two months and surplus will be created. When asked Managing director of Dhaka Bank, Emranul Haque told The Bangladesh Pratidin, the present condition can sustain up to next two months. As the number of new LCs is decreasing, in next two months the dollar crisis will transformed into dollar surplus. So, there’s no need to be worried; however, the remittance quotations should be come down slightly.

After the Russia-Ukraine war begins, Bangladesh faced a crisis of dollars. Due to the worldwide crisis regarding the price of fuel-oil and food-items, Bangladesh fallen into serious dollar crisis. However, Bangladesh Bank has taken punitive measures against more than one banks and exchange houses as they were engaged to various monetary manipulations. They also impose restriction on importing luxurious goods and sending remittance, which resulted in increasing flow of remittance.

In August, NRBs sent remittance of 203 crore 78 Lakh dollar. If counted in dollar, it’s equal to Tk 20,000 crore. In the same period, the country has seen a 12.6% growth of remittance. The central Bank also ordered to sell surplus dollars in excess of 10,000; otherwise they will take actions against them. Even amid war between Russia-Ukraine, the export of foods from Ukraine to other parts of the world has begun. Hence, the LC rate for food-commodities has been decreased.

In the meantime, the price of fuel oil decreased and Bangladesh reaped its benefits. Government is thinking whether they can import oil from countries other than Russia and Middle-eastern countries. If it’s possible, then it can use the currencies of the respective countries. In that case, there’d be no pressure on dollar.

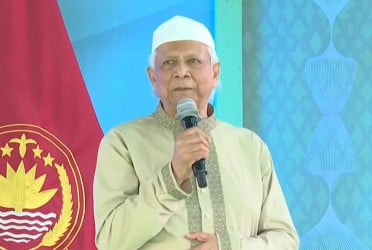

When asked, executive director and spokesperson of Bangladesh Bank, Sirajul Islam said, ‘We discussed with ABB (Association of Bankers Bangladesh) and BAFEDA (Bangladesh Foreign Exchange Dealers Association) about dollar pricing. With these two organizations, we’re monitoring the whole situation so that any crisis can’t appear. We’ve fixed the price of export bill at Tk 99 and remittance bill a slight higher. The steps taken by the central bank will make possible the price of dollars come down a lot.”

Dollar price Tk 99 in settling export bill: The new dollar price has been fixed in foreign trade. The rate has been determined in a joint meeting of Bangladesh Bank, BAFEDA and ABB officials. Now, the export revenue would be updated with maximum exchange rate of Tk 99 a dollar. In settling LC in import, the highest price of a dollar can be up to TK 104.99. However, in order to import dollars from the NRBs, maximum price of a dollar can be Tk 108.

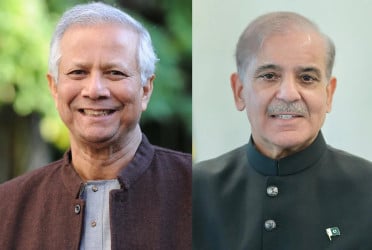

In the meeting, Chairman of ABB, Salim RF Hussain said, “The price would be changed time to time. We hope the current price of dollar would stabilize the market.”

@The article appeared on print and online versions of The Bangladesh Pratidin on September 12, 2022 and rewritten in English by Lutful Hoque