Bangladesh has passed another year amid economic turmoil. The country’s macro-economy was under pressure from the very beginning of the year to the end. The crisis was deepening in the late of the year. The dollar crisis and high inflation hindered economic activities throughout the year.

The high price of daily essentials suffered by people from all walks of life. The government has tried to stop the fall of foreign reserves but failed. The corruption and irregularities in the banking sector were widely discussed. Businessmen and entrepreneurs were helpless due to dollar shortages and high inflation. There was no notable new investment and employment throughout the year. The country's macro-economy suffers from deeper to deeper.

The overall inflation was 8.71 per cent in December of 2022 which was 8.85 per cent in November and 8.91 per cent in October of the same year. The overall inflation stands at 9.49 per cent in November of the current year. The food inflation in November was 10.76 per cent which was 12.56 per cent in October. It means inflation hits the two number figures in the current year. The new year is also going to start with this high inflation. The inflation in the current year was highest in the last 11 years although it has decreased in the last two months.

The price of the US dollar at Tk 105 in December of the last year and January of the current year which was Tk 85-86 in December of 2021. On December 24, the price of the dollar was Tk 110 which was more than Tk 124 in the kerb market.

The country’s foreign reserve was $34 billion on December 20, 2022, which stands at $20 billion on December 20 of the current year. It means the country’s $14 billion foreign reserve declined in one year.

The government has controlled imports throughout the year due to the dollar crisis. According to Bangladesh Bank data, businessmen imported goods worth $14.75 billion from July to September of the 2023-24 fiscal year which is 23.77 per cent less than the same period of the last fiscal. The country’s export and remittance earnings also declined during the period.

According to a report of the Centre for Policy Dialogue (CPD), around Tk 92,261 crore has been plundered from the country’s banking sector in 24 major scams over the past 15 years – from 2008 to 2023. The money taken illegally from the banks during the period is about 2 per cent of the current gross domestic product (GDP). As a result, the banking sector was broadly discussed all over the year.

All indexes of the economy were negative throughout the year. High inflation, declining reserve, high rate of the dollar, less remittance and export earnings, less revenue collection and budget implementation of the government crippled the whole economy.

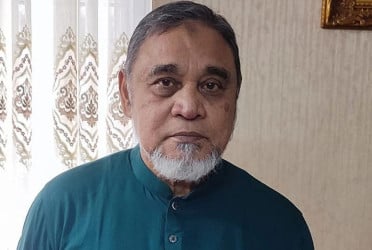

Dr Zahid Hussain, former lead economist of the World Bank's Dhaka office, told Bangladesh Pratidin that Bangladesh remains in the illusion. Bangladesh Foreign Exchange Dealers Association (BAFEDA) and Association of Bankers, Bangladesh Limited (ABB) control the dollar market which is the job of Bangladesh Bank. There was no effective technique to control the high inflation. For this reason, the country’s economy is in disarray. It is not expected that the economy will run smoothly in the next year, he added.

Meanwhile, the loan burden has increased in the country. The amount of foreign loans has increased by 322 per cent in the last 14 years which stands at $99 billion in June of the current year. Economists blamed various development projects for continuous foreign loan dependency.

Dr Zahid Hussain termed this tendency as short short-sighted, overvalued and over-corrupted development policy by the government.

@ The article was published on print and online versions of The Bangladesh Pratidin on December 28, 2023 and has been rewritten in English by Golam Rosul.