Investment flow in the country has declined remarkably amid the ongoing economic turmoil and political uncertainty.

Around 39 per cent of investment declined in the last three months Analysts said the investment is not increasing in Bangladesh due to high inflation, dollar shortage, increase of bank rate, and political unrest. If this negative trend continues, the country’s GDP won’t increase and it will impact negatively on employment.

According to the Bangladesh Investment Development Authority (BIDA), 39 per cent fewer investment proposals from local and foreign investors came from May to July this year. Investors proposed $9.4 billion in various sectors which was $15.30 billion during the same period of the previous year.

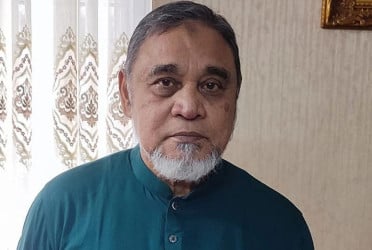

Contacted, Dhaka Chamber of Commerce & Industry (DCCI), President Barrister Sameer Sattar said the current geo-economic turmoil, disruption of the world supply-chain system, fuel price hike and high inflation started because of the Russia-Ukraine war. For these external factors, the amount of investment decreased in Bangladesh.

Mentioning that this investment drought is temporary, he said local and foreign investment will increase in the country after ending the geo-economic crisis.

Bangladesh Bank (BB) data said the foreign direct investment (FDI) declined 7 per cent in the 2022-2023 fiscal year. The country got a $3.2 billion investment in the last year. The investment decreased due to the volatility of the foreign currency market. According to the central bank, 40.91 per cent of capital investment declined in the last fiscal. On the other hand, inter-company loans decreased by 40.14 per cent. However, recurring investment from the existing foreign companies increased to 16 per cent. Some $622m investment from the United Kingdom, $603m from Korea, $512m from the Netherlands, $371m from Hong Kong, $347.2m from the United States, 330.62m from Singapore and $232m investment come from China. The country’s non-EPZ sectors received $2.8 billion in the 2022-23 fiscal. On the other hand, EPZs got $406 billion. A total of $4.2m in foreign investment comes in the economic zones.

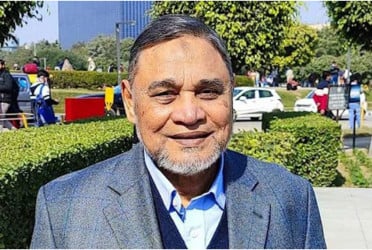

Dr Selim Raihan, executive director at the South Asian Network on Economic Modeling (SANEM), said investors are cautious about the uncertainty over the next national elections. Besides, the weakness of the macro economy, the hike of the raw materials, the high-interest rate of bank loans, and restrictions on imports declined the total investment.

He also said although all investment proposals are not fully implemented, these are considered as an index of interest of the investors and investment situation.

According to the BB, the LC opening rate to import capital machinery declined 22 per cent in July-August of the 2022-23 fiscal compared to the same period of the last fiscal year. The total amount of LCs to import capital machinery is $381.8m. Besides, the debenture settlement rate in the first two months of the current fiscal stood at $490m declining 35 per cent from the previous year. On the other hand, the growth in the private sector was 9.75 per cent in August this year which was 9.82 per cent in July.

People concerned said declining investment is a negative side for the country's lakhs of youths as it would limit their employment opportunities. At the same time, it is a reflection of a lack of economic expansion.

Entrepreneurs said generally private investment flow decreases before any general election. However, other economic challenges have worsened the situation this time.

Centre for Policy Dialogue (CPD) Research Director Khandoker Golam Moazzem said foreign businessmen are not getting confidence for new investment. The authority should find out the reasons behind the investment decline. Foreign investment decreased massively in recent years. On the other hand, FDI is increasing in the neighbouring countries including India. In reality, Bangladesh needs much more FDI in the current situation. But FDI is declining gradually, he added.

@ The article was published on print and online versions of The Bangladesh Pratidin on December 3, 2023 and has been rewritten in English by Golam Rosul.