The Ukraine war just after the Covid-19 epidemic has created many risks in the economy of the country. In order to face these risks, the government is going to take some reformation initiatives in financial sector. Reducing the governmental expenditures, along with speeding up the macro economy has been included among these initiatives.

The government will follow middle-term cautious revenue policy to control inflation. In addition, they will increase vigilance over government and state guarantee debt schemes, implement the single exchange rate of dollar in order to make the currency market disciplined, remove restrictions on import by turns to increase the pace of production in industrial sector, continue social safety sector expansion to help poor and low-income people, and increase government investment in development project.

In the statement of middle-term macroeconomic policy by ministry of finance, details idea has been provided on the direction of economy in upcoming days by facing the current global and internal conditions. Middle-term policy reformation was stressed in this policy statement.

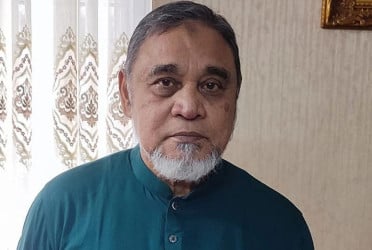

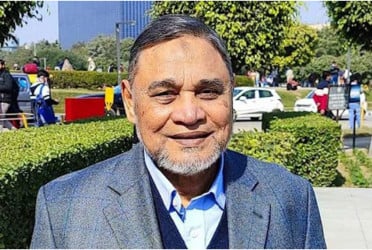

Former director general of BIDS, MK Mujeri told The Bangladesh Pratidin, “Many risk factors were entered into the economy like high inflation, reduction in foreign currency reserve, depreciation of Taka compared to dollar. The policy proposed by government wouldn’t bring good result if they’re implemented separately. Good outcome would come if all these policies are implemented after creating a combined roadmap to tackle the crisis.”

According to the information of middle-term macroeconomic policy statement, the main goals of this reformation are: increase revenue collection, reduce public debt, validate the subsidy, and increase the quality of the institutions involved in government cost management. And the overall goals are: make the external balance of payment stronger, reform the foreign currency reserve and remove the existing restrictions imposed to discourage import.

Finance directorate officials said although prudent fiscal policy will be followed in the medium term to control inflation, the condition imposed on the LC margin on product imports will be phased out in the interests of industrial production. Besides increasing expenditure on development programs and social security programmes, the government will take initiatives to rationalize expenditure on subsidies and internal loans. In this regard, special attention will be given to the size of the budget deficit and the total debt guaranteed by the government and the state.

To meet the budget deficit, the government borrows from the domestic sector as well as from the bank and non-bank sector. Borrowing from savings bonds is a major trend within the non-bank sector. As a result, the government has to pay more interest than it has to pay in other sectors. For this reason, the government has undertaken a reform program in the savings and loan schemes. Under this, the quality of government expenditure can be ensured by limiting the budget deficit and government debt quantity.

However, while reducing government expenditure, there will be a special focus on the way that it does not have a negative impact on the living conditions and development activities of low-income people. For this, initiatives will be taken to increase spending on social security and government investment. In addition to internal risks, the government will also undertake some reform measures to deal with external sector risks. Bangladesh Bank is going to take the initiative to introduce a single exchange rate instead of multiple dollar exchange rates to strengthen the balance of external sector. Monitoring will be fostered to bring order to the foreign exchange market.

@The report was published in Bengali on print and online versions of The Bangladesh Pratidin on June 10 and rewritten in English by Lutful Hoque