The government is going to announce the budget under various pressures including high inflation, rise in commodity prices, global crisis, dollar crisis, recession in business-investment, employment and upcoming National Parliament elections.

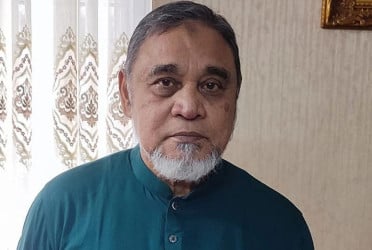

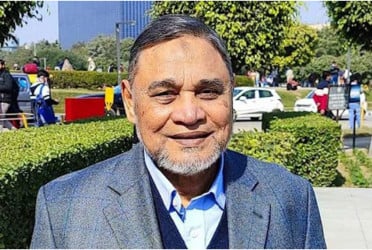

Finance Minister AHM Mustafa Kamal is expected to announce a Tk 7.64 trillion national budget for the 2023-24 fiscal year on Thursday, an amount Tk 818.91 billion higher than the previous year’s budget.

Meanwhile, a loan project of 4.7 billion dollars from the International Monetary Fund (IMF) is ongoing to overcome the dollar crisis. On the contrary, the government is increasing the price of gas and electricity while fulfilling the conditions. Which has an impact on public life.

Apart from this, the government should bring extensive reforms in the banking, financial and revenue sectors; Taxpayer must increase at the rate of 5 per cent every year.

Not only that, the National Parliament election is just six months later. In the face of multi-faceted pressure, the government wants to give a little relief to the people in the face of this election. For this reason, there are various electoral programs including social security in the budget.

According to the draft budget, the budget deficit of 2023-24 financial year can be estimated at Tk 2 lakh 61 thousand 785 crores. Among these, NBR's revenue collection target can be Tk 4 lakh 35 thousand crores. In order to collect huge amount of revenue, the scope of taxation should be increased.

For this reason, it is being planned to bring low income people under the tax. Several ministers of the government have already said that submission of income tax returns can be made mandatory only with National Identity Card (NID). But analysts consider such a decision unreasonable. Instead of doing this, they suggested to make a proper plan to bring the taxable people under the tax.

Sources said the initial plan was to formulate an expansionary budget for the next fiscal year; the size of which will be less than a quarter of Tk 8 lakh crore. But the reality is different, towards the end of the fiscal year, it was found that it would not be possible to raise the money required to prepare the big budget. Especially given the reality of an election year. Because at this time the tariff increase will be reduced as much as possible. As a result, it will not be possible for the National Board of Revenue (NBR), the body that collects money for the government, to provide a large budget. Therefore, the size of the budget has been reduced. But the government is targeting the upper class as well as the lower middle class in increasing the tax coverage.

In the next financial year, the target of income is Tk 5 lakh 3 thousand 900 crores with a grant of 3 thousand 900 crores taka; Which is about 13.5 per cent more than the current financial year. Out of this, the National Board of Revenue has to earn 430 thousand crore Taka. Tk 20 thousand crore will come from non-tax revenue board and tax free income is estimated to be Tk 50 thousand crore. The revised revenue target for the current financial year has been set at Tk 4 lakh 36 thousand 263 crore.

There will be huge deficit: To meet the deficit of Tk 2 lakh 57 thousand 885 crore (excluding grants) in the budget of 2023-24 fiscal year, the government will borrow Tk 1 lakh 32 thousand 395 crore from the banking system. Tk 86 thousand 580 crores will take long term loan from the bank. Short term loan will be taken Tk 45 thousand 815 crores. Non-bank loans will take Tk 23 thousand crore . Tk 18,000 crores will be borrowed from savings certificates. Another Tk 5 thousand crore will be taken from other sectors. The net foreign debt will be Tk 1 lakh 2 thousand 490 crore.

Promise: In the next financial year, the government will spend Tk 2 lakh 77 thousand 582 crores for the development of the country. Out of this, Tk 2 lakh 63 thousand crore will be spent on the annual development program. Tk 7 thousand 986 crores will be spent on non-annual development program projects. Tk 2 thousand 828 crores will be spent on food program in exchange for work. Tk 3 thousand 768 crores will be spent on various schemes.

In the outline of the next budget, government management and other expenses have been estimated at Tk 4 lakh 75 thousand 281 crores; Which is about 13 per cent or Tk 60 thousand 998 crore more than the current financial year. The annual development program (ADP) allocation is increasing by Tk 35 thousand 434 crore as operational expenditure.

Despite the crisis, higher GDP growth target: In the next financial year, the target of gross domestic product or GDP has been set at Tk 50 lakh 6 thousand 782 crore; Which is 13 per cent higher than the revised GDP in the current fiscal year's budget.

In the financial year 2022-23, the GDP amount is Tk 44 lakh 39 thousand 273 crore. The GDP growth target is 7.5 per cent. The government hopes to achieve this high growth even in the global crisis. However, development partners including the World Bank and IMF say that the global GDP growth rate will be lower than before.

Efforts to keep inflation at 6 per cent: For almost one and a half years, the increase in inflation has caused the common man to suffer the most; Which is now almost touching 2 digit house. It is planned to maintain this pressure of inflation at 6 per cent in the next budget.

Tax Extent: According to the IMF conditions, the tax payer has to increase at the rate of 5 per cent every year. Apart from this, the country has to fulfill some other obligations for the final transition to the rank of developing country by 2026; As a multifaceted effect, the tax burden on the people will increase. Meanwhile, plans are also being made to bring all NID card holders under tax. However, all those who have TIN may be made mandatory to pay income tax at a minimum rate of 2 thousand rupees in the coming budget.

Reflecting the conditions: The IMF has imposed 38 types of conditions against the loan of 4.7 billion dollars. As a result, the price of gas and electricity has already been increased several times. After the budget, there may be an announcement to increase the price of electricity again in a very short time.

Apart from this, the government should bring some other reforms in this sector to reduce defaults in the banking sector and bring stability to the financial sector. Especially to increase the revenue, reforms should be brought in this sector from the next budget. However, the reflection of those conditions has already started in the current budget.

According to several officials of the Ministry of Finance, the size of the possible budget will be Tk 761,785 crore in order to control inflation and maintain high GDP growth rate. The government is currently targeting a growth rate of 7.5 per cent in the next fiscal year, with inflation at around 6.5 per cent. The total investment target for next year will be 33.8 per cent of GDP.

@The report was published in Bengali on print and online versions of The Bangladesh Pratidin on May 31 and rewritten in English by Tanvir Raihan.