Deep crisis has created in the banking sector due to taking anonymous loans from public and private banks by showing fake documents, national identity cards.

Even directors of private banks take loans in collusion with other directors and lends to each other.

Due to these reasons, the amount and number of defaulters have increased, on the other hand, genuine traders are being deprived of credit facilities.

Besides, smuggling of money abroad in hundi is increasing. Currently, the amount of defaulted loans in the banking sector of the country stands at 1 lakh 34 thousand 396 crores. And 8 lakh crore taka has been smuggled since the independence of the country.

Anti-corruption organization Transparency International Bangladesh (TIB) has expressed concern over fake and anonymous loans.

In a statement on December 5 last year, the agency recommended the immediate formulation of a 'True Ownership Transparency' law in the private sector in the light of international experience to prevent fake and anonymous loan fraud.

Apart from this, TIB has called for the immediate addition of common reporting standards to facilitate exchange of information on all types of transactions at home and abroad to get specific information about money laundered.

Those concerned said, lands are being registered with fake national identity cards created in different names. The loan was taken by mortgaging the land deed in the bank. Even the national identity cards submitted to banks as loan guarantors are fake. Organized gangs are systematically embezzling huge sums of money from banks to trap fake documents.

The documents submitted to the bank are proving to be fake at one stage. In some cases, it has been observed that the size and details of the land in the documents submitted are non-existent and there is no signboard in the name of the company or the individual at the address of the borrower company.

Law enforcement forces have also found evidence of taking loans by creating fake documents of government land. In this way, the Rapid Action Battalion (RAB) arrested two people on April 15 last year on charges of embezzlement from the bank.

Sometimes they are fake donors, sometimes they have made fake documents without informing the owner of the land. A huge amount of loan was taken from the bank by keeping that document as collateral. Banks are in trouble with these lands as collateral. Fraud gangs are stealing large sums of money and smuggling them abroad.

Directors of private banks are also taking loans in connivance with each other. As they do not have the opportunity to take loans from their own banks, they are taking out thousands of crores of taka by adopting this method.

According to the annual report of the Central Bank of Switzerland, Bangladeshis have deposited money equivalent to about 3 thousand crore taka in Swiss banks in the last one year.

According to the report published on June 16 last year, the amount of money deposited by Bangladeshis has reached 8 thousand 275 crores taka till 2021; Which is the highest ever. The previous year in 2020 was 5 thousand 347 crores taka.

At the end of December 2021, the deposits of Bangladeshis in Switzerland stood at 871.1 million Swiss francs. At 95 taka per franc, it is 8 thousand 275 crore taka in local currency. Exactly one year ago, this figure was 562.9 million francs or 5 thousand 347 crores taka. In other words, the deposits of Bangladeshis in Swiss Bank increased by Tk 2 thousand 928 crore taka in one year, it said.

Meanwhile, according to the Washington-based organization Global Financial Integrity, from 2009 to 2018, 4.5 lakh crore taka has been smuggled from Bangladesh under the guise of foreign trade.

According to TIB, Every year 1000 to 1500 million dollars from Bangladesh are smuggled abroad.

Bangladesh Economic Association said that a total of Tk 8 lakh crore has been smuggled since the independence of Bangladesh.

According to the data of Bangladesh Bank, at the end of September last year, the amount of defaulted loans in the country's banking sector stood at 1 lakh 34 thousand 396 crores taka. In the first nine months of last year (January-September), defaulted loans increased by Tk 33 thousand crores. 9.36 per cent of the total loans disbursed by the banks are now in default. The amount of disbursed loans till the same time stood at Tk 14 lakh 18 thousand 266 crores taka.

Analysts said that most of the defaulted loans have been smuggled abroad. Homes bought abroad with smuggled money. Due to the increase in the money laundering of defaulted loans, the income of expatriates through legal channels is also decreasing.

They expressed apprehension that if a strict stand is not taken against fake loans, defaulted loans, corruption and hundi system, such incidents will increase in the future.

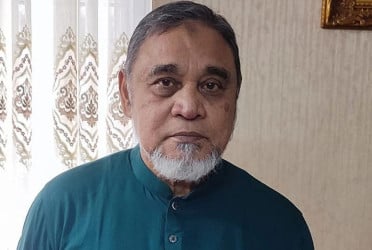

Talking to Bangladesh Pratidin Economist Dr. Jamaluddin Ahmed said, “Strict action should be taken against those who smuggled loans without payment.”

“Due to money laundering, defaulted loans are increasing and legal remittances are decreasing. As a result foreign exchange reserves are not increasing. Initiatives should be taken immediately to bring the loan fraud ring and money launderers under the law,” he added.

Md Mezbaul Haque, executive director and spokesperson of Bangladesh Bank told Bangladesh Pratidin, “Before disbursing the loan, the bank verifies the guarantee document and every paper of the borrower. There is no more opportunity to take loans on fake national identity cards and documents. Borrowing on forged documents is fraud. However, when such incidents occur, the law enforcement agencies bring the fraudsters under the law.”

“Bangladesh Bank has policies on what private bank managers can and cannot do. If the directors violate the policy while taking loans, Bangladesh Bank will take action against them. Law enforcement agencies are taking legal action against those dealing in hundi,” he added.

@The report was published in Bengali on print and online versions of The Bangladesh Pratidin on February 15 and rewritten in English by Tanvir Raihan.