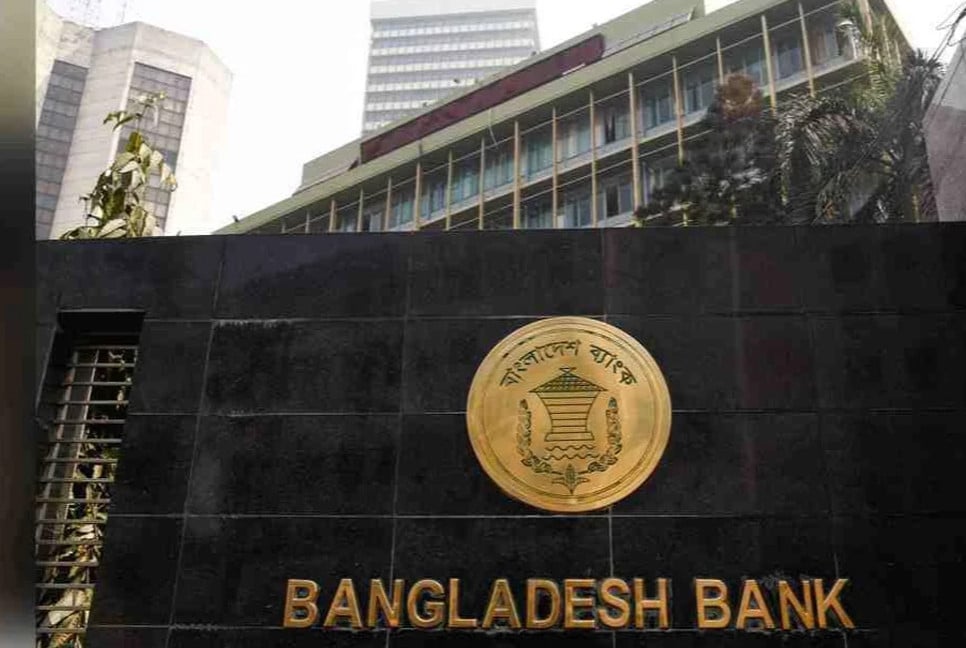

Bangladesh Bank (BB) has reduced the cash reserve ratio (CRR) of banks by 0.50 percent to boost liquidity flow in the banks.

As a result, banks will now have to maintain a daily CRR of 3 percent instead of 3.5 percent, said the central bank.

The Monetary Policy Department (MPD) of Bangladesh Bank on Tuesday issued a circular in this regard. The notification stated that from tomorrow, March 5, banks will have to maintain a minimum of 4 percent of total demand and term deposits on a bi-weekly basis and a minimum of 3 percent cash on a daily basis.

Director of the MPD Mahmud Salahuddin Naser issued the notification and sent it to the top executive of banks for immediate execution.

Bangladesh Bank is working to increase credit flow in the banking sector to boost private credit growth. The central bank already reduced the treasury bills/ bonds rate and now reduces the CRR to encourage banks to lend in the private sector.

Source: UNB

Bd-pratidin English/Lutful Hoque